ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

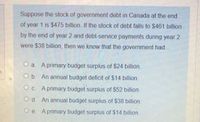

Transcribed Image Text:Suppose the stock of government debt in Canada at the end

of year 1 is $475 billion. If the stock of debt falls to $461 billion

by the end of year 2 and debt-service payments during year 2

were $38 billion, then we know that the government had...

O a. A primary budget surplus of $24 billion.

O b. An annual budget deficit of $14 billion.

O c. A primary budget surplus of $52 billion.

O d. An annual budget surplus of $38 billion.

O e. A primary budget surplus of $14 billion.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose a closed economy generates $2800 output and income in equilibrium. Suppose also that the government spends 350 and imposes a lump-sum tax of 50. By how much is the government in deficit? (round your answer to the nearest whole value)arrow_forwardIn discussing debt growth the article Debt - What Is and Should Never Be, found that by each seceding decade from 1950 the ratio of increase in Debt and increase in GDP: a) Was fairly constant over the time discussed b) Increased in each succeeding decade Oc) There was no relationship of the growth in debt to the growth in GDP ratio over time d) The Debt to GDP ratio fellarrow_forwardSuppose that a country has no public debt in year 1 but experiences a budget deficit of $40 billion in year 2, a budget surplus of $20 billion in year 3, and a budget deficit of $2 billion in year 4. Instructions: In part a, enter your answer as a whole number. For the absolute size of the public debt, enter your answer as a positive number. In part b, round your answer to 2 decimal places. a. What is the absolute size of its public debt in year 4? billion b. If its real GDP in year 4 is $104 billion, what is this country's public debt as a percentage of real GDP in year 4? percentarrow_forward

- Suppose that the existing stock of debt in Outland is $500500 billion, and the government expects to collect $184184 billion as net tax revenues. If the interest rate in this economy is 11 percent and the government wants to decrease its existing stock of debt by $4040 billion this year, then what should the government run this year?arrow_forwardConsider the government debt at the beginning of the year 2010 equals $2 000, the annual interest rate on the government debt – 8%. Government expenditures over the current year 2010 equal $1 500, government transfers - 20% of output. Government income is 40% of output. Calculate the government debt burden (government debt to total output) at the end of the current year 2010 if the output equals $5 000.arrow_forwardYear Government Purchases Government Taxes Real GDP 1 400 247 5,812 2 434 203 5,898 Suppose there is no public debt before Year 1 and that net transfers are equal to zero. What is the public debt as a percentage of GDP in Year 2? Answer this as a percentage and round your answer to two digits after the decimal without the percentage sign. ex. If you found the rate to be 5.125%, answer 5.13.arrow_forward

- Federal government expenditures and receipts for the simple economy of the nation of Topanga are listed in the table below. The government of Topanga would like to reduce the debt-to-GDP ratio, and the Finance Minister of Topanga has proposed the following: "The best way to reduce the debt-to-GOP ratio is to increase GDP, because with a larger GDP, the ratio will have to get smaller, 1 therefore propose that goverment expenditures be increased by 25 percent, personal income taxes be reduced by 25 percent, corporate income taxes be reduced by 25 percent, and contributions for social insurance be reduced by 25 percent. All of these moves will increase GDP by 10 percent by increasing consumer spending, business spending, and government spending by the exact amounts of the increased spending and reduced taxes. Debt GOP Goverment expenditures Goverment transfer payments Interest payment Personal income tax receipts Corporate income tax receipts Contributions for social insurance $20 million…arrow_forwardDescribe the potential consequences of maintaining high public debt.arrow_forwardThe government budget is in DEFICIT when OT G-Transfers (TR) - Interest on the Debt (INT) 0 Government expenditures (G) - Investment expenditures (I) 0arrow_forward

- Now suppose that the gross national debt initially is equal to $2.5 trillion and the federal government then runs a deficit of $100 billion. What is the new level of gross national debt? If 100 percent of this deficit is financed by the sale of securities to the public, what happens to the level of debt held by the public? What happens to the level of gross debarrow_forwardIn the beginning of the year, the economy has public debt (or national debt) of $450 million. This year, tax revenues collected by the government is $40 million and government outlays are $55 million. At the end of the year, this country has public debt (or national debt) of $____ million. Your Answer: Answerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education