ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

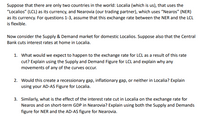

Transcribed Image Text:Suppose that there are only two countries in the world: Localia (which is us), that uses the

"Localios" (LCL) as its currency, and Nearovia (our trading partner), which uses “Nearos" (NER)

as its currency. For questions 1-3, assume that this exchange rate between the NER and the LCL

is flexible.

Now consider the Supply & Demand market for domestic Localios. Suppose also that the Central

Bank cuts interest rates at home in Localia.

1. What would we expect to happen to the exchange rate for LCL as a result of this rate

cut? Explain using the Supply and Demand Figure for LCL and explain why any

movements of any of the curves occur.

2. Would this create a recessionary gap, inflationary gap, or neither in Localia? Explain

using your AD-AS Figure for Localia.

3. Similarly, what is the effect of the interest rate cut in Localia on the exchange rate for

Nearos and on short-term GDP in Nearovia? Explain using both the Supply and Demands

figure for NER and the AD-AS figure for Nearovia.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- do question 4 onlyarrow_forward18. Which of the following statements is TRUE? A) Under a gold standard, each country fixes the price of its currency in terms of gold by standing ready to trade domestic currency for gold whenever necessary to defend the official price. B) Under a gold standard, each country is not responsible for pegging its currency's price in terms of the official international reserve asset, gold. C) Under a gold standard, countries with limited gold reserves cannot participate. D) Under a gold standard, all countries sets the same price of its currency in terms of gold. Answer:arrow_forward2. Assume two countries, Thailand (T) and Japan (J), have one good: cameras. The demand (d) and supply (s) for cameras in Thailand and Japan is described by the following functions: Qd" = 60 – P; Qs™ =-5 + 1/4 P; =-10+ 1/2 P. Qd'= 80 – P; Qs' P is the price measured in a common currency used in both a. Compute the equilibrium price (P) and b. Now assume that free trade countries, such as the Thai Baht. quantities (Q) in each country without trade. occurs. The free trade price goes to 56.36 Baht. Who exports and imports cameras and in what quantities?arrow_forward

- A6.arrow_forwardIn our pretend world there are two countries - Chile and Switzerland - that are engaged in trade. The firm Switzerland Chocolates Express sells Boxes of chocolate (a good) in Chile. Each Box of Chocolates sells for 6500 Chilean pesos in Chile. In Switzerland, each box of chocolates 11 Swiss Franc to produce. Assume that the firm has 1 million boxes of chocolate to sell. How much money (in Swiss Franc) would the firm make (or lose) on the sale at the following exchange rates: Rate 1: 550 Pesos per Swiss Franc Rate 2: 0.0015 Swiss Franc Per Chilean Pesoarrow_forwardYear 2014 2015 2016 US $ $1 $1 $1 British Pound 0.85 0.70 0.60 Based on the Exchange rates above, How might international trade be affected? A)It is cheaper for American to travel to EnglandB)The US will import more from EnglandC)England will export more to the USD)England will import more from the USarrow_forward

- Ab 44 Economics The following graph shows the market for euros, which is initially in equilibrium. Suppose an economic expansion in the United States leads to an increase in the incomes of American households, causing imports from Europe to rise. On the graph, illustrate the effect of an economic expansion on the market for euros by shifting the appropriate curve or curves.arrow_forwardSuppose that Argentina's dollar-denominated external assets and liabilities are $10 billion and $100 billion, respectively, and its Argentine peso-denominated external assets are 70 billion pesos (P) and peso-denominated external liabilities are 50 billion pesos (P). Suppose further that Argentina fixes its exchange rate at P1.5 = $US1. a) What is the peso value of Argentina's total external wealth? Is it a net debtor or creditor? b) Suppose that Argentina changes its exchange rate to P2.3 = $US1. How does the external wealth of Argentina change when this occurs?arrow_forwardPlease only typing answer Answer all questions Thankyouarrow_forward

- U S foreign exchange intervention is sometimes done by an Excha U.S. foreign exchange intervention is sometimes done by an Exchange Stabilization Fund, or ESF (a branch of the Treasury Department), which manages a portfolio of U.S. government and foreign currency bonds. An ESF intervention to support the yen, for example, would take the form of a portfolio shift out of dollar and into yen assets. Show that ESF interventions are automatically sterilized and thus do not alter money supplies. How do ESF operations affect the foreign exchange risk premium? U S foreign exchange intervention is sometimes done by an Exchaarrow_forwardDraw the exchange market where dollars trade for British Pounds, with the equilibrium exchange rate at $1.18 and the equilibrium total amount of Pounds traded at 10 million. a> Assume that people in Britain become pessimistic about visiting, buying from, or investing in the United States. How will this market be affected? (i.e., which curve(s) will shift, and in which direction?) b> What will happen to the equilibrium quantity of Pounds traded after the event in part a? What will happen to the equilibrium exchange rate?arrow_forward1. Individual Problems 11-1 Suppose that the euro is trading at $1.85 per euro in the foreign exchange market. Next, suppose that the exchange rate falls to $1.11 per euro, due to falling interest rates in the eurozone. The following graph shows the supply and demand curves for euros in the foreign exchange market. On the following graph, shift either the supply curve for euros or the demand curve for euros to reflect the influence of “carry trade” (in isolation from other factors that may affect the exchange rate) on the exchange rate for euros. (Hint: Carefully consider which price is measured on the vertical axis and which currency is being measured on the horizontal axis.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education