FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

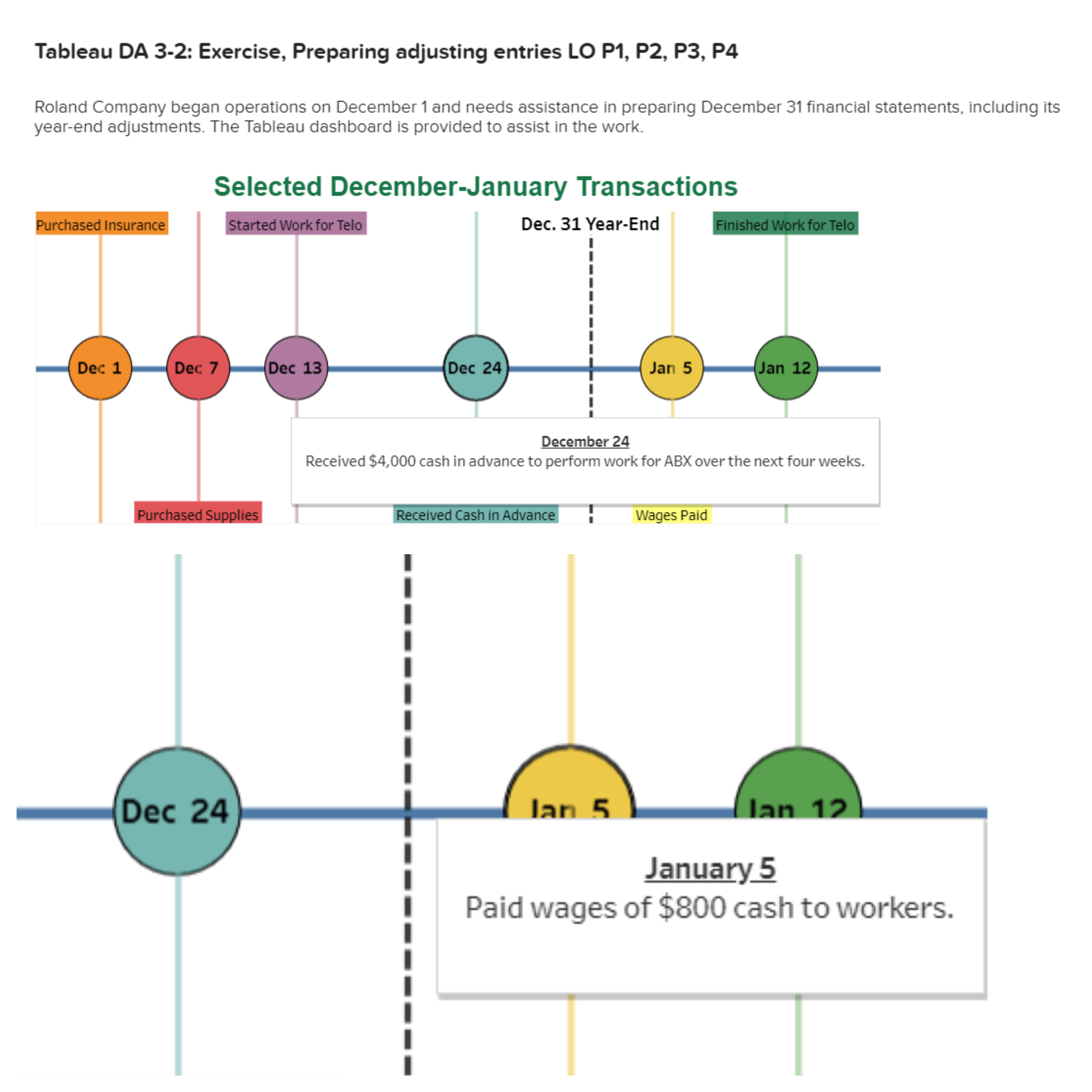

Transcribed Image Text:Tableau DA 3-2: Exercise, Preparing adjusting entries LO P1, P2, P3, P4

Roland Company began operations on December 1 and needs assistance in preparing December 31 financial statements, including its

year-end adjustments. The Tableau dashboard is provided to assist in the work.

Selected December-January Transactions

Started Work for Telo

Finished Work for Telo

Dec. 31 Year-End

Purchased Insurance

Dec 1

Dec 13

Jan 12

Dec 7

(Dec 24)

Jan 5

December 24

Received $4,000 cash in advance to perform work for ABX over the next four weeks.

Purchased Supplies

Wages Paid

Received Cash in Advance

Lan 12

Dec 24)

Jan 5

January 5

Paid wages of $800 cash to workers

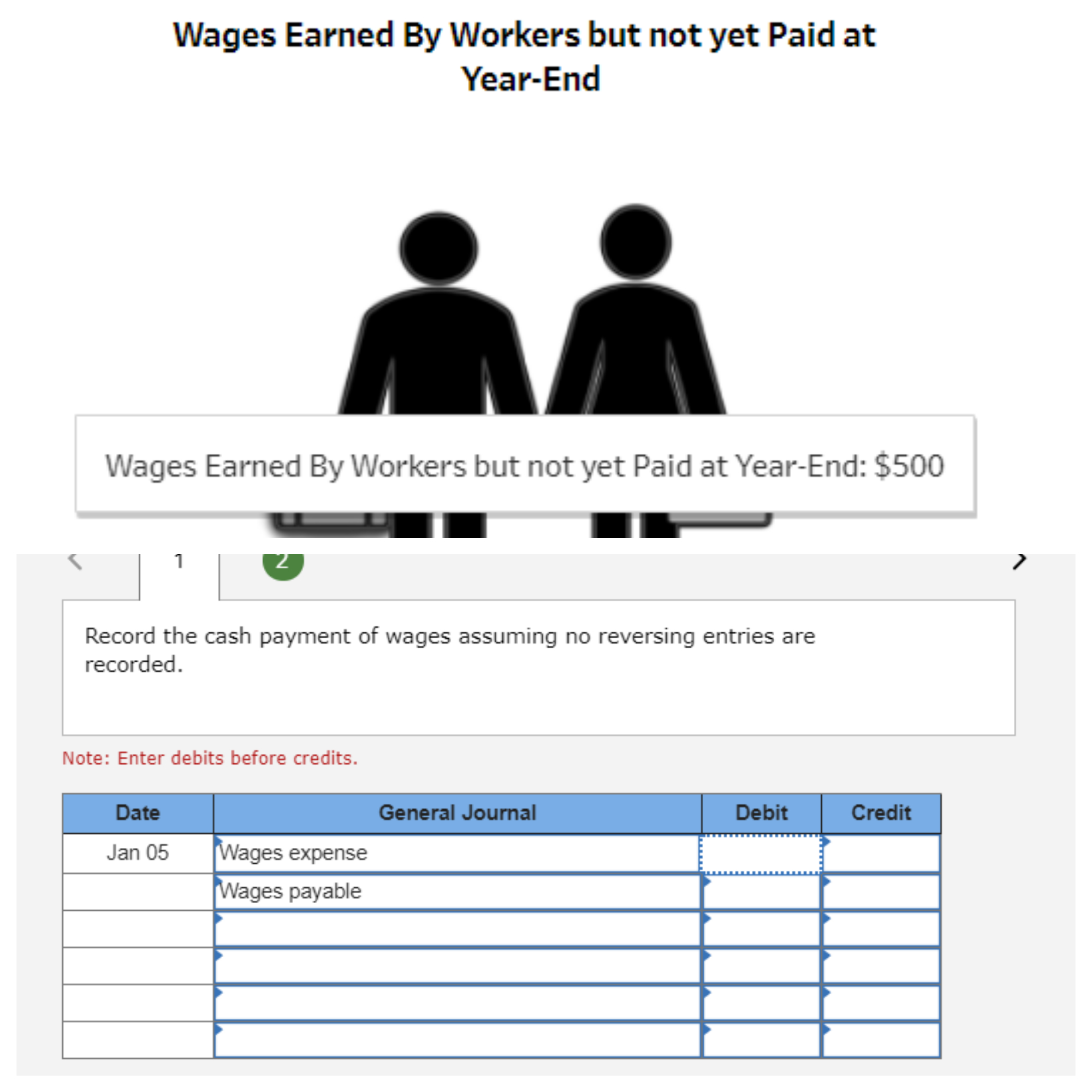

Transcribed Image Text:Wages Earned By Workers but not yet Paid at

Year-End

Wages Earned By Workers but not yet Paid at Year-End: $500

1

Record the cash payment of wages assuming no reversing entries are

recorded

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Wages expense

Wages payable

Jan 05

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- DATE OF PAY PERIOD ENDING 20- 20 PAYMENT NET СК. EARNINGS DEDUCTIONS EMPLOYEE MAR. TOTAL NAME ALLOW RATE SOC. SEC. FED. INC. STATE INC. HOSP. INS OTHERS TOTAL PAY NO. NUMBER STATUS HOURS REGULAR OVERTIME TOTAL MED. TAX TAX TAX TAX 10 2 3 6. 9. 10 11 10 12 11 13 14 13 15 14 16 17 15 18 16 17 18 25 12 7.arrow_forwardeBook Chart of Accounts Payroll Register General Journal Instructions NO. OI Mallal TOLAI HOUIS TOlal Eamings Name Allowances Status Worked Feb. 9-15 Rate Jan. 1-Feb. 8 Barone, William 40 $14.00 $3,360.00 Hastings, Gene 4 M 45 15.00 3,870.00 Nitobe, Isako 3) 46 12.00 3,168.00 Smith, Judy M. 42 13.00 3,276.00 2. Tarshis, Dolores S. 39 14.50 3,480.00 Social Security tax is withheld from the first $128,400 of earnings at the rate of 6.2%, Medicare tax is withheld at the rate of 1.45%, and city earnings tax at the rate of 1%, both applied to gross pay. Hastings and Smith have $35 withheld and Nitobe and Tarshis have $15 withheld for health insurance. Nitobe and Tarshis have $25 withheld to be invested in the bakers' credit union. Hastings has $18.75 withheld and Smith has $43.75 withheld under a savings bond purchase plan. Karen's Cupcakes' payroll is met by drawing checks on its regular bank account. The checks were issued in sequence, beginning with No. 365. Required: 1. Prepare a…arrow_forwardDIRECTIONS 1 Journalize the entry to RECORD the payroll 2 Journalize the entry to RECORD the employer's payroll taxes (SUTA rate is 3.7%) 3 Journalize the entry to deposit the FICA and FIT taxes TOTAL EARNINGS FICA OASDI FICA HI FIT W/H STATE TAX UNION DUES NET PAY $36,195.10 $2,244.10 $524.83 $6,515.00 $361.95 $500.00 $26,049.22 1 JOURNAL DATE DESCRIPTION DEBIT CREDIT 2 JOURNAL DATE DESCRIPTION DEBIT CREDIT…arrow_forward

- Francisco Company has 10 employees, each of whom earns $2,800 per month and is paid on the last day of each month. All 10 have been employed continuously at this amount since January 1. On March 1, the following accounts and balances exist in its general ledger. a. FICA-Social Security Taxes Payable, $3,472; FICA-Medicare Taxes Payable, $812. (The balances of these accounts represent total liabilities for both the employer's and employees' FICA taxes for the February payroll only.) b. Employees' Federal Income Taxes Payable, $7,000 (llability for February only). c. Federal Unemployment Taxes Payable, $336 (liability for January and February together). d. State Unemployment Taxes Payable, $3,024 (lability for January and February together). The company had the following payroll transactions. March 15 Issued check payable to Swift Bank, a federal depository bank authorized to accept employers' payments of FICA taxes and employee income tax withholdings. The $11,284 check is in payment of…arrow_forwardEmployee advances Amounts owed by customers for the sale of services (due in 30 days) Refundable income taxes Interest receivable Accepted a formal instrument of credit for services (due in 18 months) A loan to company president Dishonored a note for principal and interest which will eventually be collected $1,580 3,050 1,120 950 2,220 8,000 1,380 Based on this information, what amount should appear in the "Other Receivables" category? a. $18,300 b. $11,650 C. $13,030 d. $15,250arrow_forwardQuestion text Lidge Company of Texas (TX) is classified as a monthly depositor and pays its employees monthly. The following payroll information is for the second quarter of 20--. WITHHOLDINGS EMPLOYER'S Wages OASDI HI FIT OASDI HI April $86,100 $ 5,338.20 $1,248.46 $ 9,650 $ 5,338.20 $1,248.45 May 92,500 5,735.00 1,341.26 10,005 5,735.00 1,341.25 June 73,400 4,550.80 1,064.30 8,995 4,550.80 1,064.30 Totals $252,000 $15,624.00 $3,654.02 $28,650 $15,624.00 $3,654.00 The number of employees on June 12, 20-- was 11. a. Complete the following portion of Form 941. What are the payment due dates of each of the monthly liabilities assuming all deposits were made on time, and the due date of the filing of Form 941 (year 20--)?arrow_forward

- Payroll Journal Entry 1. Journalize the following data taken from the payroll register of CopyMasters as of April 15, 20—.When required, enter amounts in dollars and cents. If an amount box does not require an entry, leave it blank. Regular earnings $ 5,985 Overtime earnings 890 Deductions: Federal income tax 615 Social Security tax 426.25 Medicare tax 99.69 Pension plan 70 Health insurance premiums 250 United Way contributions 90 General Journal 1. Journalize the following data taken from the payroll register of CopyMasters as of April 15, 20—.When required, enter amounts in dollars and cents. If an amount box does not require an entry, leave it blank. Page: DATE ACCOUNT TITLE DOC.NO. POST.REF. DEBIT CREDIT 1 20-- Apr. 15 fill in the blank ae6550f64073076_2 fill in the blank ae6550f64073076_3 1 2 fill in the blank ae6550f64073076_5 fill in the blank…arrow_forwardView transaction list Journal entry worksheet 1 2 3 4 5 6 > Wages of $11,000 are earned by workers but not paid as of December 31. Note: Enter debits before credits. Transaction General Journal Debit Credit а. Record entry Clear entry View general journalarrow_forwardPlease complete the payrolll register. Note: this payroll register is partially done please complete the missing boxes with the right answers.arrow_forward

- Do not give image formatarrow_forwardPAGE 11 ACCOUNTING FOUATION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY Widmer Company had gross wages of $200,000 during the week ended June 17. The amount of wages subject to social security tax was $200,000, while the amount of wages subject to federal and state unemployment taxes was $30,000. Tax rates are as follows: General Journal a. Journalize the entry to record the payroll for the week of June 17. b. Journalize the entry to record the payroll tax expense incurred for the week of June 17. Social security 6.0% Medicare 1.5% State unemployment 5.4% Federal unemployment 0.8% The total amount withheld from employee wages for federal taxes was $40,500. General Journal Instructions Required: a. Journalize the entry to record the payroll for the week of June 17. b. Journalize the entry to record the payroll tax expense incurred for the week of June 17 1 2 4 DATE DESCRIPTION 5 9 7 B 9 10 JOURNALarrow_forwardАCTIVITY 1.Some companies use the overtime premium method to determine gross earnings. Use this method to complete the following payroll ledger. Overtime is paid at the time-and-a-half rate for all hours over 40? O.T. Hours Worked Gross Earnings Total Reg. 0.T. Premium S Hours Rate Hours Rate Employee S M W TH F 0.T. Total 16. Averell, B. 10 9 8 5 12 7 51 $11.40 11 $5.70 $581.40 $62.70 $644.10 - 17. Brownlee, K. 7.75 10 5 9.75 8 10 $9.50 18. Carter, M. 12 11 8 8.25 11 $8.60 - |- 19. Parks, K. 8.5 5.5 10 12 10.5 7 $12.50 - 20. Parr, J. 10 9.75 9 11.5 10 $10.20arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education