FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

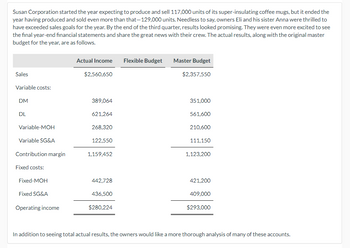

Transcribed Image Text:Susan Corporation started the year expecting to produce and sell 117,000 units of its super-insulating coffee mugs, but it ended the

year having produced and sold even more than that-129,000 units. Needless to say, owners Eli and his sister Anna were thrilled to

have exceeded sales goals for the year. By the end of the third quarter, results looked promising. They were even more excited to see

the final year-end financial statements and share the great news with their crew. The actual results, along with the original master

budget for the year, are as follows.

Sales

Variable costs:

DM

DL

Variable-MOH

Variable SG&A

Contribution margin

Fixed costs:

Fixed-MOH

Fixed SG&A

Operating income

Actual Income

$2,560,650

389,064

621.264

268,320

122,550

1,159,452

442,728

436,500

$280,224

Flexible Budget

Master Budget

$2,357,550

351,000

561,600

210,600

111,150

1,123,200

421,200

409,000

$293,000

In addition to seeing total actual results, the owners would like a more thorough analysis of many of these accounts.

Transcribed Image Text:Conduct a detailed variance analysis for all product costs (price, efficiency, and volume variances), taking the following details into consideration.

●

The company purchased and used 268,320 pounds of DM.

36,120 DL hours were used.

Price variance

Efficiency variance

Price variance

Volume variance

$

$

$

$

21528

DM

Favorable

Unfavorable

Fixed-MOH

Unfavorable

Favorable

$

DL

Unfavorable

Favorable

$

$

Variable-MOH

Unfavorable

Unfavorable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 8 images

Knowledge Booster

Similar questions

- V Energy Tech Ltd. has just had a very profitable year as rising energy costs have driven a rapid increase in sales of its solar power cells. The firm also developed a new process which has lowered its manufacturing costs significantly. V Energy Tech believes that this new process will give it a major advantage over its competitors, which it estimates will last for three years. It expects to enjoy high profits during this period, estimating profit growth over the next three years to be 18%, 16% and 13% respectively, before returning to constant industry growth pattern of 6% per year in year 4. V Energy Tech Ltd. has just paid a dividend of $2.50 per share and expects that the dividend will grow at the same rate as its profits. The firm’s cost of capital is 9%. a. What is the firm’s share price today (P0)? b. What is the expected share price next year (P1)? c. Calculate the dividend yield for year 2. d. Calculate the current capital gains yield (year 1).arrow_forwardHello! I need help on how to do this. Thank you!arrow_forwardTom Scott is the owner, president, and primary salesperson for Scott Manufacturing. Because of this, the company's profits are driven by the amount of work Tom does. If he works 45 hours each week, the company's EBIT will be $555,000 per year; if he works a 55-hour week, the company's EBIT will be $635,000 per year. The company is currently worth $3.25 million. The company needs a cash infusion of $1.35 million and can issue equity or issue debt with an interest rate of 7 percent. Assume there are no corporate taxes. a. What are the cash flows to Tom under each scenario? (Do not round intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to the nearest whole number, e.g., 1,234,567.) b. Under which form of financing is Tom likely to work harder? a. Debt issue and 45-hour week a. Debt issue and 55-hour week a. Equity issue and 45-hour week a. Equity issue and 55-hour week b. Which form of financing is Tom likely to work harder?arrow_forward

- I would like to expand my business by creating a new production line. Today, I hired a consultant to plan the project, at a cost of 200,000. In the first year, I spent $800,000 on new machinery. In the second year, I made $125,000. In the third year, I made $200,000. In the fourth year, I made $ 360,000. In the fifth year, I made $620,000. During years 6-8, I made $540,000 each year. Assuming a discount rate of 7.1%, what was the NPV of this project? Question $973,179 $1,242,275 None of these $1,042,275arrow_forward5. Your company has been doing well, reaching $1.15 million in earnings, and is considering launching a new product. Designing the new product has already cost $466,000. The company estimates that it will sell 756,000 units per year for $2.94 per unit and variable non-labor costs will be $1.03 per unit. Production will end after year 3. New equipment costing $1.07 million will be required. The equipment will be depreciated to zero using the 7-year MACRS schedule. You plan to sell the equipment for book value at the end of year 3. Your current level of working capital is $306,000. The new product will require the working capital to increase to a level of $378,000 immediately, then to $396,000 in year 1, in year 2 the level will be $354,000, and finally in year 3 the level will return to $306,000. Your tax rate is 21%. The discount rate for this project is 9.8%. Do the capital budgeting analysis for this project and calculate its NPV. Note: Assume that the equipment is put into use in…arrow_forwardEnvironmental Designs, Inc., produces and installs energy-efficient window systems in commercial buildings. During the past ten years, sales revenue has increased from $25 million to $65 million. (A) Calculate the company's growth rate in sales using the constant growth model with annual compounding. (B) Derive a five-year and a ten-year sales forecast. 3arrow_forward

- Please help mearrow_forwardPlease Solve In 20minsarrow_forwardSmartlink Computer Services Co. specializes in customized software development for the broadcast and telecommunications industries. The company was started by three people to develop software primarily for a national network to be used in broadcasting national election results. After sustained and manageable growth for many years, the company has grown very fast over the last three years, doubling in size. This growth has placed the company in a challenging financial position. Within thirty days, Smartlink will need to renew its P300,000 loan with Philippine National Bank. This loan is classified as a current liability on Smartlink’s balance sheet. Steve Heart, president of Smartlink, is concerned about renewing the loan. The bank has requested Smartlink's most recent financial statements which appear below, including balance sheets for this year and last year. The bank has also requested four ratios relating to operating performance and liquidity. Required: Explain why the Philippine…arrow_forward

- A new CEO takes control of Do-Da Industries to turn it around (to make it profitable). Based on market research she wants to focus on two specific product lines. By the end of the first year the company exceeded budgeted profits by 18%. The company’s controller knows his annual bonus depends on exceeding budgeted profit and that next year’s performance would unlikely be similar to this year’s. Profit must exceed budget by 10% before the controller’s bonus kicks in. The controller realizes he can accrue some of next year’s expenses and defer some of this year’s revenue while still exceeding this year’s budgeted profit by 10%. Required: Why would the controller want to defer revenues but accrue expenses? Is this ethical? Why?arrow_forwardCigars for Enthusiasts Inc., a start-up company, founded by Cuauhtemoc Meza and Lars Knutson following their respective tours with the United States Army, is off to a great start. Both gentlemen enjoy the premium products themselves and expect their initial first year as an online distributor of premium cigars and accessories to bust records for start-ups. Cigars for Enthusiasts expects to maintain the same inventories at the end of the year as at the beginning of the year. The estimated fixed costs for the year are $ 288,000 and the estimated variable costs per unit are $ 14. It is expected that 60,000 units will be sold at a price of $ 20 per unit. Maximum sales within the relevant range are 70,000 units. What is (a) the contribution margin ratio and (b) the unit contribution margin? Determine the break-even point in units. Construct a cost-volume-profit chart, indicating the break-even point. Construct a profit-volume chart, indicating the break-even point. What is the margin…arrow_forwardCarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education