ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

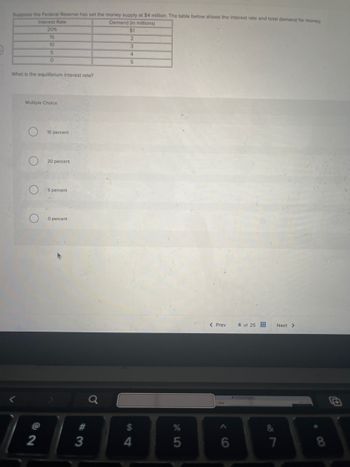

Transcribed Image Text:Suppose the Federal Reserve has set the money supply at $4 million. The table below shows the interest rate and total demand for money.

Demand (in millions)

Interest Rate

20%

15

10

5

0

$1

2

3

4

5

What is the equilibrium interest rate?

Multiple Choice

C

O

10 percent

20 percent

5 percent

O percent

< Prev

6 of 25

Next >

<

#

%

&

8888886

$

@

2

3

4

5

7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Interest Rate Transactions Demand for Money Asset Demand for Money Money Supply 2% $220 $300 $460 4 220 280 460 6 220 260 460 8 220 240 460 10 220 220 460 Based on the given table, an increase in the money supply of $20 billion will cause the equilibrium interest rate to Multiple Choice fall by 4 percentage points. fall by 2 percentage points. Correct rise by 4 percentage points. rise by 2 percentage points.arrow_forward9. How would you incorporate security considerations/costs into the transactions demand model? What would this imply for the demand for currency in a relatively insecure urban environment (a) compared with a relatively safe one, (b) when owner-identified smart cards become available? Do these factors affect the demand for demand deposits? How would the proportion of currency to demand deposits be affected in these cases? 10. Can the transactions demand model be used to explain why financial innovations in recent decades have reduced the transactions demand for M1? 11. Are transactions demand models useless, as Sprenkle (1969) argued? If they are, how would you explain the demand for M1 or just for demand deposits in the economy?arrow_forwardIf a bank gets $100 in new reserves from the Fed and the required-reserve ratio is 0.2, then the O rate of interest falls in the economy O money supply grows by $500 O money multiplier is 5 O all of the abovearrow_forward

- How much money is created by a bank with $20 million in assets if it lends out half of its assets with a required reserve ratio of 10%. O $100,000,000 O $50,000,000 $1,000,000,000 $10,000arrow_forwardGive correct typing answerarrow_forwardInterest rate 2% 4 6 8 10 Transaction demand for money $220 220 220 220 220 Asset demand B) horizontal line. C) line sloping downward and to the right. D) line sloping upward and to the right. for money $300 280 260 240 220 Money supply $460 460 460 460 460 1. The transactions demand for money in the above market for money would graph as a: A) vertical line.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education