SWFT Comprehensive Vol 2020

43rd Edition

ISBN: 9780357391723

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

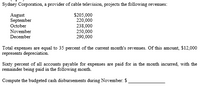

Transcribed Image Text:Sydney Corporation, a provider of cable television, projects the following revenues:

August

September

October

$205,000

220,000

238,000

250,000

290,000

November

December

Total expenses are equal to 35 percent of the current month's revenues. Of this amount, $12,000

represents depreciation.

Sixty percent of all accounts payable for expenses are paid for in the month incurred, with the

remainder being paid in the following month.

Compute the budgeted cash disbursements during November: $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Finch Company began its operations on March 31 of the current year. Finch has the following projected costs: April May June $155,600 $192,800 $213,600 Manufacturing costs* Insurance expense** 880 Depreciation expense 2,180 Property tax expense*** 590 *Of the manufacturing costs, three-fourths is paid for in the month they are incurred; one-fourth is paid in the following month. **Insurance expense is $880 a month; however, the insurance is paid four times yearly in the first month of the quarter (i.e., January, April, July, and October). ***Property tax is paid once a year in November. 880 2,180 590 880 2,180 590 The cash payments expected for Finch Company in the month of May are O a. $183,500 O b. $144,600 Oc. $38,900 O d. $222,400arrow_forwardFinch Company began its operations on March 31 of the current year. Finch has the following projected costs: May $198,000 April $156,000 a. $49,500 b. $252,000 c. $202,500 d. $153,000 Manufacturing costs* Insurance expense** Depreciation expense Property tax expense*** *Of the manufacturing costs, three-fourths is paid for in the month they are incurred; one-fourth is paid in the following month. **Insurance expense is $900 a month; however, the insurance is paid four times yearly in the first month of the quarter (i.e., January, April, July, and October). ***Property tax is paid once a year in November. The cash payments for Finch Company expected in the month of June are 900 1,850 500 900 1,850 June 500 $204,000 900 1,850 500 Previous Nextarrow_forwardNoventis Corporation prepared the following estimates for the four quarters of the current year:Additional Information• First-quarter administrative costs include the $160,000 annual insurance premium.• Advertising costs paid in the second quarter relate to television advertisements that will be broadcast throughout the entire year.• No special items affect income during the year.• Noventis estimates an effective income tax rate for the year of 40 percent. a. Assuming that actual results do not vary from the estimates provided, determine the amount of net income to be reported each quarter of the current year.b. Assume that actual results do not vary from the estimates provided except for that in the third quarter, the estimated annual effective income tax rate is revised downward to 38 percent. Determine the amount of net income to be reported each quarter of the current year.arrow_forward

- Accountarrow_forwardFinch Company began its operations on March 31 of the current year. Finch has the following projected costs: April May June Manufacturing costs* $156,800 $195,200 $217,600 Insurance expense** 1,000 1,000 1,000 Depreciation expense 2,000 2,000 2,000 Property tax expense*** 500 500 500 *Of the manufacturing costs, three-fourths is paid for in the month they are incurred; one-fourth is paid in the following month.**Insurance expense is $1,000 a month; however, the insurance is paid four times yearly in the first month of the quarter (i.e., January, April, July, and October).***Property tax is paid once a year in November. The cash payments expected for Finch Company in the month of April are a.$120,600 b.$123,100 c.$121,100 d.$122,600arrow_forwardFinch Company began its operations on March 31 of the current year. Finch has the following projected costs: April May June Manufacturing costs* $156,800 $195,200 $217,600 Insurance expense** 1,000 1,000 1,000 Depreciation expense 2,000 2,000 2,000 Property tax expense*** 500 500 500 *Of the manufacturing costs, three-fourths is paid for in the month they are incurred; one-fourth is paid in the following month. **Insurance expense is $1,000 a month; however, the insurance is paid four times yearly in the first month of the quarter (i.e., January, April, July, and October).***Property tax is paid once a year in November. The cash payments expected for Finch Company in the month of April are Group of answer choices $120,600 $123,100 $121,100 $122,600arrow_forward

- Finch Company began its operations on March 31 of the current year. Finch has the following projected costs: June $201,000 Manufacturing costs" Insurance expense** April May $157,200 $197,600 970 970 2,200 420 2,200 420 970 Depreciation expense Property tax expense*** "Of the manufacturing costs, three-fourths are paid for in the month they are incurred; one-fourth is paid in the following month. **Insurance expense is $970 a month; however, the insurance is paid four times yearly in the first month of the quarter, (.e., January, April, July, and October). ***Property tax is paid once a year in November. The cash payments expected for Finch Company in the month of May are O&$187.500 b. $39,300 Oe5148,200 Od $226,800 2,200 420arrow_forwardSalo Enterprise which makes up its accounts to 30 June each year, has two types of fixed assets namely Motor vehicles and Office equipment. Annual depreciation on Motor vehicles is calculated at the rate of 20% per annum on book value. Provision for depreciation is to be made on the basis of one month's ownership, one month's provision for depreciation. Depreciation on office equipment is calculated at the rate of 15 % per annum on cost, based on assets in existence at the end of the year. On 30 June 1999, the following information has been extracted from the Balance Sheet of Salo Enterprise. Fixed assets Motor vehicles Office equipment Cost (RM) 280,000 143,000 Net Book Value (RM) 108,000 78,000 On 1 October 1999, the business bought a second hand car from a friend for RM28.000. The car was sent for repairs and the repair cost amounted to RM2,300. An air conditioning unit was also installed in the car at a cost of RM1000. The business bought two photocopying machines on 1 February…arrow_forwardStay Handy company is a large company providing door to door delivery service forgroceries and other daily need items. In the most recent year, company had 60 millionmembers, through which provided it a revenue of $33,347 in the most recent year. Thedetails relating to Costs and expenses for the year were as follows:ParticularsCost of revenueSelling, general, and administrative expensesDepreciation and amortizationAmount (S in millions)§14 958S§7 9948,150Form the total cost of revenue 30% was fixed and the selling, general and administrativeexpenses are fixed to the extent of 70% to the number of members. How manymemberships does the company need to break-even? (All interim calculations and finalanswers should be rounded off to one decimal place)arrow_forward

- Finch Company began its operations on March 31 of the current year. Finch has the following projected costs: April May June Manufacturing costs (1) $155,800 $190,300 $203,900 Insurance expense (2) 1,080 1,080 1,080 Depreciation expense 2,110 2,110 2,110 Property tax expense (3) 540 540 540 (1) Of the manufacturing costs, three-fourths are paid for in the month they are incurred; one-fourth is paid in the following month.(2) Insurance expense is $1,080 a month; however, the insurance is paid four times yearly in the first month of the quarter, (i.e., January, April, July, and October).(3) Property tax is paid once a year in November. The cash payments expected for Finch Company in the month of May are a.$38,950 b.$181,675 c.$220,625 d.$142,725arrow_forwardSafeMark Financial Inc. was organized on February 28. Projected selling and administrative expenses for each of the first three months of operations are as follows: March $102,200 April 96,100 May 87,500 Depreciation, insurance, and property taxes represent $22,000 of the estimated monthly expenses. The annual insurance premium was paid on February 28, and property taxes for the year will be paid in June. 59% of the remainder of the expenses are expected to be paid in the month in which they are incurred, with the balance to be paid in the following month. Prepare a schedule indicating cash payments for selling and administrative expenses for March, April, and May. SafeMark Financial Inc. Schedule of Cash Payments for Selling and Administrative Expenses For the Three Months Ending May 31 March April May March expenses: Paid in March $fill in the blank 1 Paid in April $fill in the blank 2 April expenses: Paid in April fill in the…arrow_forwardKinston Industries issued $4,000,000 in commercial paper which matures in six months and received $3,876,000. Calculate the effective annual rate that Kinston is paying.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you