Exploring Economics

8th Edition

ISBN: 9781544336329

Author: Robert L. Sexton

Publisher: SAGE Publications, Inc

expand_more

expand_more

format_list_bulleted

Question

eco

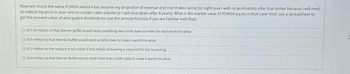

Transcribed Image Text:Now lets revisit the same POWSA venture but assume my projection of revenue and cost makes sense for eight years with no profitability after that (either because I will need

to reduce my price in year nine to sustain sales volume or I will shut down after 8 years). What is the market value of POWSA equity in that case? Hint: use a spreadsheet to

get the present value of anticipated dividends (or use the annuity formula if you are familiar with that)

O $21.34 million so that Warren buffet would need something like a 95% stake to make the deal worth his while

O $25 million so that Warren Buffet would need an 80% stake to make it worth his while

O $17 million so the venture is not viable if $20 million of funding is required for the marketing

O $32 million so that Warren Buffet would need more than a 50% stake to make it worth his while

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume that the cost of a university education will be $250,000 when Mr. Parata's child enters university in 12 years' time. If the discount rate is 6.76% per annum, compounded monthly, what is the present value (in 2 decimal places)?" Do not enter "$" in your answer. For example, enter "1000.23" for "$1000.23".arrow_forwardAsaparrow_forwardb) A stock you are evaluating just paid an annual dividend of £2.50. Dividends have grown at a constant rate of 1.5% over the last 15 years and you expect this to continue. i. If the required rate of return on the stock is 12%, what is the fair present value? If the required rate of return on the stock is 15%, what should the fair value be four years from today? ii.arrow_forward

- I am confused about the order of operations on this equation here. In what order do I need to move the various variables? Could you give me a step-by-step illustration as oppesed to simply the final answer for this equation? Please see the image for the particular problem. Otherwise it is Problem 5P from Chapter 7 (Rate of Return) in Contemporary Engineering Economics 6th Edition.arrow_forward1. Consider a wine dealer who has k bottles of wine. The dealer can sell them now (t = 0) or can store it for some time and then sell them later. The value of k bottles at t-th month is given by: Vt = ket The dealer can use the sales revenue as principal in a risk-free investment at rate r. (b) Write out the present value PV, of k bottles at t-th month.arrow_forwardSuppose that you plan to retire at 65. You invest $8,000 per year on your birthday for 10 years starting on your 25th and ending on your 34th birthday. Since you are young, you take more risks with your investments, and earn a rate of return of 12%. Then, you have children and decide to put all your retirement savings into investing in a college fund for them. You leave all accumulated funds in the retirement account, and it earns 6% per year, reflecting an (unwise) rise in caution during middle age. How much money will you have to retire on at 65 (31 years after you stop contributing)arrow_forward

- please solve with formulas like (F/P, 5% , n) not with the excell.arrow_forward1- In year 12 Adam earns $1450 and saves $550. In year 21 Adam gets a $4550 raise so that he earns a total of $6000. Out of that $6000, he saves $650. What is Adam's MPC out of his $4550 raise?arrow_forwardAn investor can invest money with a particular bank and earn a stated interest rate of 4.40%; however, interest will be compounded quarterly. What i are the nominal, periodic, and effective interest rates for this investment opportunity? Interest Rates Nominal rate Periodic rate Effective annual rate Rahul needs a loan and is speaking to several lending agencies about the interest rates they would charge and the terms they offer. He particularly likes his local bank because he is being offered a nominal rate of 4%. But the bank is compounding bimonthly (every two months). What is the effective interest rate that Rahul would pay for the loan? ○ 3.945% 4.152% 4.067% 04.186 % Another bank is also offering favorable terms, so Rahul decides to take a loan of $12,000 from this bank. He signs the loan contract at 5% comanded daily for 12 months. Based on a 365-day year, what is the total amount that Rahul owes the bank at the end of the loan's term? (Hint: To calculate the number of days,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc