ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

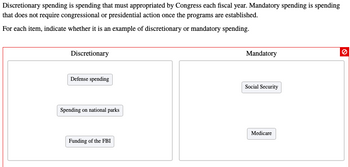

Transcribed Image Text:Discretionary spending is spending that must appropriated by Congress each fiscal year. Mandatory spending is spending

that does not require congressional or presidential action once the programs are established.

For each item, indicate whether it is an example of discretionary or mandatory spending.

Discretionary

Defense spending

Spending on national parks

Funding of the FBI

Mandatory

Social Security

Medicare

O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Answer plzzarrow_forwardSuppose that the demand for CDs is very price elastic and the supply is very price inelastic. A per unit tax imposed on CDs would be borne a. equally by buyers and sellers. b. more heavily by buyers. c. more heavily by sellers. d. by neither buyers or sellers.arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- I need the other side of the chart for regressive taxarrow_forward(Answer the E) Its is known that the demand function for a product is P = 24 - 1/2Q and the supply function Q = 4 + 2PIts is known that the demand function for a product is P = 24 - 1/2Q and the supply function Q = 4 + 2P If the government provides a subsidy for tge product of Rp 10/ unit of goods, what is the price and quantity of goods in balance new E. Calculate the amount of subsidy received by consumers and manufacturers , as well subsidies issued by the government *Rp : Indonesian currencyarrow_forwardestion 9 Golden Age of fiscal policy is has all of the following, except: O under 2 percent inflation rate O below 5 percent unemployment rate income tax cut O income tax increased Et e ch ex DEarrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardHello I need help with introducing a per unit tax into this diagram? Also How do I do this,label the quantity, the new buyer (consumer) price and the new seller (producer) price?arrow_forwardSpecial interest groups tend to be able to infil hce legis O a. special interest groups have rational ignorance. O b. voters have an incentive to oppose the legislation. O c. the costs for voters opposing the legislation are higher than the benefits. O d. special interest groups have an incentive to educate voters.arrow_forward

- 5. How can lowering replacement rates or increasing the retirement age affect the Social Security tax rate?arrow_forwardThe graph shows befire-tax, where the equilibrium is at 25. When the government levies the tax of 30 on X, price consumer have to pay changes to 35, and prince sellers recieve changes to 5. And at Ps:5, quantity is at 10. What is the consumers’ tax incidence and sellers’ tax incidence, when comaparing the chnage in the prices from before-tax equilibrium price 25??arrow_forward4. Which two ministries use up more of the provincial budget than all the others combined?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education