FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

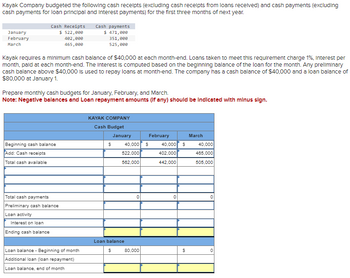

Transcribed Image Text:Kayak Company budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding

cash payments for loan principal and Interest payments) for the first three months of next year.

January

February

March

Cash Receipts

$ 522,000

402,000

465,000

Kayak requires a minimum cash balance of $40,000 at each month-end. Loans taken to meet this requirement charge 1%, Interest per

month, paid at each month-end. The Interest is computed based on the beginning balance of the loan for the month. Any preliminary

cash balance above $40,000 is used to repay loans at month-end. The company has a cash balance of $40,000 and a loan balance of

$80,000 at January 1.

Prepare monthly cash budgets for January, February, and March.

Note: Negative balances and Loan repayment amounts (if any) should be indicated with minus sign.

Beginning cash balance

Add: Cash receipts

Total cash available

Total cash payments

Preliminary cash balance

Loan activity

Interest on loan

Ending cash balance

Cash payments

$ 471,000

351,000

525,000

Loan balance - Beginning of month

Additional loan (loan repayment)

Loan balance, end of month

KAYAK COMPANY

Cash Budget

$

January

40,000 $

522,000

562,000

Loan balance

$

80,000

February

40,000 $

402,000

442,000

$

March

40,000

465,000

505,000

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vinubhaiarrow_forwardFact Pattern: The Raymar Company is preparing its cash budget for the months of April and May. The firm has established a $200,000 line of credit with its bank at a 12% annual rate of interest on which borrowings for cash deficits must be made in $10,000 increments. There is no outstanding balance on the line of credit loan on April 1. Principal repayments are to be made in any month in which there is a surplus of cash. Interest is to be paid monthly. If there are no outstanding balances on the loans, Raymar will invest any cash in excess of its desired end-of-month cash balance in U.S. Treasury bills. Raymar intends to maintain a minimum balance of $100,000 at the end of each month by either borrowing for deficits below the minimum balance or investing any excess cash. Expected monthly collection and disbursement patterns are shown below. . . . Collections: 50% of the current month's sales budget and 50% of the previous month's sales budget Accounts Payable Disbursements: 75% of the…arrow_forwardThe following is the sales budget for Lemonis, Incorporated, for the first quarter of 2021: January February March Sales budget $198,000 $218,000 $241,000 Credit sales are collected as follows: 55 percent in the month of the sale. 30 percent in the month after the sale. 15 percent in the second month after the sale. The accounts receivable balance at the end of the previous quarter was $82,000 ($52,000 of which was uncollected December sales). a. Calculate the sales for November. (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. Calculate the sales for December. (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. Calculate the cash collections from sales for each month from January through March. (Do not round Intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) a. November sales b. December sales c. January cash collections c. February cash collections c.…arrow_forward

- i do not understand why the loan payment amount is wrongarrow_forwardGroup of answer choices $3,729,968 $3,781,600 $4,025,200 $4,408,000arrow_forwardKarim Corporation requires a minimum $8,800 cash balance. Loans taken to meet this requirement cost 1% interest per month (paid at the end of each month). Any preliminary cash balance above $8,800 is used to repay loans at month-end. The cash balance on July 1 is $9,200, and the company has no outstanding loans. Budgeted cash receipts (other than for loans received) and budgeted cash payments (other than for loan or interest payments) follow. Cash receipts Cash payments Beginning cash balance Add: Cash receipts Total cash available Less: Cash payments for Interest on loan Interest revenue Prepare a cash budget for July, August, and September. Note: Negative balances and Loan repayment amounts (If any) should be Indicated with minus sign. Round your final answers to the nearest whole dollar. Total cash payments Preliminary cash balance Loan activity July $ 24,800 29,208 Ending cash balance August $ 32,800 30,800 Loan balance Beginning of month Additional loan (loan repayment) Loan…arrow_forward

- Kayak Company budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for loan principal and interest payments) for the first three months of next year. Cash Receipts Cash payments January $ 520,000 $ 463,500 February 401,500 345,000 March 465,000 527,000 Kayak requires a minimum cash balance of $50,000 at each month-end. Loans taken to meet this requirement charge 1%, interest per month, paid at each month-end. The interest is computed based on the beginning balance of the loan for the month. Any preliminary cash balance above $50,000 is used to repay loans at month-end. The company has a cash balance of $50,000 and a loan balance of $100,000 at January 1. Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign.)arrow_forwardKayak Company budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for loan principal and interest payments) for the first three months of next year. January February March Cash Receipts 523,000 $ Beginning cash balance Total cash available Kayak requires a minimum cash balance of $40,000 at each month-end. Loans taken to meet this requirement charge 1%, Interest per month, paid at each month-end. The Interest is computed based on the beginning balance of the loan for the month. Any preliminary cash balance above $40,000 is used to repay loans at month-end. The company has a cash balance of $40,000 and a loan balance of $80,000 at January 1. 408,500 476,000 Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign.) Total cash payments Preliminary cash balance Loan activity Ending cash balance Cash payments $ 469,800…arrow_forwardDineshbhaiarrow_forward

- A company requires a minimum $12,400 cash balance at each month-end. If necessary, a loan is taken to meet this requirement at a cost of 1% interest per month (paid at the end of each month). Any preliminary cash balance above $12,400 is used to repay loans at month-end. The cash balance on March 1 is $12,400, and the company has no outstanding loans. Budgeted cash receipts from sales are: March, $26,000; April, $32,400; and May, $41,000. Budgeted cash payments (excluding loan or interest payments) are: March, $30,000; April, $30,200; and May, $32,400. Required: Prepare a cash budget for March, April, and May. Note: Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Round your final answers to the nearest whole dollar. Beginning cash balance Add: Cash receipts from sales Total cash available Add: Cash receipts from sales Total cash payments Preliminary cash balance Loan activity Additional loan (loan repayment) Ending cash balance Loan balance,…arrow_forwardSpartan Industries has budgeted the following information for January Cash Receipts $ 43,400 Beginning Cash Balance $ 16,400 Cash Payments $ 61,400 Desired Ending Cash Balance $ 11,400 If there is not enough cash on hand to meet the desired ending balance, the company borrows money from the bank. All cash is borrowed at the beginning of the month in $1,700 increments. Interest is paid monthly on the first day of the following month. The interest rate is 1 percent per month. The company had no debt before January 1 The shortage or surplus of cash before considering cash borrowed or interest payments in January would be a: Multiple Choice $1,600 shortage $9,800 shortage.arrow_forwardHow do you get the last addition loan and ending cash balance?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education