FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

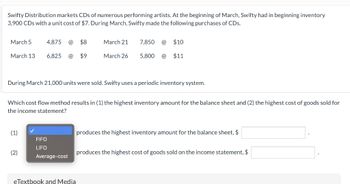

Transcribed Image Text:Swifty Distribution markets CDs of numerous performing artists. At the beginning of March, Swifty had in beginning inventory

3,900 CDs with a unit cost of $7. During March, Swifty made the following purchases of CDs.

March 5

March 13

(1)

4,875 @ $8

6,825 @ $9

(2)

During March 21,000 units were sold. Swifty uses a periodic inventory system.

✓

Which cost flow method results in (1) the highest inventory amount for the balance sheet and (2) the highest cost of goods sold for

the income statement?

FIFO

LIFO

March 21

Average-cost

March 26

eTextbook and Media

7,850

$10

5,800 @ $11

produces the highest inventory amount for the balance sheet, $

produces the highest cost of goods sold on the income statement, $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Baby Store had a beginning inventory on January 1 of 320 full-size strollers at a cost of $180 per unit. During the year, the following purchases were made: Units Unit Cost Mar. 15 78 $181 July 20 62 180 Sept. 4 25 178 Dec. 2 10 173 At the end of the year, there were 35 units on hand. The Baby Store uses a periodic inventory system. During the year, The Baby Store sold the strollers for $300 per unit. Calculate the number of units sold during the year and total sales revenue. Number of units sold units Sales revenuearrow_forwardGreg’s Bicycle Shop has the following transactions related to its top-selling Mongoose mountain bike for the month of March. Greg's Bicycle Shop uses a periodic inventory system. Date Transactions Units Unit Cost Total Cost March 1 Beginning inventory 20 $ 175 $ 3,500 March 5 Sale ($250 each) 15 March 9 Purchase 10 195 1,950 March 17 Sale ($300 each) 8 March 22 Purchase 10 205 2,050 March 27 Sale ($325 each) 12 March 30 Purchase 8 225 1,800 $ 9,300 For the specific identification method, the March 5 sale consists of bikes from the beginning inventory, the March 17 sale consists of bikes from the March 9 purchase, and the March 27 sale consists of four bikes from the beginning inventory and eight bikes from the March 22 purchase. Required: ***Only Ending…arrow_forwardConcord Distribution markets CDs of the performing artist Fishe. At the beginning of October, Concord had in beginning inventory 2,500 of Fishe’s CDs with a unit cost of $7. During October, Concord made the following purchases of Fishe’s CDs. Oct. 3 3,125 @ $8 Oct. 19 3,750 @ $10 Oct. 9 4,375 @ $9 Oct. 25 5,000 @ $11 During October, 13,625 units were sold. Concord uses a periodic inventory system. Calculate weighted average cost per unit. (Round answer to 2 decimal places, e.g. 2.25.) Weighted average cost per unit $Type your answer herearrow_forward

- i need the answer quicklyarrow_forwardABC Company employs a periodic inventory system and sells its inventory to customers for $20 per unit. ABC Company had the following inventory information available for May: May 1 May 3 May 8 May 13 May 18 May 20 May 24 May 30 Beginning inventory 1,900 units @ $10.20 cost per unit Purchased 2,100 units @ $11.60 cost per unit Sold 1,400 units Purchased 3,700 units @ $8.10 cost per unit Sold 2,600 units Purchase 4,100 units @ $14.70 cost per unit Sold 2,900 units Purchased 2,200 units @ $12.60 cost per unit During May, ABC Company reported operating expenses of $14,000 and had an income tax rate of 36%. Calculate the amount of net income shown on ABC Company's income statement for May using the LIFO method.arrow_forwardNew Tech Cycles started October with 12 bicycles that cost $42 each. On October 16, New Tech purchased 40 bicycles at $68 each. On October 31, New Tech sold 28 bicycles for $99 each. Requirements 1. Prepare New Tech Cycle's perpetual inventory record assuming the company uses the FIFO inventory costing method. 2. Journalize the October 16 purchase of merchandise inventory on account and the October 31 sale of merchandise inventory on account.arrow_forward

- Swifty Distribution markets CDs of numerous performing artists. At the beginning of March, Swifty had in beginning inventory 3,900 CDs with a unit cost of $7. During March, Swifty made the following purchases of CDs. March 5 March 13 4,875 (a) 6,825 $8 $9 March 21 X Your answer is incorrect. March 26 During March 21,000 units were sold. Swifty uses a periodic inventory system. Determine the cost of goods available for sale. 7,850 @ $10 $11 Cost of goods available for sale $ 5,800 181725arrow_forwardGlee Distribution markets CDs of the performing artist Unique. At the beginning of October, Glee had in beginning inventory 2,000 of Unique's CDs with a unit cost of $7. During October, Glee made the following purchases of Unique's CDs. Oct. 3 2,500 @ $8 Oct. 19 3,000 @ $10 Oct. 9 3,500 @ $9 Oct. 25 4,000 @ $11 During October, 10,900 units were sold. Glee uses a periodic inventory system. v (a) Determine the cost of goods available for sale. Cost of goods available for sale Open Show Work Click if you would like to Show Work for this question: LINK TO TEXTarrow_forwardThe Baby Store had a beginning inventory on January 1 of 320 full-size strollers at a cost of $180 per unit. During the year, the following purchases were made: Units Unit Cost Mar. 15 78 $181 July 20 62 180 Sept. 4 25 178 Dec. 2 10 173 At the end of the year, there were 35 units on hand. The Baby Store uses a periodic inventory system. (a) Determine the cost of goods available for sale. Cost of goods available for salearrow_forward

- GameGirl, Incorporated, has the following transactions during August. August 6 Sold 60 handheld game devices for $150 each to DS Unlimited on account, terms 3/10, net 60. The cost of the 60 game devices sold was $130 each. August 10 DS Unlimited returned four game devices purchased on August 6 since they were defective. August 14 Received full amount due from DS Unlimited. Required:Prepare the transactions for GameGirl, Incorporated, assuming the company uses a perpetual inventory system. The items returned on August 10 were considered worthless to GameGirl and were discarded. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardGreg’s Bicycle Shop has the following transactions related to its top-selling Mongoose mountain bike for the month of March. Greg's Bicycle Shop uses a periodic inventory system. Date Transactions Units Unit Cost Total Cost March 1 Beginning inventory 20 $ 175 $ 3,500 March 5 Sale ($250 each) 15 March 9 Purchase 10 195 1,950 March 17 Sale ($300 each) 8 March 22 Purchase 10 205 2,050 March 27 Sale ($325 each) 12 March 30 Purchase 8 225 1,800 $ 9,300 For the specific identification method, the March 5 sale consists of bikes from the beginning inventory, the March 17 sale consists of bikes from the March 9 purchase, and the March 27 sale consists of four bikes from the beginning inventory and eight bikes from the March 22 purchase. Required: ***Only Ending…arrow_forwardCamino Jet Engines, Inc. Is a supplier of jet engine parts. The company began the most reecent Fiscal Year with inventory of 75 units. The units cost 8,500 each. The company uses a perpetual inventory system to account for inventory. The following transactions occurred during the year. a. Purchases 50 additional units at a cost of $8,900 per unit. Terms of the purchases were 2/10, n/30, and payments was made within 10-days discount period. The company uses the gross method to record purchase discounts. The merchandise was purchased f.o.b shipping point. The company paid freight charges of $500 per unit b. 6 of the units purchased during the year were returned to the manufacturer for credit. The company were also given credit for the freight charges of $500 per unit it had paid on the original purchase. The units were defective and were returned two days after they were received c. Sales for the year totaled…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education