ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

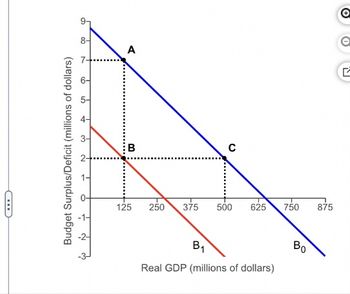

Transcribed Image Text:6

8-

Budget Surplus/Deficit (millions of dollars)

1 2 3

+

+3

¿

N

A

B

0

125

250

375

500 625 750

875

Bo

B₁

Real GDP (millions of dollars)

O

a

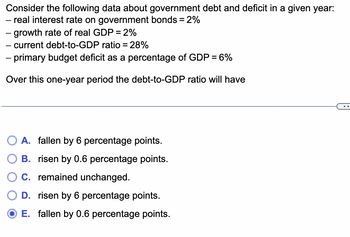

Transcribed Image Text:Consider the following data about government debt and deficit in a given year:

― real interest rate on government bonds = 2%

- growth rate of real GDP = 2%

- current debt-to-GDP ratio = 28%

- primary budget deficit as a percentage of GDP = 6%

Over this one-year period the debt-to-GDP ratio will have

A. fallen by 6 percentage points.

B. risen by 0.6 percentage points.

C. remained unchanged.

D. risen by 6 percentage points.

E. fallen by 0.6 percentage points.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Jse the following information to answer the next 5 questions. Year 2008 2018 Nominal Debt 150 500 Nominal GDP 1,000 2,500 Price Level/GDP Deflator 150 200 Assuming that the interest rate on the debt is 5%, what is the annual interest payment on the debt in 2018? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a 15 b -5 C 10 d 25arrow_forwardIncorrect Question 9 The ability of forests to reduce soil erosion is an example of what type of economic value? Ecosystem service value Intrinsic value O Nonuse value Contingent value Revealed valuearrow_forward2. Mang Oleh Kembang in Lembang has 10 major fields that are used to grow Mango. The productivity of each field is expressed as follows: Annual Yield, Hundreds of Kilograms Field 1 2000 Field 2 1800 Field 3 1750 Field 4 1625 Field 5 1500 Field 6 1450 Field 7 1375 Field 8 1225 Field 9 8500 Field 7250 10 Assume that each field is the same size and that the variable costs of farming are $74,600 per year per field. The variable costs cover labour and machinery time, which is rented. Tamima farm must decide each year how many fields to plant. a. In 2017, corn farmers received $5.15 per 100 KG. How many fields did Tamima plant? Explain. b. By 2020, the price of corn had fallen to $4.23 per 100 KG. How will this price decrease change Tamima's decision? How will it affect his demand for labour?arrow_forward

- Calculate the value of output in the given imagearrow_forward1111 b. 4 5 1 4. 5 $3,000 - $5,000 4G Find G?arrow_forward1. Individual Problems 1-11 The owners of a small manufacturing concern have hired a vice president to run the company with the expectation that he will buy the company after five years. For the first $150,000 of profit, the vice president's compensation is a flat annual salary of $50,000 plus 50% of company profits. Beyond the first $150,000 in profits, the vice president's compensation is the salary he receives at $150,000 profit plus 20% of company profits in excess of $150,000. On the following graph, use the purple points (diamond symbols) to plot the vice president's salary as a function of annual profit, for the profits levels of $0, $50,000, $100,000, $150,000, $200,000, $250,000, and $300,000. MANAGER SALARY (Thousands of dollars) 250 725 200 175 110 125 100 Total VP Salaryarrow_forward

- If the total budget expenditure is 6200 and the total budget receipts are 1300 find the budgetary deficitarrow_forwardCalculate primary deficitarrow_forwardQuestion: the economic impact of another Covid-19 relief package in USA. Do we need it? How can it stimulate the economy? Does it will helps stable the economic or it bring debt for country ? https://www.cbpp.org/research/federal-budget/is-1-trillion-enough-for-a-new-economic-relief-packagearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education