ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

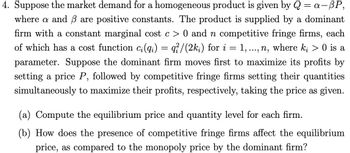

Transcribed Image Text:4. Suppose the market demand for a homogeneous product is given by Q = a-BP,

where a and 3 are positive constants. The product is supplied by a dominant

firm with a constant marginal cost c> 0 and n competitive fringe firms, each

of which has a cost function c;(qi) = q//(2ki) for i 1, ..., n, where ki > 0 is a

parameter. Suppose the dominant firm moves first to maximize its profits by

setting a price P, followed by competitive fringe firms setting their quantities

simultaneously to maximize their profits, respectively, taking the price as given.

=

(a) Compute the equilibrium price and quantity level for each firm.

(b) How does the presence of competitive fringe firms affect the equilibrium

price, as compared to the monopoly price by the dominant firm?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider an industry with 2 firms engaging in quantity competition and facing the market demand function as Q = 200 – 4P. Suppose each firm bears the same cost production as C(q) = 100 + 0.25q? when producing q units. a. Derive Firm 1's best response function, q1(q2), against Firm 2's output level choice, q2. b. Find the equilibrium output level of Firm 1 at the N.E. equilibrium. c. Find the deadweight loss caused by the duopoly. d. Find again the equilibrium output level of Firm 1 if it acts as the leader while Firm 2 as the follower.arrow_forwardAn upstream firm (U) sells an input to a downstream firm (D) which resells it to consumers. The marginal cost of U is 4. Each unit is sold by U to D at a transfer price r. Requirement final is p = 12 - y. a) Suppose U and D are separate firms. Find r, y and p. b) Suppose U and D are one integrated firm. Find p and y. c) Suppose the firms are not integrated, but firm U uses a two-part tariff: it requires payment of r for each unit sold to D; in addition, it requires payment lump sum of T. Find the value of r that U will choose. Find the minimum and maximum values by T. d) Suppose the firms are not integrated, but U imposes a resale price control on firm D. Find the value of r that U will choose, and the constraint that it will impose on the price final parrow_forwardAn upstream firm (U) sells an input to a downstream firm (D) which resells it to consumers. The marginal cost of U is 4. Each unit is sold by U to D at a transfer price r. Requirement final is p = 12 - y. a) Suppose U and D are separate firms. Find r, y and p. b) Suppose U and D are one integrated firm. Find p and y. c) Suppose the firms are not integrated, but firm U uses a two-part tariff: it requires payment of r for each unit sold to D; in addition, it requires payment lump sum of T. Find the value of r that U will choose. Find the minimum and maximum values by T. d) Suppose the firms are not integrated, but U imposes a resale price control on firm D. Find the value of r that U will choose, and the constraint that it will impose on the price final p Plzz give the answer of all questions.arrow_forward

- Demand is assumed to be unit-elastic: X(p) = 1/p. There are m ≥ b2 firms operating in the market with constant marginal cost levels c1 ≤ c2 ≤ ……. ≤ cm. They engage in Cournot competition. a. Show that the equilibrium price implies Lerner indexes Where si is the market share of firm i. b. Using the equilibrium price, show that the profit of firm i is equal to (si)2. c. Show that the industry profit is equal to the Herfindahl index H = Σi(si)2. d. What is the effect of a specific taxt on equilibrium price? How does this tax affect the industry profit and the Herfindahl index?arrow_forward**Practice**arrow_forwardSuppose that there are two types of firms in a perfectly competitive market. Firms of type A have costs given by CA(q) = 30q2 + 10q. Firms of type B have costs given by CB(q) = 50q2 + 10. ( dCA dq = 60q + 10 and dCB dq = 100q). There are 60 firms of type A and 100 firms of type B. Derive the individual firm supply functions for each type of firm and What is the range of prices in which some firms produce but others do not? Are there prices at which no firms produce Why?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education