ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

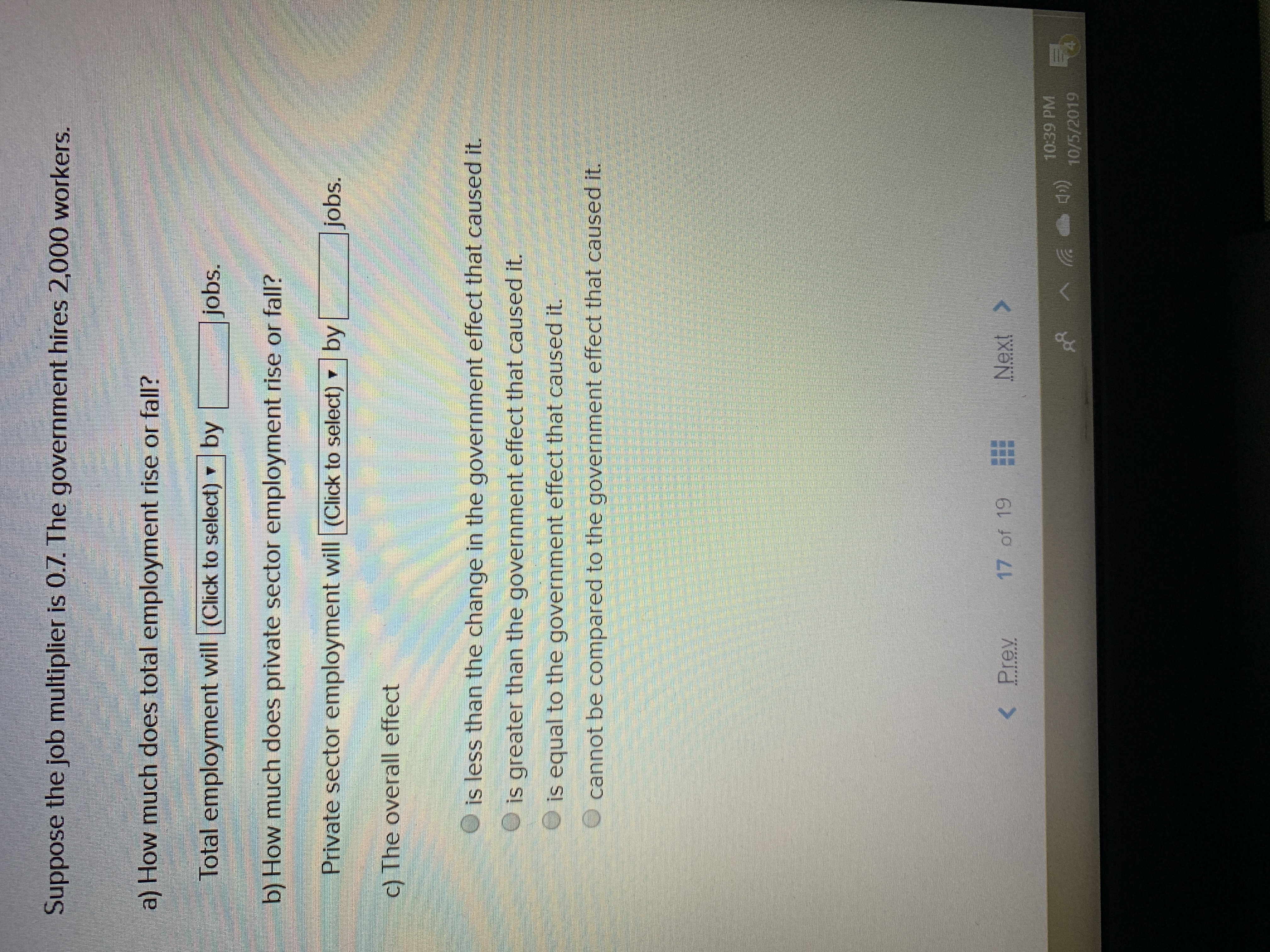

Transcribed Image Text:Suppose the job multiplier is 0.7. The government hires 2,000 workers.

a) How much does total employment rise or fall?

Total employment will (Click to select)

by

jobs.

b) How much does private sector employment rise or fall?

Private sector employment will (Click to select)

by

jobs.

c) The overall effect

is less than the change in the government effect that caused it.

is greater than the government effect that caused it.

is equal to the government effect that caused it.

cannot be compared to the government effect that caused it.

Next>

17 of 19

Prev

10:39 PM

10/5/2019

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 3 images

Knowledge Booster

Similar questions

- The Laffer curve suggests A.there is some maximum amount of tax revenue that the government can collect from taxing income. B.the optimal tax rate leads to the highest amount of tax revenue. C.the optimal tax rate on labor income is 0% D.an increase in tax rates leads to an increase in labor supply.arrow_forwardsupply equation is Y - Ypot + 80 (P-Pe), where Ypot is the potential level of output. In 2016, the population was 400 million, and the structure of the economy was described by the following equations for household consumption behavior and taxes received: C = 100+ 0.8DI, and T = 0. where all monetary values are in billions of dollars. Government spending was fixed at $1700 billion, and firm's investment behavior was fixed at $800 billion. Trading is allowed in this economy and in 2016, trading occurred such that the trade account was balanced. That is, net exports (X-IM) was equal to zero. (Question 15 of 20) Now consider that in in the following year (2017), the government decided to implement a policy aimed at moving the economy to full employment. In its decision to move the economy to full employment, they used government spending as the policy tool. The structure and fixed spending behaviors remain the same as they were in 2016, except for government spending. In addition, changes…arrow_forwardA government is evaluating the effectiveness of a new tax policy. Economists collect data on tax rates, government revenue, and economic growth before and after the policy implementation. They use econometric methods to assess the policy's impact on economic indicators. This application of econometrics primarily serves to:A) Estimate policy impactB) Create new tax lawsC) Design government websitesD) Recruit government staff Note:- Please avoid using ChatGPT and refrain from providing handwritten solutions; otherwise, I will definitely give a downvote. Also, be mindful of plagiarism.Answer completely and accurate answer.Rest assured, you will receive an upvote if the answer is accuratearrow_forward

- Keynes believed equilibrium income was: Multiple Choice not fixed at the economy's potential income. fixed at the economy's potential income. always below the economy's potential income. always above the economy's potential income.arrow_forwardConsider the economy of Cocoland, where citizens consume only coconuts. Assume that coconuts are priced at $1 each. The government has devised the following tax plans: Plan A • Consumption up to 1,000 coconuts is taxed at 35%. • Consumption higher than 1,000 coconuts is taxed at 20%. Plan B • Consumption up to 2,000 coconuts is taxed at 10%. • Consumption higher than 2,000 coconuts is taxed at 25%. Use the Plan A and Plan B tax schemes to complete the following table by deriving the marginal and average tax rates under each tax plan at the consumption level of 700 coconuts, 1,500 coconuts, and 2,500 coconuts, respectively. Consumption Level Plan A Plan B (Quantity of coconuts) Marginal Tax Rate Average Tax Ratearrow_forwardFiscal Policy- Ask FRED The accompanying graph depicts the unemployment insurance benefits paid by the U.S. government as a percentage ALFRED 1.2 1.0 of GDP over time. 0.8 0.6 0. 0.4 0.2 0.0 1960 1970 1980 1990 2000 2010 Source: U.S. Bureau of Economic Analysis c. As a percentage of GDP, how much was spent on unemployment insurance around the peak of the 2008-2009 recession? % of GDParrow_forward

- If the government increases taxes, what happens to the price index and the actual real GDP holding all else constant? Group of answer choices In this case, the price index decreases and the actual real GDP decreases. In this case, the price index increases and the actual real GDP decreases. In this case, the price index increases and the actual real GDP increases. In this case, the price index decreases and the actual real GDP increases.arrow_forwardFor the U.S. government, which of the given is NOT an example of discretionary spending? defense spending science spending Medicaid Medicare For the U.S. government, which of the given is NOT an example of mandatory spending? Medicare education spending Social Security interest on the national debt Which type of spending currently takes up a larger proportion of the U.S. federal budget? Mandatory spending and discretionary spending take up an equal amount. mandatory spending discretionary spendingarrow_forwardIf actual GDP is $640 billion and there is a positive GDP gap of $20 billion, potential GDP isarrow_forward

- The Australian Government in the 2015-16 financial year is set to spend $31.9 billion dollars on national defence. There is talk that some of this money will go towards building submarines in South Australia, generating thousands of jobs for South Australia. Kevin is complaining to Henry that this is an inefficient use of money as no individual Australian values national defence at that level and that the spending is just to ensure government politicians get re-elected. There can be multiple answers for this, not just the one.arrow_forwardUsing a graph and words, explain the effect of SRAS and LRAS curves when the President of the United States would give businesses who invested in new plant and equipment an investment tax credit equal to 10 percent of their investment and the marginal tax rate has been reduced to people who make over $50,000 and are permanent. Will you work more or less when marginal tax rates are cut and will businesses invest more in plant and equipment when an investment tax credit has been implemented by the President of the United States? Also explain in your graph what will happen to equilibrium price level and equilibrium real GDP and the unemployment rate when the marginal tax rates are cut and are permanent for people making over $50,000 and the investment tax credit has been implemented by the President of the United States.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education