ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Suppose that the euro is trading at $1.15 per euro in the foreign exchange market. Next, suppose that the exchange rate falls to $0.94 per euro, due to falling interest rates in the eurozone.

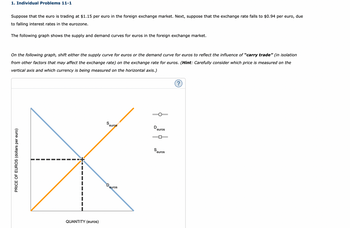

The following graph shows the supply and demand curves for euros in the foreign exchange market.

On the following graph, shift either the supply curve for euros or the demand curve for euros to reflect the influence of “carry trade” (in isolation from other factors that may affect the exchange rate) on the exchange rate for euros. (Hint: Carefully consider which price is measured on the vertical axis and which currency is being measured on the horizontal axis.)

Transcribed Image Text:PRICE OF EUROS (dollars per euro)

1. Individual Problems 11-1

Suppose that the euro is trading at $1.15 per euro in the foreign exchange market. Next, suppose that the exchange rate falls to $0.94 per euro, due

to falling interest rates in the eurozone.

The following graph shows the supply and demand curves for euros in the foreign exchange market.

On the following graph, shift either the supply curve for euros or the demand curve for euros to reflect the influence of "carry trade" (in isolation

from other factors that may affect the exchange rate) on the exchange rate for euros. (Hint: Carefully consider which price is measured on the

vertical axis and which currency is being measured on the horizontal axis.)

QUANTITY (euros)

S

euros

D

euros

D

euros

S

euros

(?)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- view picturearrow_forwardSuppose a currency is temporarily undervalued by a fixed exchange rate system, such as the international gold standard. Let that currency be the US dollar, and expressed in terms of British pounds. First show this disequilibrium using a supply and demand graph and then Clearly explain how one could profit by arbitraging in dollars using a bill of exchange.arrow_forwardPresently, the dollar is worth 140 Japanese yen in the spot market. The interest rate in Japan on 90-day government securities is 4 percent; it is 8 percent in the United States. a. If the interest-rate parity theorem holds, what is the implied 90-day forward exchange rate in yen per dollar? b. What would be implied if the U.S. interest rate were 6 percent?arrow_forward

- Assume that the amount of dollar (domestic) assets is fixed in the foreign exchange market. Explain the effects of an increase in the domestic interest rate, holding all other factors constant, on the exchange rate. Draw a diagram for the foreign exchange market to support your explanation.arrow_forwardplease do this for the country China.arrow_forwardThe following paragraphs discuss the impact of various economic events on the exchange rate. Complete the paragraphs by filling in the blanks. Use any of the words from the following list (you can use each of these words as many times as you wish but choose carefully - your sentence must make grammatical sense):demand supply left right buy sell imports exports rise fall increases decreases What happens to the current account balance and the exchange rate when the following happens? Suppose that New Zealand firms become more profitable relative to foreign firms and so increase their payment of dividends (everything else held constant). The value for net foreign income therefore ________ and the value of the current account balance will _______. Payment of NZ dividends to foreign owners affects the _______ or/of $NZ while payments of foreign dividends to NZ owners of foreign companies affects the _______ for/of $NZ. Therefore the impact of the change in profit of NZ firms is…arrow_forward

- An explosion of education levels causes Europeans' incomes to increase. How would this event impact the foreign exchange market for Euros? the dollar price of Euros decreases and the quantity of Euros increases the dollar price of Euros decreases and the quantity of Euros decreases the dollar price of Euros increases and the quantity of Euros increases the dollar price of Euros increases and the quantity of Euros decreasesarrow_forwardplease see imagearrow_forwardYear 2014 2015 2016 US $ $1 $1 $1 British Pound 0.85 0.70 0.60 Based on the Exchange rates above, How might international trade be affected? A)It is cheaper for American to travel to EnglandB)The US will import more from EnglandC)England will export more to the USD)England will import more from the USarrow_forward

- If a "Big Mac costs $4.00 in the United States and 200 yen in Japan, then the implied "purchasing-power-parity" exchange rate using the "Big Mac" is __________. If the actual exchange rate in the market is 120 yen = $1, then an economist would say that the actual Japanese yen is __________ in comparison with its "purchasing-power-parity" rate.arrow_forwardAb 44 Economics The following graph shows the market for euros, which is initially in equilibrium. Suppose an economic expansion in the United States leads to an increase in the incomes of American households, causing imports from Europe to rise. On the graph, illustrate the effect of an economic expansion on the market for euros by shifting the appropriate curve or curves.arrow_forwardDraw and carefully label the Euro-U.S. dollar foreign exchange graph. You must use the Euro/US $ exchange rate as your price variable. Assume we are currently in market equilibrium. Illustrate using the graph how the equilibrium euro/dollar foreign exchange rate would be affected by the following events, holding all else constant. Use a different graph for each part. Explain in words why the equilibrium exchange rate changed. An unexpected increase in the US inflation rate relative to the Euro Area.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education