Concept explainers

Smartlink Computer Services Co. specializes in customized software development for the broadcast and telecommunications industries. The company was started by three people to develop software primarily for a national network to be used in broadcasting national election results. After sustained and manageable growth for many years, the company has grown very fast over the last three years, doubling in size.

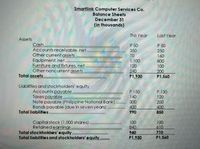

This growth has placed the company in a challenging financial position. Within thirty days, Smartlink will need to renew its P300,000 loan with Philippine National Bank. This loan is classified as a current liability on Smartlink’s

Required:

Discuss (at least 4) briefly the limitations and difficulties that can be encountered in using ratio analysis.

Step by stepSolved in 2 steps

- Smartlink Computer Services Co. specializes in customized software development for the broadcast and telecommunications industries. The company was started by three people to develop software primarily for a national network to be used in broadcasting national election results. After sustained and manageable growth for many years, the company has grown very fast over the last three years, doubling in size. This growth has placed the company in a challenging financial position. Within thirty days, Smartlink will need to renew its P300,000 loan with Philippine National Bank. This loan is classified as a current liability on Smartlink’s balance sheet. Steve Heart, president of Smartlink, is concerned about renewing the loan. The bank has requested Smartlink's most recent financial statements which appear below, including balance sheets for this year and last year. The bank has also requested four ratios relating to operating performance and liquidity. Required: Explain why the Philippine…arrow_forwardToro Company is expanding its US-based plastic molding plant as it continues to transfer work from Juarez, Mexico contractors. The plant bought a $1.1 million precision injection molding machine to make plastic parts for Toro lawn mowers, trimmers, and snow blowers. The plant expects to hire 12 people, including some engineers for the expansion. If the average loaded cost (i.e., including benefits) of each employee is $100,000 per year, determine the annual worth of the new systems over a five-year planning period at an interest rate of 10% per year. Assume a 20% salvage value for the new equipment. $-2,436,420 $-2,539,420 $-1,454,142 $-1,973,420arrow_forwardBusiness at your design engineering firm has been brisk. To keep up with the increasing workload, you are considering the purchase of a new state-of-the-art CAD/CAM system costing $550,000, which would provide 4,500 hours of productive time per year. Your firm puts a lot of effort into drawing new product designs. At present, this is all done by design engineers on an old CAD/CAM system installed five years ago. If you purchase the system, 40% of the productive time will be devoted to drawing (CAD) and the remainder to CAM. While drawing, the system is expected to out-produce the old CAD/CAM system by a factor of 2.1. You estimate that the additional annual out-of-pocket cost of maintaining the new CAD/CAM system will be $155,000, including any tax effects. The expected useful life of the system is eight years, after which the equipment will have no residual value. As an alternative, you could hire more design engineers. Each normally works 1,800 hours per year, and 50% of this time is…arrow_forward

- Answer the question. As part of a broad effort to invigorate its pipeline and move more aggressively into biotechnology, a major pharmaceutical company plans to set up a new division dedicated to developing biotherapeutic drugs and research technologies. The company expects to pay $125 million for set up costs of its new division now and $7 million operating costs each year for the next 13 years. The company estimates that the new division will be able to generate annual revenue of $42 million beginning 6 years from now. What is the conventional Benefit-to-Cost ratio for this investment if the company's discount rate is 9 % per year and the project life is 13 years? Answer:arrow_forwardGorilla, Inc., has recently launched a ramen/sushi fusion dish that has received an overwhelmingly positive reaction from the market. In response to this success, the company is reinvesting all of its earnings to fuel further expansion. This past year, the earnings per share stood at $10, and these are anticipated to increase by 20% annually over the next five years. However, by the end of the fifth year, it's expected that competitors will introduce similar products. Consequently, analysts forecast that Gorilla will then reduce its reinvestment rate and start distributing 60% of its earnings as dividends. Additionally, from that point onwards, the company's growth rate is projected to decelerate to a stable 3% per annum. If Gorilla's equity cost of capital is 8%, what is the value of a share today? Complete the table below. You can use an Excel spreadsheet and then copy and paste the sheet. Additionally, please provide detailed explanations beneath the table on how to determine the…arrow_forwardA pharmaceutical company has been able to generate a capital of $5 million from a generous investor. The higher management wants to use the money wisely. The company is looking forward to investing in acquiring patents that will cost around $3 million in the coming year. There is a need to maintain $180,000 of working capital every month to keep running its operations. Currently, the company can barely generate enough revenue to meet its monthly expenses and suffers an occasional loss every two quarters. Below are some of the options for using the capital. Evaluate each one of them and recommend the best one. Invest in acquiring a newly formed company worth $5million that has great technical assets. The company has not been fortunate to generate enough revenue to run its operations. Do not invest the money and use it to keep running the company’s operations.arrow_forward

- The ink-jet printing division of Environmental Printing has grown tremendously in recent years. Assume the following transactions related to the ink-jet division occur during the year ended December 31, 2021. Environmental Printing is being sued for $9 million by Addamax. Plaintiff alleges that the defendants formed an unlawful joint venture and drove it out of business. The case is expected to go to trial later this year. The likelihood of payment is reasonably possible. Environmental Printing is the plaintiff in an $7 million lawsuit filed against a competitor in the high-end color-printer market. Environmental Printing expects to win the case and be awarded between $4.5 and $7 million. Environmental Printing recently became aware of a design flaw in one of its ink-jet printers. A product recall appears probable. Such an action would likely cost the company between $300,000 and $700,000. Record any amounts as a result of each of these contingencies. (If no entry is…arrow_forwardDoug Washington, the owner of Coyote Printing, is evaluating a printing company in Texas. Stan College, the company's CFO, has just finished his analysis of company. He has estimated that the printing company would be productive for eight years, during which the market would be completely diminished. Stan has taken an estimate of the balance statement and forecast to Hattie May, the company's financial officer. Hattie has been asked by Doug to perform an analysis of the printing company and present her recommendation on whether the company should open the take over the printing company. Hattie May has used the estimates provided by Stan to determine the revenues that could be expected from the printing company. She has also projected the expense of taking over the printing company and the annual operating expenses. If the company takes over the printing company, it will cost $700 million today, and it will have a cash outflow of $75 million nine years from today in costs associated…arrow_forwardHansabenarrow_forward

- Suppose you have been hired as a financial consultant to Defense Electronics, Incorporated (DEI), a large, publicly traded firm that is the market share leader in radar detection systems (RDSS). The company is looking at setting up a manufacturing plant overseas to produce a new line of RDSS. This will be a five-year project. The company bought some land three years ago for $7.2 million in anticipation of using it as a toxic dump site for waste chemicals, but it built a piping system to safely discard the chemicals instead. If the land were sold today, the net proceeds would be $7.66 million after taxes. In five years, the land will be worth $7.96 million after taxes. The company wants to build its new manufacturing plant on this land; the plant will cost $13.24 million to build. The following market data on DEI's securities are current: Debt: Common stock: Preferred stock: Market: 91,200 6.9 percent coupon bonds outstanding, 23 years to maturity, selling for 94.4 percent of par; the…arrow_forwardPCW Co is a listed company that operates in the automobile industry. Due to an increase in local demand for the company’s products, PCW Co decides to invest in a new machinery. Such an investment project requires some initial investment in working capital of $300,000. And the investment in working capital is subject to general inflation, which is forecasted to be 5% per annum. The cost of the new machine is $3 million. Each year, the new investment is estimated to generate 7,000 products and all of them are expected to be sold. For simplicity’s reason, there is no scrap value of the machine. The usual lifetime of the machinery would be 3 years, after which it is supposed to be replaced. The costs and selling price in current price terms are summarised as follows: Annual sector-specific inflation Variable costs. $100 / unit 6.0 % Incremental fixed costs $200,000 / year. 4.5 % Selling price $400 / unit…arrow_forwardWhite Oaks Properties builds strip shopping centers and small malls. The company plans to replace its refrigeration, cooking, and HVAC equipment with newer models in one entire center built 10 years ago. 10 years ago, the original purchase price of the equipment was $700,000 and the operating cost has averaged $220,000 per year. Determine the equivalent annual cost of the equipment if the company can now sell it for $224,000. The company's MARR is 17% per year. The equivalent annual cost of the equipment is determined to be $arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education