Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Ajit

Transcribed Image Text:6A

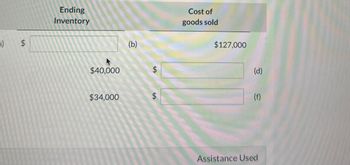

Ending

Inventory

(b)

Cost of

goods sold

$127,000

$40,000

$34,000

A

SA

(d)

(f)

Assistance Used

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Q. 3.. Compute the commission and net proceeds for the sale on consignment. Trucking & Gross Sales $42,800 Commission Rate 6% Commission Delivery $988.00 Storage $650 Air Freight $0 Net Proceedsarrow_forwardFor each of the following, determine the missing amounts. SalesRevenue Cost ofGoods Sold GrossProfit OperatingExpenses NetIncome $100,000 $ $ $30,000 $12,000 $ $135,000 $125,000 $ $80,000arrow_forwardBeginningInventory Purchases Cost of GoodsAvailable for Sale EndingInventory Cost ofgoods sold $ 87,000 $ 117,000 $ (a) $ (b) $ 127,000 $ 56,000 $ (c) $ 121,000 $ 40,000 $ (d) $ (e) $ 107,000 $ 167,000arrow_forward

- 5. Abu Ali Company purchased equipment for SR15,000. sales tax on the purchase freight charges repairs for damage during installation installation costs insurance of equipment after installation What is the cost of the equipment? a. 15,925 b. 15,500 c. 15,000 d. 16,275 SR500 200 350 225 300arrow_forwardRevenue 11,600,000ExpensesSalaries & Wages 7,600,000Employer NIS Contribution 1,400,000Rent and Rates 2.400,000Interest 500,000Maintenance 120,000Depreciation 550,000Loss on Disposal of Vehicle 80,000Telephone 235,000Electricity 255,000General Expenses 700,000Donations 85,000Provision for Bad Debts 80,000Fines and Penalties 115,000Drawings 105,000 14,225,000Net Loss2,625,000 Notes to the Income Statement1. $55,000 of the drawings relate to Mrs. Shine and $50,000 to Mr. Rain2. Gross Salary for Mrs. Shine was $250,000 per month, and $200,000 for Mr. Rain. Bothpartners worked in the business during the year.3. The annual allowance was $450,000.4. The partners agreed to dispose of an old pick-up truck with a net book value of $350,000for $400,000. The pick-up had a tax written down value of $300,000.5. Donations of $60,000 were made to a local political party to fund its campaign. Theremainder was donated to an approved local children’s home.6. The partners could not determine if all…arrow_forwardO Given Gross Margin of $212,000, Cost of Goods Sold of $544,000, Sales of $756,000 and net income of $65,000 what is Selling, General and Administrative expense 8$147.000 6. $132,000 c. $156,000 d. $488,000 e. $212,000arrow_forward

- Calculate the sales from the given information Cost of goods sold is $38,000 Net income is $14,625 Depreciation is $5000 Tax rate is 35% A. $35,500 B. $51,619 C. $69,000 D. $64,000arrow_forwardRevenues Costs of Goods Sold Gross Profit Selling, General and Admin Depreciation EBIT Income tax (35%) Net Income Capital Purchases Changes to NWC A. -$258,750.00 B. -$153,046.63 Year O O C. $195,972.79 O D. $201,324.52 -600,000 +36,000 Year 1 800,000 Year 2 Year 3 800,000 800,000 -320,000 -320,000 -320,000 480,000 480,000 480,000 -105,000 -105,000 -105,000 -200,000 -200,000 -200,000 175,000 175,000 175,000 Cromwell Industries is considering a new project which will have costs, revenues, etc. as shown by the data above. If the cost of capital is 8.5%, what is the net present value (NPV) of this project? -61,250 -61,250 -61,250 113,750 113,750 113,750 -12,000 -12,000 -12,000arrow_forwardThe current expenscs arc (Rs. in crorcs) Particulars Rs Particulars Rs. Particulars Rs. RM Consumed 15,017 Rent 29 Depreciation Plant 560 and Machinery Direct Labour 280 Powar and Fucl 10 Opcning WIP 250 Excise Dutics 5993 Equipment HireT Charges Closing WIP 120 Repairs 165 Office spar chemicals and 71 Socurity I Charges Depreciation 45 Printing & 8 Rent Office 30 Office Stationary Insurance 50 Office Salarices 280 Traveling and 20 Conveyance to Salesman Depreciation Advertising on &82 Production staff salary 100 transport equipment Publicity Sales 50000 You are nequred to help Uic peoduction and cost departnnent by Tinding the per unit cost in different functions and the profit IN tof seling 300000 tornes CLO3arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT