SWFT Individual Income Taxes

43rd Edition

ISBN: 9780357391365

Author: YOUNG

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

sahj

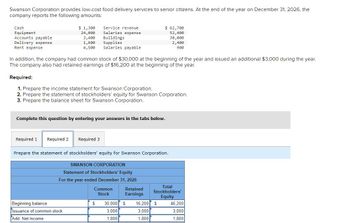

Transcribed Image Text:Swanson Corporation provides low-cost food delivery services to senior citizens. At the end of the year on December 31, 2026, the

company reports the following amounts:

Cash

Equipment

Accounts payable

Delivery expense

Rent expense

$ 1,300

24,000

3,400

Service revenue

Salaries expense

Buildings

$ 62,700

52,400

30,000

1,600

Supplies

4,500 Salaries payable

2,400

900

In addition, the company had common stock of $30,000 at the beginning of the year and issued an additional $3,000 during the year.

The company also had retained earnings of $16,200 at the beginning of the year.

Required:

1. Prepare the income statement for Swanson Corporation.

2. Prepare the statement of stockholders' equity for Swanson Corporation.

3. Prepare the balance sheet for Swanson Corporation.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Required 3

Prepare the statement of stockholders' equity for Swanson Corporation.

SWANSON CORPORATION

Statement of Stockholders' Equity

For the year ended December 31, 2026

Beginning balance

Issuance of common stock

Add: Net income

Common

Stock

Retained

Earnings

Total

Stockholders'

Equity

30,000 $ 16,200 $

46,200

3,000

3,000

3,000

1,800

1,800

1,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 6 images

Knowledge Booster

Similar questions

- Hi, Could you please help me fill in the missing values labeled a through i. Thank youarrow_forwardAlex Corporation has the following account balances on December 31, 2020: Accounts receivable ₱ 400,000 Allowance for uncollectible accounts 8,400 Alex completed the following transactions in 2019: Net credit sales, ₱ 4,000,000. Collections on accounts, ₱ 3,870,000. Write-off of uncollectible accounts, ₱ 10,000. Recovery of accounts previously written-off, ₱ 2,000. Uncollectible accounts expense, 2/3 of 1% of net credit sales. REQUIRED: 1. Journalize the foregoing transactions. 2. Compute the balance of accounts receivable and allowance for uncollectible accounts at December 31, 2020. What amount of Accounts receivable, net would Alex report on its December 31, 2020 balance sheet? 3. Assume that Alex uses the aging of accounts instead of the percent of sales method in estimating uncollectible accounts. Analysis indicates that Php 30,800 of outstanding accounts on December 31, 2020 may prove to be uncollectible. Compute the uncollectible accounts expense and the…arrow_forwardFor the year ended December 31, 2020, Bramble Electrical Repair Company reports the following summary payroll data. Gross earnings: Administrative salaries $193,000 Electricians’ wages 365,000 Total $558,000 Deductions: FICA taxes $37,293 Federal income taxes withheld 167,500 State income taxes withheld (3%) 16,740 United Fund contributions payable 27,900 Health insurance premiums 18,000 Total $267,433 Bramble’s payroll taxes are Social Security tax 6.2%, Medicare tax 1.45%, state unemployment 2.5% (due to a stable employment record), and 0.8% federal unemployment. Gross earnings subject to Social Security taxes of 6.2% total $471,000, and gross earnings subject to unemployment taxes total $127,000. No employee exceeds the $127,200 limit related to FICA taxes. (a) Prepare a summary journal entry at December 31 for the full year’s payroll. (b) Journalize the adjusting entry at December 31 to…arrow_forward

- 1. The total amount remitted to the BIR through the Tax Remittance Advice? 2. How much is the unused Notice of Cash Allocation (NCA) for the quarter? 3. The entry to record the payment of payroll include a credit to? 4. The entry to recognize the payroll includes a?arrow_forward1. What amount should be reported as sales revenue including the revenue earned from points for 2020? 2. What is the revenue earned from loyalty points for 2021?arrow_forwardFor the year ended December 31, 2020, Lily Electrical Repair Company reports the following summary payroll data. Gross earnings: Administrative salaries $199,000 Electricians’ wages 375,000 Total $574,000 Deductions: FICA taxes $38,951 Federal income taxes withheld 175,000 State income taxes withheld (3%) 17,220 United Fund contributions payable 28,700 Health insurance premiums 18,500 Total $278,371 Lily’s payroll taxes are Social Security tax 6.2%, Medicare tax 1.45%, state unemployment 2.5% (due to a stable employment record), and 0.8% federal unemployment. Gross earnings subject to Social Security taxes of 6.2% total $494,000, and gross earnings subject to unemployment taxes total $142,000. No employee exceeds the $127,200 limit related to FICA taxes. (a) Prepare a summary journal entry at December 31 for the full year’s payroll. (b) Journalize the adjusting entry at December 31 to record…arrow_forward

- Current Attempt in Progress For the year ended December 31, 2022, Sheridan Electrical Repair Company reports the following summary payroll data. Gross earnings: Administrative salaries Electricians' wages Total Deductions: FICA taxes Federal income taxes withheld State income taxes withheld (3%) United Fund contributions payable Health insurance premiums (a) (b) Total $204,000 358,000 $562,000 $37,785 171,500 16,860 27,114 19,000 $272,259 Sheridan's payroll taxes are Social Security tax 6.2%, Medicare tax 1.45%, state unemployment 2.5% (due to a stable employment record), and 0.6% federal unemployment. Gross earnings subject to Social Security taxes of 6.2% total $478,000, and gross earnings subject to unemployment taxes total $150,000. No employee exceeds the $132,900 limit related to FICA taxes. Prepare a summary journal entry at December 31 for the full year's payroll. Journalize the adjusting entry at December 31 to record the employer's payroll taxes. (Round answers to 0 decimal…arrow_forwardFor the year ended December 31, 2022. Concord Electrical Repair Company reports the following summary payroll data. Gross earnings: Administrative salaries $188,000 Electrician's wages 342,000 Total 530,000 Deductions: FICA taxes $35,027 Federal income taxes withheld 160,000 State income taxes withheld (3%) 15,900 United Fund contributions payable 25,570 Health insurance premiums 19,500 Total $255,997 Concord's payroll taxes are Social Security tax 6.2%, Medicare tax 1.45%, state unemployment 2.5% (due to a stable employment record), and 0.6% federal unemployment. Gross earnings subject to Social Security taxes of 6.2% total $441,000, and gross earnings subject to unemployment taxes total $136,000. No employee exceeds the $132,900 limit related to FICA taxes. (a) Prepare a summary journal entry at December 31 for the full year's payroll. (b) Journalize the adjusting entry at December 31 to record the employer's payroll taxes.arrow_forwardAt December 31, 2019, Park Beauticians had 1,000 gift certificates outstanding, which had been sold to customers during 2019 for $50 each. Park operates on a gross margin of 60%. How much revenue pertaining to the 1,000 outstanding gift certificates should be deferred at December 31, 2019? a. $50,000 b. $30,000 c. $20,000 d. $0 Back Nextarrow_forward

- For the year ended December 31, 2022, Crane Electrical Repair Company reports the following summary payroll data. Gross earnings: Administrative salaries $214,000 Electricians’ wages 362,000 Total $576,000 Deductions: FICA taxes $38,639 Federal income taxes withheld 187,500 State income taxes withheld (3%) 17,280 United Fund contributions payable 27,789 Health insurance premiums 19,500 Total $290,708 Crane’s payroll taxes are Social Security tax 6.2%, Medicare tax 1.45%, state unemployment 2.5% (due to a stable employment record), and 0.6% federal unemployment. Gross earnings subject to Social Security taxes of 6.2% total $488,500, and gross earnings subject to unemployment taxes total $150,000. No employee exceeds the $132,900 limit related to FICA taxes. (a) Prepare a summary journal entry at December 31 for the full year’s payroll. (b) Journalize the adjusting entry at…arrow_forwardProjected revenue for year 20X1 is as follows: $845,622 in January, $517,629 in February, $528,674 in March, and $847,032 in April. Historical net revenues categorized by payer: Payer Medicare Medicaid Blue Cross Private Payer Revenue Percent Medicare 8,331,224 Medicaid 12,723,238 Blue Cross 10,763,087 Collection patterns by payer: Private Total Within 1 Month 21% 9% 5% 54% 5,527,687 Within 2 Months 33% 17% 40% 30% ? Within 3 Months 35% 48% 36% 5% Within 4 Months Total ? 100% ? 100% ? 100% ? 100% How much revenue do we expect to collect in total in March? (Doarrow_forwardYou are provided with the following information form the accounts of BBS Ltd for the year ending 30 June 2019Cash Sales950 000Cost of Goods Sold35 000Amount received in advance for services to be performed in August 20199 500Rent expenses for year ended 30 June 20199 000Rent Prepaid for two months to 31 August 20191 200Doubtful debts expenses1 200Amount provided in 2019 for employees’ long-service leave entitlements5 000Goodwill impairment expenses7 000Required:Calculate the taxable profit and accounting profit for the year ending 30 June 2019. my confusion : not sure if LSL will be 50%of or not?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you