Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

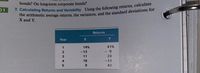

Transcribed Image Text:bonds? On long-term corporate bonds?

the arithmetic average returns, the variances, and the standard deviations for

X and Y.

Returns

Year

Y

1

14%

41%

-13

- 9

11

23

4

18

-13

42

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Month Zemin Corp. Market1 5% 3%2 2% 1%3 -1% 1%4 -2% -1%5 4% 4%6 3% 4% a. Given the following holding-period returns, compute the average returns and the standard deviations for the Zemin Corporation and for the market. b.If Zemin's beta is 0.83 and the risk-free rate is 9 percent, what would be an expected return for an investor owning Zemin? (Note: Because the preceding returns are based on monthly data, you will need to annualize the returns to make them comparable with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by 12.) c. How does Zemin's historical average return compare with the return you believe you should expect based on the capital asset pricing model and the firm's systematic risk?arrow_forwardA B с E F Investment Opportunity set for stocks and bonds with varios correlation coeffients SD s SDB 19 8 E(rs) 10 Weight in stocks WS -0.1 0.0 0.1 0.2 0.3 0.4 0.6 0.8 1.0 1.1 D E(TB) 5 Portfolio expected return ws(min) = (GB^2 - OBOSP) / (Os^2 + B^2 - 2*0BÚSP) E(rp) = ws(min) *E(rs)+(1-wg(min))*E(rb) = SDp = G -1 Portfolio Standard Deviation for Given Correlation 0 0.2 0.5 H Minimum Variance Portfolio 1arrow_forward129 12 13 1 2 3 Examine the Year-to-Year Total Return Data in the table below Compute the annual Risk Premiums for Stocks and Bonds Compute the average returns for stocks, bonds, and bills. Compute the standard deviation of returns for stocks, bonds, and bills Graph the Distribution of Total Returns for Stocks, Bonds, and Bills Complete ALL cells in Yellow 4 5 6 7 8 9 10 11 Year to Year Total Returns Large Long Company Government T-Bills Stocks Bonds 14 15 16 17 18 19 A B D E G 3. Risk and Return Calculations for Stocks, Bonds, and Bills 20 21 22 3000 -1.89% 3001 -11.89% 3002 -22.10% 3003 38.68% 3004 10.88% 3005 14.91% 3006 5.80% 3007 15.49% 3008 -37.00% 3009 26.46% Average 24 Return X✓ fx Standard 25 Deviation 26 3.93% 21.58% 22.16% 5.98% 8.32% 5.33% 14.23% 4.61% 6.51% 4.03% 10.53% 3.43% 10.56% 4.30% 14.11% 3.97% 22.56% 21.78% 3.24% 5.52% -25.75% 3.15% 10.50% 4.36% F 13.31% 0.94% Risk Premiums Large Long Company Government Stocks Bonds 50.00% 40.00% 30.00% 20.00% 10.00% 0.00% -10.00%…arrow_forward

- UNIT 7-7arrow_forwardunit 8-5arrow_forwardCalculate Cost of Common Equity using CAPM (Capital Asset Pricing Model), DCF (Discounted Cash Flow Model) and Bond Yield Risk Premium CAPM data: VEC’s beta = 1.2 The yield on T-bonds = 3% Market risk premium = 7% DCF data: Stock price = $27.08 Last year’s dividend (D0) = $2.10 Expected dividend growth rate = 4% Bond-yield-plus-risk-premium data: Risk premium = 5.5% Amount of retained earnings available = $80,000 Floatation cost for newly issued shares = 7%arrow_forward

- 7 Suppose the interest rates in the market for one-year, zero-coupon Treasury strips and for one-year, zero-coupon grade B corporate bonds are, respectively: i = 2.05% k = 7.80% Compute the probabilities of repayment and default as well as the risk premium.arrow_forwardConsider the following 3 assets portfolio: Asset US Equity Intl. Equity US Corporate Bonds Correlations US Equity Intl. Equity US Corporate Bonds 18% O 14.95% O 13.36% Weights O 1.79% 50% 30% 20% US Equity What is the portfolio's standard deviation? 1 0.8 0.1 St. Dev. 18% 16.50% 5% Intl. Equity 1 -0.1 US Corporate Bonds 0.1 -0.1 1arrow_forwardCurrently, 3-year Treasury securities yield8.7%,7-year Treasury securities yield8.4%, and 10 -year Treasury securities yield8.2%. If the expectations theory is correct, what does the market expect will be the yield on 3-year Treasury securities seven years from today? 8.13%8.33%7.73%7.53%7.93%arrow_forward

- Consider the following information on different asset classes from 1926 through 2020. Arithmetic Mean 12.2% 16.2 6.5 6.1 5.3 3.3 2.9 Series Large-company stocks Small-company stocks Long-term corporate bonds Long-term government bonds Intermediate-term government bonds U.S. Treasury bills Inflation a. What is the real return on long-term government bonds? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. What is the real return on long-term corporate bonds? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. Real return b. Real return % %arrow_forward8. A portfolio consists of bonds, stocks, commodities and real estates. The portfolio weightings, expected returns, variances and correlation matrix are shown below. Bonds Stocks Commodities Real Estate Correlation Matrix Bonds Stocks Commodities Real Estate Weight 50% 10% 15% 25% Bonds 1.0 Stocks -0.2 1.0 Expected Return 8% 12% 20% 16% Commodities 0.1 0.4 1.0 Variance (%²) 10 30 15 20 Real Estate 0.3 0.6 0.2 1.0 a. Calculate the expected return and the standard deviation of the return of the portfolio.arrow_forwardGiven the following calculate the Cost of Equity. Beta Equity Risk Premium Pre-tax Yield on Debt Return on the Bond Market Return on the Stock Market Risk Free Rate Tax Weight of Debt in the Total Capital Structure Weight of Equity in the Total Capital Structure 1.5 5.5% 6.0% 4.5% 8.0% 2.5% 25.0% 25.0% 75.0%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education