ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

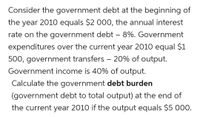

Transcribed Image Text:Consider the government debt at the beginning of

the year 2010 equals $2 000, the annual interest

rate on the government debt – 8%. Government

expenditures over the current year 2010 equal $1

500, government transfers - 20% of output.

Government income is 40% of output.

Calculate the government debt burden

(government debt to total output) at the end of

the current year 2010 if the output equals $5 000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 3. Budget balances and the national debt The following table lists federal expenditures, revenues, and GDP for the U.S. economy during several years. All numbers are in billions of dollars. Revenues Year (Billions of dollars) 1929 3.9 1948 1967 1986 2005 FEDERAL EXPENDITURES AND RE VENUES (Percent of GDP) 25 20 15 10 41.6 Plot the data for revenues and expenditures as a percentage of GDP on the following graph, rounded to the nearest percent. Use the orange points (square symbol) for expenditures and the green points (triangle symbol) for revenues. Line segments will automatically connect the points. 1929 148.8 769.2 2,153.9 Expenditures GDP (Billions of dollars) (Billions of dollars) 3.1 103.6 1948 29.8 157.5 990.4 2,472.2 1987 YEAR 1986 269.2 2005 832.6 4,462.8 12,421.9 Expenditures Δ Revenues ?arrow_forwardThe question is based on the following information: Item R million 510 540 490 534 Total government revenue Total government expenditure Current government revenue Current government expenditure Non-interest expenditure Cyclically adjusted revenue Cyclically adjusted expenditure The current budget balance is R million. If the balance is negative indicate it using the minus sign in your answer for instance-32 Answer: 500 480 500arrow_forwardThere is $10 trillion in the loanable funds market. $6 trillion in private borrowing and $4 trillion in government borrowing. The federal government increases its borrowing to $5 trillion, crowding out $1 trillion in private borrowing. Interest rates remain the same. Make an argument that the GDP remains the same and that we don’t care about the crowding out.arrow_forward

- Year Government Purchases Government Taxes Real GDP 1 400 247 5,812 2 434 203 5,898 Suppose there is no public debt before Year 1 and that net transfers are equal to zero. What is the public debt as a percentage of GDP in Year 2? Answer this as a percentage and round your answer to two digits after the decimal without the percentage sign. ex. If you found the rate to be 5.125%, answer 5.13.arrow_forwardThe table below shows hypothectical figures of revenue and spending for the Canadian government. For simplicity, assume that all of the spending grants to other levels of government were spent in Canada on goods and services. REVENUES Personal income taxes Corporate income taxes Other income taxes. GST and excise taxes EI premiums Federal Government's Budget Plan for Fiscal Year ($billion) OUTLAYS $95 36 5 47 13 17 Transfers to persons Spending grants to other levels of government Public debt charges Direct program spending Total Outlays Projected Budget Plan Surplus Other revenues Total Revenues 213 a. The projected NTR in this budget plan is $ b. The value of NTR less government spending on goods and services (G) is $ billion. billion. $42 36 31 100 209 4arrow_forwardCalculate the value of revenue deficit when the value of revenue expenditure is $8000 and the value of revenue receipts is $$3000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education