Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

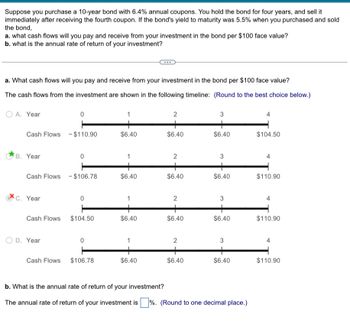

Transcribed Image Text:Suppose you purchase a 10-year bond with 6.4% annual coupons. You hold the bond for four years, and sell it

immediately after receiving the fourth coupon. If the bond's yield to maturity was 5.5% when you purchased and sold

the bond,

a. what cash flows will you pay and receive from your investment in the bond per $100 face value?

b. what is the annual rate of return of your investment?

a. What cash flows will you pay and receive from your investment in the bond per $100 face value?

The cash flows from the investment are shown in the following timeline: (Round to the best choice below.)

A. Year

0

1

2

3

4

Cash Flows $110.90

$6.40

$6.40

$6.40

$104.50

B. Year

0

1

2

3

4

Cash Flows - $106.78

$6.40

$6.40

$6.40

$110.90

C. Year

0

2

3

4

Cash Flows $104.50

$6.40

$6.40

$6.40

$110.90

OD. Year

1

2

3

Cash Flows $106.78

$6.40

$6.40

$6.40

$110.90

b. What is the annual rate of return of your investment?

The annual rate of return of your investment is %. (Round to one decimal place.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: We need to determine bond and yield to maturity of the bond.

VIEW Step 2: To determine cash flows we need to determine price of bond today and price of bond after 4 years

VIEW Step 3: We need to determine cash flow timeline.

VIEW Step 4: Annual rate of return is calculated

VIEW Solution

VIEW Step by stepSolved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume that you wish to purchase a bond with a 17-year maturity, an annual coupon rate of 11.5%, a face value of $1,000, and semiannual interest payments. If you require a 9.5% return on this investment, what is the maximum price you should be willing to pay for the bond?arrow_forward1. Suppose you buy an annual coupon bond with a coupon rate of 6% for $915. The bond has 10 years to maturity and a par value of $1000. What rate of return do you expect to ern on your investment? Two years from now the YTM on your bond has declined by one percentage point, and you decide to sell. What is the holding period yield on your investment? Compare this yield to the YTM when you first bought the bond. Why are they different?arrow_forward30) Suppose that you currently hold a bond with a face value of $1000, six-year maturity that pays 8 percent coupons with an 8 percent yield to maturity, with annual coupon payment. Also, suppose that for each of the first five years that you receive coupon payments, you reinvest each coupon payment into an asset that pays 9% interest. What is your reinvestment income at the end of year 5?arrow_forward

- An investor is considering the purchase of a(n) 7.500 %, 15-year corporate bond that's being priced to yield 9.500%. She thinks that in a year, this bond will be priced in the market to yield 8.500%. Using annual compounding, find the price of the bond today and in 1 year. Next, find the holding period return on this investment, assuming that the investor's expectations are borne out. The price of the bond today is $ (Round to the nearest cent.) Got mom help Clear all Check answearrow_forwardConsider a bond with a face value of $2,000 that pays a coupon of $150 for 10 years. Suppose the bond is purchased at $500, and can be resold next year for $400. What is the rate of return of the bond? 10% 0% -10% 20%arrow_forwardAn investor is considering the purchase of a(n) 8.375%, 15-year corporate bond that's being priced to yield 10.375%. She thinks that in a year, this bond will be priced in the market to yield 9.375%. Using annual compounding, find the price of the bond today and in 1 year. Next, find the holding period return on this investment, assuming that the investor's expectations are borne out. The price of the bond today is $. (Round to the nearest cent.) 4arrow_forward

- Suppose you bought a 5-year Treasury note (paying annual coupon of 2.0% and having face value of $1000) at par value. Two years later you sold the bond at a quoted price of $1020. If you can reinvest the coupons at the note's current yield to maturity, what is your geometric ANNUALIZED average holding period return over the 2-year periodarrow_forwardSuppose that for a price of $960 you purchase a 7-year Treasury bond that has a face value of $1,000 and a coupon rate of 4%. If you sell the bond one year later for $1,120, what was your rate of return for that one-year holding period? The rate of return for the one-year holding period was %. (Round your response to one decimal place.)arrow_forwardAssume you have some money and want to save to amass a given amount at the end of 5 years. One of the options you have is a 5-year, 10% coupon bond that is currently selling at par. Assume that bond is default free. What will determine the total amount of money you will have at the end of year 5 if you buy the bond today?arrow_forward

- Suppose you bought a 10 year coupon bond with par value $500 and coupon rate 6%. What is the market price of this bond two years later if the current yield is 1.5%?arrow_forwardSuppose you purchased a ten-year, 8% coupon bond(annual coupon payment) at $980. Two years later, you decide to take a vacation and sell the bond to acquire the necessary funds. At the time you sell the bond, eight-year bonds with similar characteristics sell for yields of 9%. What is your realized yield on the bond?arrow_forwardIf you purchased a bond one year ago for $1000 and just sold it for $1100 after receiving the $50 annual coupon payment, then what was your real return on the investment if theinflation rate was 2.1% for the same year?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education