ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Suppose the economy is initially at a long-run equilibrium. The Fed then increases the money supply. In the following three diagrams, assume the resulting inflation is unexpected.

Transcribed Image Text:O Macmillan Learning

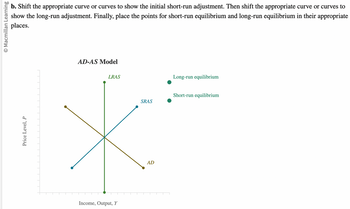

b. Shift the appropriate curve or curves to show the initial short-run adjustment. Then shift the appropriate curve or curves to

show the long-run adjustment. Finally, place the points for short-run equilibrium and long-run equilibrium in their appropriate

places.

Price Level, P

AD-AS Model

LRAS

Income, Output, Y

SRAS

AL

Long-run equilibrium

Short-run equilibrium

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- !arrow_forwardAnswer the given question with a proper explanation and step-by-step solution.arrow_forwardDiscussion Question Ch 12 33 unread replies.33 replies. Discussion Question (DQ) Chapter 12: According to the textbook, How do economists use the equation m * v = p * yR to explain the cause of inflation? Required: In not less than 300 words and not more than 600 words, use a term(s) or idea(s) or concept(s) from the chapter of your textbook you are currently assigned to respond to the DQ. Every response should have three elements: a textbook term(s); section citation and correct grammar and punctuation Use of a TEXTBOOK term(s) or idea(s) or concept(s) from the assigned chapter textbook . Textbook citation—however, since your e-textbook does not have page numbers you can cite to a relevant chapter “section” (see below for an example of what a chapter sections look like). For example, you could say “I used the comparative advantage section’s discussion of _________ to answer this question.)arrow_forward

- The long-run effects of monetary policy The following graphs plot the long-run equilibrium situation for an economy. The first graph plots the aggregate demand (AD) and long-run aggregate supply (LRAS) curves. The second graph plots the long-run and short-run Phillips curves (LRPC and SRPC, respectively). LRAS H AD 3 6 9 12 OUTPUT (Trillions of dollars) PRICE LEVEL 0 15 18 AD 441 LRASarrow_forward!arrow_forwardSuppose the economy is experiencing inflation. If the Federal Reserve enacts contractionary monetary policy, interest rates will likely Multiple Choice rise causing prices to decrease. fall causing prices to increase. fall causing prices to decrease. rise causing prices to increasearrow_forward

- Suppose the current inflation rate is a constant 7% and the central bank implements a disinflation policy to reduce it to its target rate of 3%. To achieve this objective the central bank, by increasing its cash rate, raise the nominal interest rate from its current 9% to 14%. In the long run, at which the central bank achieves its inflation target, what will be the nominal rate of interest, the real rate of interest and the inflation rate?arrow_forwardThe following graph shows the current short-run Phillips curve for a hypothetical economy; the point on the graph shows the initial unemployment rate and inflation rate. Assume that the economy is currently in long-run equilibrium. Suppose the central bank of the hypothetical economy decides to decrease the money supply. On the following graph, shift the curve or drag the blue point along the curve, or do both, to show the short-run effects of this policy. Hint: You may assume that the central bank's move was unanticipated. SR Phillips Curve0246810126543210INFLATION RATE (Percent)UNEMPLOYMENT RATE (Percent)SR Phillips Curve In the short run, an unexpected decrease in the money supply results in in the inflation rate and in the unemployment rate. On the following graph, shift the curve or drag the blue point along the curve, or do both, to show the long-run effects of the decrease in the money supply. 0246810126543210INFLATION RATE…arrow_forwardWhat Can the Fed Do about Inflation? In the article by Thomas Hogan, we learn that Russia's invasion of the Ukraine nor the shortage or supply chain issues has not derived the main causes of inflation. (Hogan, 2022) The main cause for the issues that we have been facing come directly from the constant price changes and the monetary policy that is currently in place. We learn that with Federal Open Market Committee (FOMC) has not adjusted their monetary policy, and have been raising the rates in such small increments that is causing the inflation to continue in an upward trend. What needs to occur is the FOMC needs to raise interest rates in greater scales in order the combat the inflation that is taking place and stabilize the price levels that are out there. (Hogan, 2022) What needs occur is that the Fed needs to come up with a policy that will allow for a predetermined path that slows down and regulating the money growth back to a safe place. Having the guidance from the article…arrow_forward

- The economy was in equilibrium; the rate of inflation was on target. An increase in the level of technology in period 1 leads to an increase in potential output. a) Use a graph of the DAD-DAS curves to show the short and long-run consequences of the increase in potential output. Explain the shifts of the curves. b) Suppose that the increase in potential output is accompanied by a permanent reduction in the level of the central bank's inflation target. Use a graph of the DAD-DAS curves to show the short and long-run consequences of the increase in potential output and the change in inflation target. Explain the shifts of the curves.arrow_forwardCore inflation is more volatile than headline inflation. True False Speculative demand for money falls when the opportunity cost of money rises. True Falsearrow_forwardThe aggregate economy of India has a rate of money growth equal to 7. Initially the velocity of money is not changing. The long-run aggregate supply curve equals 2 But then there is a banking panic, causing the growth rate of the velocity of money to fall to -6 percent per year. In the absence of government intervention, the resulting recession would last for 3 years (meaning it would grow at the recession growth rate for 3 years, then return to long-run equilibrium after that). Assume that just before the recession started, India's level of GDP was equal to $100 billion. Your boss has proposed that the government should step in and use fiscal policy to end the recession immediately. But Raj Kumar, a member of the opposition, has claimed that fiscal policy is too expensive, and anyways there is no reason to end the recession because it will end on its own. To counter his argument, your boss has asked you to calculate how much lower GDP would be by the end of the recession if the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education