ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

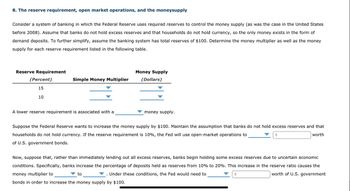

Transcribed Image Text:8. The reserve requirement, open market operations, and the moneysupply

Consider a system of banking in which the Federal Reserve uses required reserves to control the money supply (as was the case in the United States

before 2008). Assume that banks do not hold excess reserves and that households do not hold currency, so the only money exists in the form of

demand deposits. To further simplify, assume the banking system has total reserves of $100. Determine the money multiplier as well as the money

supply for each reserve requirement listed in the following table.

Reserve Requirement

(Percent)

15

10

Simple Money Multiplier

A lower reserve requirement is associated with a

Money Supply

ollars)

money supply.

Suppose the Federal Reserve wants to increase the money supply by $100. Maintain the assumption that banks do not hold excess reserves and that

households do not hold currency. If the reserve requirement is 10%, the Fed will use open-market operations to

worth

$

of U.S. government bonds.

to

Now, suppose that, rather than immediately lending out all excess reserves, banks begin holding some excess reserves due to uncertain economic

conditions. Specifically, banks increase the percentage of deposits held as reserves from 10% to 20%. This increase in the reserve ratio causes the

money multiplier to

Under these conditions, the Fed would need to

$

worth of U.S. government

bonds in order to increase the money supply by $100.

Transcribed Image Text:10

A lower reserve requirement is associated with a

money supply.

Suppose the Federal Reserve wants to increase the money supply by $100. Maintain the assumption that banks do not hold excess reserves and that

households do not hold currency. If the reserve requirement is 10%, the Fed will use open-market operations to

$

worth

of U.S. government bonds.

Now, suppose that, rather than immediately lending out all excess reserves, banks begin holding some excess reserves due to uncertain economic

conditions. Specifically, banks increase the percentage of deposits held as reserves from 10% to 20%. This increase in the reserve ratio causes the

money multiplier to

Under these conditions, the Fed would need to

worth of U.S. government

to

bonds in order to increase the money supply by $100.

Which of the following statements help to explain why, in the real world, the Fed cannot precisely control the money supply? Check all that apply.

The Fed cannot control whether and to what extent banks hold excess reserves.

The Fed cannot control the amount of money that households choose to hold as currency.

$

The Fed cannot prevent banks from lending out required reserves.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- No written by hand solution and no imagearrow_forward1.6 Suppose that the required reserve ratio is 2 percent, and you deposit $100,000 of currency into Chase Bank. What is the potential increase in deposits in the banking system brought about by your deposit? What is the potential change in the money supply? rese hy is the real-world depos where RR is the requiredarrow_forwardThe reserve requirement, open market operations, and the moneysupply Consider a system of banking in which the Federal Reserve uses required reserves to control the money supply (as was the case in the United States before 2008). Assume that banks do not hold excess reserves and that households do not hold currency, so the only money exists in the form of demand deposits. To further simplify, assume the banking system has total reserves of $300. Determine the money multiplier as well as the money supply for each reserve requirement listed in the following table. Reserve Requirement Simple Money Multiplier Money Supply (Percent) 5 (0.5, 1, 5, 10 or 20) (150, 300, 1500, 3000 or 6000) 10 (0.5, 1, 5, 10 or 20) (150, 300, 1500, 3000 or 6000) A higher reserve requirement is associated with a (LARGER or SMALLER) money supply. Suppose the Federal Reserve wants to increase the money supply by $200. Maintain the assumption that banks do not…arrow_forward

- 5. Money Multiplier: Given: Money Multiplier: 1+c rr+e+C required reserve ratio = 0.10 C = currency in circulation = $ 400 billion D =_ checkable deposits = $800 billion ER = excess reserve - $0.80 billion M = money supply_(M1) = C + D = $1,200 c = currency ratio = C/D = $400/$800= 0.5 e = excess reserve ratio = ER/D = $.80 b/ $800 b Using the formula for the money multiplier above, derive is the Money Multiplier?arrow_forward12arrow_forward1.What is the money multiplier if the target reserve ratio ofbanks is 4%? 2. If the target reserve ratio for a bank is 5%, deposits are $1billion, and loans are $800 million, what are the targetreserves?$50 million•80%$40 million$200 million3. Which measurement of the money in Canada will be the largest? 4. Is there more money or currency in Canada?5.arrow_forward

- 8. The reserve requirement, open market operations, and the money supply Consider a system of banking in which the Federal Reserve uses required reserves to control the money supply (as was the case in the United States before 2008). Assume that banks do not hold excess reserves and that households do not hold currency, so the only money exists in the form of demand deposits. To further simplify, assume the banking system has total reserves of $400. Determine the money multiplier as well as the money supply for each reserve requirement listed in the following table. Reserve Requirement Simple Money Multiplier Money Supply (Percent) (Dollars) 20 10 A higher reserve requirement is associated with a money supply. Suppose the Federal Reserve wants to increase the money supply by $200. Maintain the assumption that banks do not hold excess reserves and that households do not hold currency. If the reserve requirement is 10%,…arrow_forward3. What would be the effect of increasing the banks' reserve requirements on the money supply?arrow_forward8. A bank's "required reserves" are: none of the answers given is correct held as deposits with the Federal Reserve System equal to its transactions deposits equal to its checkable depositsarrow_forward

- 2arrow_forward1. What is money? Discuss the characteristics of money as medium of exchange, unit of account, store of value, and means of deferred payment. 2. Define M1 and M2 3. Describe the money multiplier and explain how it works. Give examples for each one.arrow_forward39. Which of the following are ways in which banks can help businesses in the United States? Choose all that apply. Banks can reduce the money supply through the use of the money multiplier. Banks can serve as a stopgap to save struggling businesses from bankruptcy with small loans. Bank loans remove personal liability from company owners. O Bank loans are tax-deductible for businesses.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education