Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

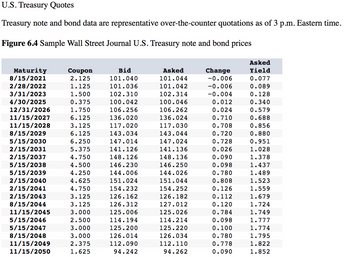

Transcribed Image Text:U.S. Treasury Quotes

Treasury note and bond data are representative over-the-counter quotations as of 3 p.m. Eastern time.

Figure 6.4 Sample Wall Street Journal U.S. Treasury note and bond prices

Maturity

8/15/2021

2/28/2022

3/31/2023

4/30/2025

12/31/2026

11/15/2027

11/15/2028

8/15/2029

5/15/2030

2/15/2031

2/15/2037

5/15/2038

5/15/2039

2/15/2040

2/15/2041

2/15/2043

8/15/2044

11/15/2045

5/15/2046

5/15/2047

8/15/2048

11/15/2049

11/15/2050

Coupon

2.125

1.125

1.500

0.375

1.750

6.125

3.125

6.125

6.250

5.375

4.750

4.500

4.250

4.625

4.750

3.125

3.125

3.000

2.500

3.000

3.000

2.375

1.625

Bid

101.040

101.036

102.310

100.042

106.256

136.020

117.020

143.034

147.014

141.126

148.126

146.230

144.006

151.024

154.232

126.162

126.312

125.006

114.194

125.200

126.014

112.090

94.242

Asked

101.044

101.042

102.314

100.046

106.262

136.024

117.030

143.044

147.024

141.136

148.136

146.250

144.026

151.044

154.252

126.182

127.012

125.026

114.214

125.220

126.034

112.110

94.262

Change

-0.006

-0.006

-0.004

0.012

0.024

0.710

0.708

0.720

0.728

0.026

0.090

0.098

0.780

0.808

0.126

0.112

0.120

0.784

0.098

0.100

0.780

0.778

0.090

Asked

Yield

0.077

0.089

0.128

0.340

0.579

0.688

0.856

0.880

0.951

1.028

1.378

1.437

1.489

1.523

1.559

1.679

1.724

1.749

1.777

1.774

1.795

1.822

1.852

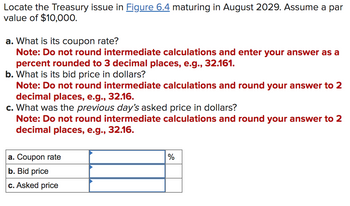

Transcribed Image Text:Locate the Treasury issue in Figure 6.4 maturing in August 2029. Assume a par

value of $10,000.

a. What is its coupon rate?

Note: Do not round intermediate calculations and enter your answer as a

percent rounded to 3 decimal places, e.g., 32.161.

b. What is its bid price in dollars?

Note: Do not round intermediate calculations and round your answer to 2

decimal places, e.g., 32.16.

c. What was the previous day's asked price in dollars?

Note: Do not round intermediate calculations and round your answer to 2

decimal places, e.g., 32.16.

a. Coupon rate

b. Bid price

c. Asked price

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Refer to the bond listing table below to determine the coupon rate and maturity of a bond issued by Citigroup. Bond Listing from Wall Street Journal Online 1 2 3 4 5 6 7 8 9 10 Issuer Name Symbol Coupon Maturity Rating Moody's/S&P/ Fitch High Low Last Change Yield % CITIGROUP C.HRY 8.500% May 2019 A3/A/A+ 119.268 116.615 117.733 0.448 5.940 GENERAL ELECTRIC CAPITAL GE.HMX 5.500% Jan 2020 Aa2/AA+/−− 105.307 102.374 103.097 −0.028 5.090 KRAFT FOODS KFT.GX 5.375% Feb 2020 Baa2/BBB−/BBB− 106.081 101.999 103.411 0.687 4.930 BANK OF AMERICA BAC.ICB 7.625% Jun 2019 A2/A/A+ 113.172 111.839 112.847 0.283 5.786 ANHEUSER- BUSCH BUD.ID 5.375% Jan 2020 Baa2/BBB+/−− 104.693 104.061 104.526 −0.466 4.784 COMCAST CORP CMCD.GC 5.150% Mar 2020 Baa1/BBB+/BBB+ 104.832…arrow_forwardConsider the following two Treasury securities: Bond Price Modified duration (years) A $100 6 B $80 7 For a 25 basis-point change in interest rates, what is the percentage change in price for Bond A? A. -2.00% B. -1.50% C. 3.00% D. 3.50%arrow_forwardProblem 3.3. Yields on money market instruments roblem 3.4. Calculate the following: a. If the overnight fed funds rate is quoted as 2.25 percent, what is the bond equivalent rate? b. Suppose a bank enters a repurchase agreement in which it agrees to buy Treasury securities from a correspondent bank at a price of Rs 24,950,000, with promise to buy them back at a price of Rs 25,000,000. Calculate the yield on the repo if it has 21 days to maturity. c. A government securities dealer is currently borrowing Rs 10 million from a money center bank using repurchase agreements based on Treasury bills. If today's repo rate is 5.5 percent, how much in interest will the dealer owe the bank for an overnight borrowing? d. A security dealer borrows Rs 25 million cash through repo from a company for one day. The dealer pays Rs 2,500 in interest on this loan. What is repo rate on this loan? You can buy commercial nanorarrow_forward

- H Video Excel Online Structured Activity: Interest rate premiums A 5-year Treasury bond has a 4.95% yield. A 10-year Treasury bond yields 6.75%, and a 10-year corporate bond yields 9.85%. The market expects that inflation will average 3.15% over the next 10 years (IP10 = 3.15%). Assume that there is no maturity risk premium (MRP = 0) and that the annual real risk-free rate, r*, will remain constant over the next 10 years. (Hint: Remember that the default risk premium and the liquidity premium are zero for Treasury securities: DRP = LP = 0.) A 5-year corporate bond has the same default risk premium and liquidity premium as the 10-year corporate bond described. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet What is the yield on this 5-year corporate bond? Round your answer to two decimal places. % Check My Work Reset Problemarrow_forwardIssuer Rating Yield Spread (bps) Treasury Benchmark Corporation A Triple A 7.87 50 10 Corporation B Double A 7.77 40 10 Corporation C Triple A 8.60 72 30 Corporation D Double A 8.66 78 30 Corporation E Triple B 9.43 155 30 Which of the five bonds has the greatest credit risk?arrow_forwardAnswer question a and b please and thank youarrow_forward

- C20 fx A В C On January 1, Ruiz Company issued bonds as follows: 3 4 Face Amount: $500,000 5 Number of Years: 15 Stated Interest Rate: 7% 7 Interest payments per year 2 8. 9. Required: 10 1) Calculate the bond selling price given the two market interest rates below. 11 Use formulas that reference data from this worksheet and from the appropriate future or present value tables (found by clicking the tabs at the bottor 12 this worksheet). 13 Note: Rounding is not required. 14 15 a) Annual Market Rate 9% 16 Semiannual Interest Payment: $17,500 17 PV of Face Amount: 18 PV of Interest Payments: 19 Bond Selling Price: 0.00 20 21 b) Annual Market Rate 6.00% 22 Semiannual Interest Payment: $17,500 23 PV of Face Amount: 24 PV of Interest Payments: 25 Bond Selling Price: %3D 26 A Future Value of Annuity of $1 A Present Value of Annuity of $1 A Graded Worksheet IIarrow_forwardV5 2. Go to the CANSIM database and download monthly data, from January 1976 to January 2021, on the three-month T-bill rate (series V122531) and the interest rate on long-term Canada bonds (Government of Canada benchmark bond yields, long term )(series V122544). (Note these are daily rates – convert it into monthly rates) a) Construct a yield curve by creating a line graph for January 2021 and for the same month in 2020, across all the maturities. (on excel) b) How do the yield curves compare? What does the changing slope say about potential changes in economic conditions?arrow_forward6. Below is a list of daily Treasury note and bond listings from Wall Street Journal. Treasury bonds make semiannual payments. First column is the maturity date. Second column is the coupon rate. Third and Fourth columns show the bid and ask prices. Treasury prices are quoted as a percentage of face value. So on the 2025/10/31 bond, the bid price is shown to be 106.212. With $1000 face value, this quote represents $1062.12. The Fifth column shows the change in the ask price from the previous day, measured as percentage of face value. So the 2025/10/31 bond's ask price decreased by 0.002%, or $0.02 with face value of $1000, from previous day's value. The last column shows the yield to maturity, based on the ask price. Locate the Treasury bond in Figure 7.5 maturing in November 2026. Is this a premium or a discount bond? What is its current yield? What is its yield to maturity? What is the bid-ask spread in dollars? Assume a par value of $10,000. Maturity 10/31/2025 11/15/2026 Coupon…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education