Managerial Economics: A Problem Solving Approach

5th Edition

ISBN: 9781337106665

Author: Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

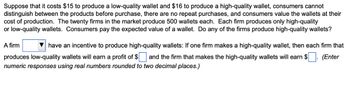

Transcribed Image Text:Suppose that it costs $15 to produce a low-quality wallet and $16 to produce a high-quality wallet, consumers cannot

distinguish between the products before purchase, there are no repeat purchases, and consumers value the wallets at their

cost of production. The twenty firms in the market produce 500 wallets each. Each firm produces only high-quality

or low-quality wallets. Consumers pay the expected value of a wallet. Do any of the firms produce high-quality wallets?

A firm

have an incentive to produce high-quality wallets: If one firm makes a high-quality wallet, then each firm that

produces low-quality wallets will earn a profit of $ and the firm that makes the high-quality wallets will earn $ (Enter

numeric responses using real numbers rounded to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Scenario Between recalls on mass-produced commercial dog food and a general understanding of the benefits of a healthier diet for pets, the demand for natural or organic dog food is experiencing a significant increase. Wanda's treats are more expensive than the mass-produced treats found in most grocery and big box stores, but she prides herself on providing high-quality products and believes that her customers are willing to pay the extra money for quality. 1. How does Wanda's strategy of being a high-quality provider take advantage of the shifts in consumer demand for healthy dog treats? 2. Identify and describe an event that might occur in the economy that would cause Wanda's strategy to no longer be successful for Salty Pawz. If this event occurred, What actions would Wanda have to take in response, and what impact might they have on her business?arrow_forwardThe setting is a Ralph Lauren outlet store, and the product line is Polo golf shirts. A product manager and the General Manager for Outlet Sales are analyzing the discounted price to be offered at the outlet stores. Let’s work through the decision at the level of one color of golf shirts sold per outlet store per day. The decision being made is how low a price to select at the start of any given day to generate sales at that price throughout the day. The demand, revenue, and variable cost information is collected on the following spreadsheet:Questions1. Identify the change in total revenue (the marginal revenue) from the fourth shirt per day. What price reduction was necessary to sell four rather than three shirts?2. Does this fourth shirt earn an operating profit or impose an operating loss? How large is it?3. What is the change in total revenue from lowering the price to sell seven rather than six shirts in each color each day? In what sense is the decision to sell this seventh shirt…arrow_forwardBeta's Price Policy High Low A B $20 $30 High Alpha's Price Policy $20 $10 C D $10 $15 Low $30 $15 Refer to the diagram, where the numerical data show profits in millions of dollars. Beta's profits are shown in the northeast corner and Alpha's profits in the southwest corner of each cell. If both firms follow a high-price policy. Multiple Choice Beta will realize a $10 million profit and Alpha a $30 million profit. each will realize a $15 million profit Alpha will realize a $10 million profit and Beta a $30 million profitarrow_forward

- A computer hardware firm sells both laptop computers and printers. Their pricing team determines that there are 3 types of customers with the following willingness to pay: Laptop Printer Customer Type A $800 $100 $900 Customer Type B $1,000 $50 $1050 Customer Type C $600 $150 $750 If the firm were to change only individual prices, what prices should it charge for its laptops and printers? Assume for simplicity that the firm has only 1 customer of each type and that incremental costs for laptops and printers = $0. How much profit does the firm earn? How much consumer surplus will there be?arrow_forwardThe following table presents the valuations that 5 different consumers have for 2 different products. The production costs are $10 per unit of good A and $10 per unit of good B. The firm producing them can choose to price them independently or using a bundling strategy. What is the profit the firm will realize, if it prices optimally? VALUATIONS Product A Product B Consumer 1 5 95 Consumer 2 10 90 Consumer 3 50 50 Consumer 4 80 20 Consumer 5 95 5 ANSWER SHOULD BE 410. I will like if it is right! showing my support. Thank you.arrow_forwardAt a price of $8 per unit, Gadgets Incorporated is willing to supply 19,000 gadgets, while United Gadgets is willing to supply 16,000 gadgets. If the price were to rise to $10 per unit, their respective quantities supplied would rise to 28,000 and 22,000. If these are the only two firms supplying gadgets, what is the elasticity of supply in the market for gadgets? Multiple Choice 1.59 1.4 2.22 0.63arrow_forward

- Concept Integration. Review the theory ofsupply and demand in Chapter 2 (see pages 39–43).How do skimming and penetration pricing strategiesinfluence a product’s supply and demand?arrow_forwardHoward Millard recently opened a retail store specializing in hiking equipment and accessories. He was quite comfortable making decisions about the kinds of equipment he would stock in the store’s inventory, the décor of the retail space and his marketing strategy.An avid hiker since he was in his early teenage years and a competitive athlete, Howard knew the type of equipment that would be best to his target audience, and he knew that he needed to round out his merchandise mix with hats, shoes, energy drinks, snacks and other accessories. He was however, not certain about how to source the financing for this business venture. In speaking to a colleague he admitted that he personally did not possess the required financing to start such a business. To that end, he was cognizant of the fact that a sound business plan was necessary before approaching any potential lending institution or investor. This plan would provide details on the amount of money required and how he intends to utilize…arrow_forwardSuppose you are trying to determine the pricing for popcorn at a movie theater. There are just two types of customers (for simplicity assume just two total customers). One customer has a low demand for popcorn and will pay $1.00 for 16 oz of popcorn and nothing for a second 16oz. The high demand customer will pay $1.25 for the first 16oz and $0.50 for the second 16oz. If you charge one price for every 16oz a customer buys, what would you charge?arrow_forward

- 5. Foreign direct investment versus licensing Giocattolo is a profit-maximizing firm producing toy cars-a capital-intensive good-which are sold in its home country, Italy, and abroad in Spain. Giocattolo chose foreign production as a method of penetrating the Spanish market and has to decide whether it is more efficient to directly invest in Spain to establish a production subsidiary or to license the technology to a Spanish firm to produce its goods. On the following graph, AVC Spain is the average variable cost curve of a Spanish firm producing toy cars. (This curve represents costs such as labor and materials.) The curve ATC subsidiary represents the total unit costs Giocattolo will face if it establishes a subsidiary in Spain. PER-UNIT COST (Dollars) 10 9 8 2 1 0 0 15 ATC Subsidiary + 105 30 45 60 75 90 PRODUCT (Thousands) 120 AVC Spain + 135 150 ?arrow_forwardEconomics you are the manager of College Computers, a manufacturer of customized computers that meet the specifications required by the local university. Over 90 percent of your clientele consists of college students. College Computers is not the only firm that builds computers to meet this university’s specifications; indeed, it competes with many manufacturers online and through traditional retail outlets. To attract its large student clientele, College Computers runs a weekly ad in the student paper advertising its “free service after the sale” policy in an attempt to differentiate itself from the competition. The weekly demand for computers produced by College Computers is given by Q = 1,000 − 5P, and its weekly cost of producing computers is C(Q) = 1,200 + 2Q2. If other firms in the industry sell PCs at $250, what quantity and price of computers should you produce to maximize your firm’s profits? Instructions: Round your response to the nearest whole number. Quantity: _____…arrow_forwardThe following table contains different consumers' values for three software titles: PowerPoint, Excel, and Word. Suppose there are 100 consumers of each type. It costs Microsoft $0 to produce each piece of software. Consumer Types Administrative Assistants Marketing/Sales Accountants Price per each Profit on just that software PowerPoint Total profit on all software $76 $200 $25 A la carte pricing If Microsoft were to sell each of the software individually, what price should it set for each and what would its profits on each be? PowerPoint Excel $100 $100 $250 $ Word $200 $125 $25 Excel Word Bundled Pricing If Microsoft were to only sell the three products as a bundle, what price should they set for bundle and what would profits be? Bundled Price $ Total Profit S Mixed Pricing Suppose that Microsoft offered a bundle of all three for $375, but it also offers a price of $200 for each software separately. What is the new profit level for this pricing scheme?$ Is this mixed-pricing scheme…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning