FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

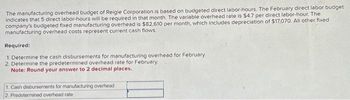

Transcribed Image Text:The manufacturing overhead budget of Reigle Corporation is based on budgeted direct labor-hours. The February direct labor budget

indicates that 5 direct labor-hours will be required in that month. The variable overhead rate is $4.7 per direct labor-hour. The

company's budgeted fixed manufacturing overhead is $82,610 per month, which includes depreciation of $17,070. All other fixed

manufacturing overhead costs represent current cash flows.

Required:

1. Determine the cash disbursements for manufacturing overhead for February

2. Determine the predetermined overhead rate for February.

Note: Round your answer to 2 decimal places.

1. Cash disbursements for manufacturing overhead

2. Predetermined overhead rate

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- what is the Total factory overhead cost variance?arrow_forwardCost classifications For each of the following costs, check the columns that most likely apply (both variable and fixed might apply for some costs).Product Costs Direct Indirect Period Variable FixedWages of assembly-line workersDepreciation of plant equipmentGlue and threadOutbound shipping costsRaw materials handling costsSalary of public relations managerProduction run setup costsPlant utilitiesElectricity cost of retail storesResearch and developmentexpensearrow_forwardActivity Rates and Determining the cost of a product, which consist of direct materials, direct labor, and factory overhead.Product Costs using Activity-Based Costing Lonsdale Inc. manufactures entry and dining room lighting fixtures. Five activities are used in manufacturing the fixtures. These activities and their associated budgeted activity costs and A measure of activity that is related to changes in cost. Used in analyzing and classifying cost behavior.activity bases are as follows: Activity BudgetedActivity Cost Activity Base Casting $329,350 Machine hours Assembly 214,600 Direct labor hours Inspecting 41,650 Number of inspections Changing the characteristics of a machine to produce a different product.Setup 38,250 Number of setups Materials handling 37,800 Number of loads Corporate records were obtained to estimate the amount of activity to be used by the two products. The estimated activity-base usage quantities and units produced follow: Activity…arrow_forward

- A company uses activity-based costing to determine the costs of its three products: A, B, and C. The budgeted cost and activity for each of the company's three activity cost pools are shown in the following table: Budgeted Activity Activity Cost PoolBudgeted Cost Product AProduct BProduct Activity 1 7,500 10,500 21,500 Activity 2 8,500 16,500 9,500 Activity 3 4,000 2,500 3,125 How much overhead will be assigned to Product B using activity-based costing? 85,000 60,000 112,000arrow_forwardWhat does a manufacturing overhead budget tell us?arrow_forwardWhat term refers to a grouping of costs that consists of direct labor and factory overhead costs and is considered to be the cost of converting the materials into a finished product? Group of answer choices prime costs conversion costs allocation costs just-in-time costsarrow_forward

- A company uses activity-based costing to determine the costs of its three products: A, B, and C. The budgeted cost and activity for each of the company's three activity cost pools are shown in the following table: Budgeted Activity Activity Cost PoolBudgeted Cost Product AProduct BProduct Activity 1 7,500 10,500 21,500 Activity 2 8,500 16,500 9,500 Activity 3 4,000 2,500 3,125 How much overhead will be assigned to Product B using activity-based costing? 85,000 60,000 112,000arrow_forward3. Calculate the budgeted unit cost of basic and deluxe trophies if Acclaim allocates overhead costs in each department using activity-based costing, where setup costs are allocated based on number of batches and general overhead costs for each department are allocated based on direct manufacturing labor costs of each department. 4. Explain briefly why plantwide, department, and activity-based costing systems show different costs for the basic and deluxe trophies. Which system would you recommend and why?arrow_forwardWhat is a key difference between variable costing and absorption costing? a. The usage of homogenous cost pools. b. The classification of fixed factory overhead. c. classification of direct materials and labor. d. The choice of allocation base.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education