Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

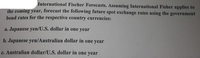

Transcribed Image Text:International Fischer Forecasts. Assuming International Fisher applies to

the coming year, forecast the following future spot exchange rates using the government

bond rates for the respective country currencies:

a. Japanese yen/U.S. dollar in one year

b. Japanese yen/Australian dollar in one year

C. Australian dollar/U.S. dollar in one year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The spot rate for the Argentine peso is $0.3600 per peso. Over the year inflation in Argentina is 10% and U.S. inflation is 4%. If purchasing power parity holds, at year-end the exchange rate should be approximately ______________ dollars per Real. A. 0.2875 B. 0.2987 C. 0.3384 D. 0.3614arrow_forwardToday's spot exchange rate: 1 euro = $1.25.US interest rate (home interest rate) is 7%.EU interest rate (foreign interest rate) is 10%.a) If the IRP (Interest rate parity) holds, what should the forward exchange rate be today?b) Assume that today, you invest $500 in the EU market for one year and at the same time, enter a currency forward contract to sell euro in a year at the forward rate from part a). If today's spot exchange rate is: 1 euro=$1.32 instead of $1.25, show how much profits or losses you make next year.arrow_forwardAssume that you believe that purchasing power parity (PPP) holds. You are an Australian investor with 225,000 AUD to invest for the next year. The current exchange rate is AUD/EUR 0.62. The expected inflation in Germany is 1.3% while the expected inflation in Australia is 3.6%. Current interest rates in Germany are 0.5% and in Australia 4.1%. What is your expected yield on a German investment? 4.1% 5.9% O 0.5% 2.8% None of the other options are correctarrow_forward

- 17arrow_forwardUse the following information for the next 2 questions. Assume that the U.S. one-year interest rate is 8% and the one-year interest rate on Australian dollars is 13%. The U.S. annual inflation is expected to be 5%, while the Australian annual inflation is expected to be 7%. The current spot exchange rate of an Australian dollar is $0.689. You have $100,000 to invest for one year. Question 4 (6.25 points) You believe that IFE holds. What will be the yield on your investment if you invest in the Australian market? (HINT: You believe that IFE holds, so the spot rate one year later is the rate obtained from IFE. Note that the interest rate given in the problem is the nominal rate.) 13.00% 8.00% 18.23% 7.16%arrow_forwardFacing the increasing interest rate of the U.S. that will be even higher in the next several months, what is the trend of the exchange rate of your home country? If your home country runs a fixed exchange rates regime, what suggestions can you provide to the monetary authority?arrow_forward

- Assume that the Mexican peso currently trades at 11 pesos to the U.S. dollar. During the year U.S. inflation is expected to average 4%, while Mexican inflation is expected to average 5%. What is the current value of one peso in terms of U.S. dollars? Given the relative inflation rates, what will the exchange rates be 1 year from now? Which currency is expected to appreciate and which currency is expected to depreciate over the next year? The current value of one Mexican peso in terms of U.S. dollars, USS, is US$/MP. (Round to six decimal places.) Given the relative inflation rates, the exchange rate of one U.S. dollar in terms of Mexican pesos, MP, one year from now will be MP/US$. (Round to six decimal places.) Given the relative inflation rates, the exchange rate of one Mexican peso in terms of U.S. dollars, US$, one year from now will be US$ /MP. (Round to six decimal places.) ▼is expected to appreciate, while the is expected to depreciate over the next year. (Select from the…arrow_forwardplease help me solve this. Explain to me step by step how to find the answerarrow_forwardSuppose you observe the following spot and forward exchange rates between the U.S. dollar ($) and the Canadian dollar (C$): Spot Exchange Rate One-Year Forward Exchange Rate Canadian dollar (U.S. dollar/Canadian dollar) 0.8842 0.9001 The current one-year interest rate on U.S. Treasury securities is 6.89%. If interest rate parity holds, what is the expected yield on one-year Canadian securities of equal risk? 4.75% 4.00% 5.00% 5.75%arrow_forward

- Assume the following information: Spot rate of U.S. dollar Quoted Price AUD1.2500/USD 180-day forward rate of U.S. dollar 180-day Australian interest rate (a periodic rate) 180-day U.S. interest rate (a periodic rate) AUD1.2800/USD 4.75% 3.10% A. What USD-denominated percent rate of return can a US investor earn if they attempt covered interest arbitrage? (to two decimal places like 6.54%) B. What AUD-denominated percent rate of return can an Australian investor earn if they attempt covered interest arbitrage? (to two decimal places like 6.54%) C. Given this information, who has a covered interest arbitrage opportunity? Answer either "Australian investors" or "U.S. investors". D. What changes in the 2 quoted prices above would likely occur to eliminate any further possibilities of covered interest arbitrage? (answer with just or 1) Spot rate of U.S. dollar 180-day forward rate of U.S. dollararrow_forwardplease help me figure out step by step how to ca;culate and find the answerarrow_forward1.A research institution has just published projected inflation rates for the United States andGermany for the next year. U.S. inflation is expected to be at 10% per year while German inflationis expected to be at 4% per year. If the current exchange rate is $0.95/€, what should be theexchange rate for the next years? 4. Suppose exchange rate for the British pound, Euro, and Australia dollar were $1.400, $1.225, and$0.875, respectively. At the time, the associated 90-day interest rates (annualized) were 12%, 6%,and 4%, while the U.S. 90-day interest rate (annualized) was 8%. What was the 90-day forwardrate on a Dollar Currency portfolio (DCP) (DCP 1 = £1 + €1 + AU$1) if interest parity were tohold?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education