ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

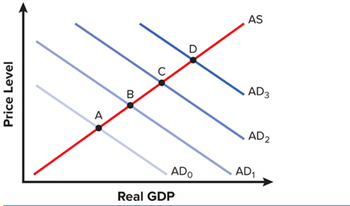

Suppose the economy is in equilibrium at point B which is below the full-employment output of point D. If the government implements fiscal policy targeted at moving real

Multiple Choice

A

B

C

D

Transcribed Image Text:Price Level

A

B

C

D

St

AS

AD3

AD 2

AD₁

ADO

Real GDP

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- a) Draw an aggregate demand/aggregate supply graph of an economy in a Recessionary situation. b) show clearly the GDP gap on your graph. c) examine the impact of the fiscal policy described above on the relevant components of AD and SRAS( if applicable). Account for the role of the autonomous spending multiplier.arrow_forwardIf a recession persists due to nominal wage and price stickiness (i.e., slow adjustment of nominal wages downward), what kind of fiscal policy can bring us out of this recession? decreased government expenditures and increased taxes increased government expenditures and decreased taxes decreased government expenditures contractionary fiscal policyarrow_forwardIf Investment = f(r*) a. Explain with pictures how it affects the balance of Supply/Saving and Investment Demand in the event of Fiscal policy, namely by decreasing state spending and increasing taxes. b. Explain with pictures how it affects the balance of Supply/Saving and Investment Demand in the event of Fiscal policy, namely by decreasing state spending and increasing taxes if it happens overseasarrow_forward

- Suppose you are given the following information. Autonomous spending is at $3000, government spending is at $4000, investment spending is at $2000, net exports are $1000, taxes are set at $3000 and the mpc is .8 or 80%. What is the equilibrium level of output? What would happen if the government tried to balance the budget? The other day, it was announced the consumer confidence was up last month. This sounded good news bells for firms. Why? What would be affected in our equation above? Why would it matter? Suppose the government tried to balance the budget my cutting spending, what would be the equilibrium level of output? If there is “crowding out (or in)”, what else might change in your equation? What impact would that havearrow_forwardOn the following graph, AD1 represents the initial aggregate demand curve in a hypothetical economy, and AS represents the initial aggregate supply curve. The economy's full-employment output is $12 billion. On the following graph, use the grey point (star symbol) to mark the equilibrium. (Note: You will not be graded on any adjustments made to the graph.) PRICE LEVEL (CPI) 106 105 104 103 102 H AS 1ŏ1 101 ADA 100 AD 3 99 AD 2 98 AD1 97 Full Employment 96 6 7 8 9 10 11 12 13 14 15 16 REAL GDP (Billions of dollars) Equilibrium (?)arrow_forwardBased on our understanding of the model presented in Ch3, a 5% tax cut in a country with balanced budget will cause an increase in equilibrium output? TRUE OR FALSEarrow_forward

- in another economy, the MPC = 4/5, government needs to increase expenditures $20 to complete a project, but it does not want to increase debt so it increases taxes $20 also. What, if any, will be the change in output generated by this balanced - budget expenditure scenario?arrow_forwardWhich of the following would not be considered an automatic stabilizer? Question 13 options: Income tax Unemployment compensation Education spending Food stampsarrow_forwarda) What are the three fiscal policy tools and how would each be used to counter a contractionary gap? b) True or False and explain: Fiscal Policy is effective at reducing the duration of an economic contraction. c) If the spending multiplier is 2.5 and the economy is in a $500 billion contractionary gap, how much should I increase government purchases to eliminate the gap? d) Continuing with c, if the MPC is 0.8, how much would I need to increase transfer payments to eliminate the $500 billion contractionary gap? e) True or False and explain: Households always react to tax changes in a predictable manner. Module 6: Deficits and the Debt. a) Distinguish between deficit and debt. b) Explain what crowding out is and why it reduces the impact of fiscal stimulus. c) True or false and explain: The national debt represents a threat of bankruptcy. (For d and e) Suppose the interest on the debt was $600 billion. If interest is paid domestically, 90% will be spent domestically (the remainder is…arrow_forward

- Which of the following is an example of an automatic stabilizer? tax rates the MPC the amount of dollars collected in taxes interest ratesarrow_forwardConsider a hypothetical closed economy in which households spend $0.80 of each additional dollar they earn and save the remaining $0.20. The marginal propensity to consume (MPC) for the economy is______, and the spending multiplier for the economy is______. suppose the government in this economy decides to decrease the government purchases by $300 billion. The decrease in government purchases will lead to a decrease in income generating an initial change in consumption equal to______. This decreases income yet again, causing a second change in consumption equal to_______. the total change in demand resulting from the initial change in government spending is_____________. The following graph shows that aggregate demand curve (AD1) for this economy before the change in government spending. Use the green line (triangle symbol) to plot the new aggregate demand curve (AD2) after the spending multiplier effect takes place. Hint: be sure that the new aggregate demand curve (AD2) is parallel…arrow_forwardSuppose actual real GDP is $5.49 trillion, potential real GDP is $12.48 trillion, and the marginal propensity to consume is 0.76. If we ignore price effects, and if the government already decided to increase its spending by $1.07 trillion, by how many trillions of dollars should the government change its lump sum taxes to fix the gap? (Round this to two digits after the decimal and enter this value as either a positive value or a negative value without the dollar sign.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education