Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

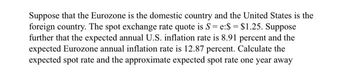

Transcribed Image Text:Suppose that the Eurozone is the domestic country and the United States is the

foreign country. The spot exchange rate quote is S=e:$ = $1.25. Suppose

further that the expected annual U.S. inflation rate is 8.91 percent and the

expected Eurozone annual inflation rate is 12.87 percent. Calculate the

expected spot rate and the approximate expected spot rate one year away

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You expect that the rate of inflation next year in Australia will be 3% and in the United States will be 2%. The spot rate of the Australian dollar is US$0.75 and the one year forward rate is US$0.70. (a) Using purchasing power parity, calculate the expected change in the exchange rate for the Australian dollar. (b) Using your answer to (a), calculate the expected spot rate of the Australian dollar in one year.arrow_forwardThe current spot rate between the euro and dollar is €1.0951/S. The annual inflation rate in the U.S is expected to be 2.93 percent and the annual inflation rate in euroland is expected to be 2.39 percent. Assuming relative purchasing power parity holds, what will the exchange rate be in two years? Group of answer choices €1.0892/$ €1.0775/$ €1.0833/$ €1.1070/$ €1.1010/Sarrow_forwardToday's spot exchange rate: 1 euro = $1.25.US interest rate (home interest rate) is 7%.EU interest rate (foreign interest rate) is 10%.a) If the IRP (Interest rate parity) holds, what should the forward exchange rate be today?b) Assume that today, you invest $500 in the EU market for one year and at the same time, enter a currency forward contract to sell euro in a year at the forward rate from part a). If today's spot exchange rate is: 1 euro=$1.32 instead of $1.25, show how much profits or losses you make next year.arrow_forward

- Suppose the year 1, year 2 and year 3 forecasts for the rate of inflation in Denmark are 3%, 4% and 5% respectively. Suppose also that the year 1, year 2 and year 3 forecasts for the rate of inflation in France are 11%, 9% and 8% respectively. If the expected spot rate between the Danish Krone (DKK) and the EUR is EUR0.1344/DKK at the end of year 3, what is the current spot rate? a.EUR0.119024/DKK b.EUR0.151762/DKK c.EUR0.111027/DKK d.EUR0.128269/DKK e. Not enough information to answer this question.arrow_forward17arrow_forward3. The expected inflation rate in Oman is 3.5%. The current spot rate between OMR and INR is INR174.325/OMR and the expected spot exchange rate in one year is INR176.435/OMR. How much is the expected inflation rate in India?arrow_forward

- Facing the increasing interest rate of the U.S. that will be even higher in the next several months, what is the trend of the exchange rate of your home country? If your home country runs a fixed exchange rates regime, what suggestions can you provide to the monetary authority?arrow_forwardSuppose that the interest rate on a US dollar deposit is 3% and the interest rate on a Japanese yen deposit is 1%. Today’s exchange rate is $1/¥ and the expected rate one year in the future is $1.2/¥, so $100 today can be exchanges for ¥100. Which currency deposit yield a higher expected rate of return (which currency investors should be willing to hold)? Why?arrow_forwardAssume that the Mexican peso currently trades at 11 pesos to the U.S. dollar. During the year U.S. inflation is expected to average 4%, while Mexican inflation is expected to average 5%. What is the current value of one peso in terms of U.S. dollars? Given the relative inflation rates, what will the exchange rates be 1 year from now? Which currency is expected to appreciate and which currency is expected to depreciate over the next year? The current value of one Mexican peso in terms of U.S. dollars, USS, is US$/MP. (Round to six decimal places.) Given the relative inflation rates, the exchange rate of one U.S. dollar in terms of Mexican pesos, MP, one year from now will be MP/US$. (Round to six decimal places.) Given the relative inflation rates, the exchange rate of one Mexican peso in terms of U.S. dollars, US$, one year from now will be US$ /MP. (Round to six decimal places.) ▼is expected to appreciate, while the is expected to depreciate over the next year. (Select from the…arrow_forward

- On November 1, 1999, the exchange rate between the Brazilian real and U.S. dollar is R$1.95/$. The consensus forecast for the U.S. and Brazil inflation rates for the next 3-year period is 2.6% and 20.0% per year, respectively. What would you forecast the exchange rate to be at around November 1, 2002? R$3.6673/$ O R$3.1199/$ O R$2.6675/$ O R$2.2807/$arrow_forwardSuppose the british pound U-S.dollar exchange rate is currently So =£.50.Further suppose that the inflation rate in britain is predicted to be 10percent over the year coming year and(for the moment)the inflation rate in the united states is predicted to be zero. What do you think the exchange rate will be in a yeararrow_forwardSuppose you observe the following spot and forward exchange rates between the U.S. dollar ($) and the Canadian dollar (C$): Spot Exchange Rate One-Year Forward Exchange Rate Canadian dollar (U.S. dollar/Canadian dollar) 0.8842 0.9001 The current one-year interest rate on U.S. Treasury securities is 6.89%. If interest rate parity holds, what is the expected yield on one-year Canadian securities of equal risk? 4.75% 4.00% 5.00% 5.75%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education