Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

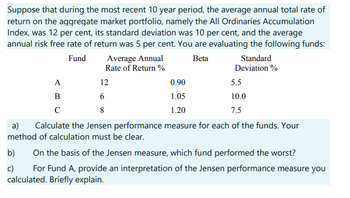

Transcribed Image Text:Suppose that during the most recent 10 year period, the average annual total rate of

return on the aggregate market portfolio, namely the All Ordinaries Accumulation

Index, was 12 per cent, its standard deviation was 10 per cent, and the average

annual risk free rate of return was 5 per cent. You are evaluating the following funds:

Fund

Beta

A

B

с

Average Annual

Rate of Return%

12

6

8

b)

c)

0.90

1.05

1.20

Standard

Deviation %

5.5

10.0

7.5

a) Calculate the Jensen performance measure for each of the funds. Your

method of calculation must be clear.

On the basis of the Jensen measure, which fund performed the worst?

For Fund A, provide an interpretation of the Jensen performance measure you

calculated. Briefly explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider the following historical performance data for two different portfolios, the Standard and Poor's 500, and the 90-day T-bill presented below. What is the Fama diversification measure for the Globex Fund? Assume the T-bill rate as the risk- free rate and the S&P return as the market average return. Use at least four decimal places in your calculations, but report your answer in percentage terms rounded to two decimal places. (Ex..12345 should be entered as "12.35") Investment Vehicle Globex Fund World Fund S&P500 90-day T-bill Answer: Average Rate of Return% 25.2 13.92 15.52 7.10 Standard Deviation 21.33 14 12.8 0.3 Beta 1.05 0.95 R² 0.756 0.741arrow_forwardThe average return, standard deviation, and beta for Fund A is given below along with data for the S&P 500 Index. Fund Average Return Standard Deviation Beta A 14.5% 24.6% 1.4 S&P 500 14.5% 21.3% 1 Risk-free 1% Calculate the Sharpe measure of performance for the S&P 500.arrow_forwardThe value in pounds of a fund at time t = 0 is V0 = 50, 000. After one year (at t = 1) it has increased to V1 = 51, 500 and at that time £1, 500 is withdrawn. After two years (at t = 2) the fund is worth V2 = 50, 800. (a) Compute the time-weighted rate of return. (b) If the fund is liquidated after two years what is the yield that has been achieved?arrow_forward

- Investor has had the following returns in the Magic Fund for the past 4 years: 15%, 25%, -30%, 18%. c) State whether the annual geometric return (assume positive) should be higher, lower, or the same as the annual arithmetic return. Neither calculation nor explanation is necessary. d) State which measure, annual arithmetic return or annual geometric return, better represents how an investment performed over time. Neither calculation nor explanation is necessary.arrow_forwardThe average return, standard deviation, and beta for Fund A is given below along with data for the S&P 500 Index. Fund Average Return Standard Deviation Beta A 14% 24% 1.21 S&P 500 17.4% 19.4% 1 Risk-free 5.1% Calculate the Treynor measure of performance for the S&P 500. Convert percentages to decimal places before calculating your answer. ENTER your answer using FOUR DECIMAL places.Example: 1.2345arrow_forwardSuppose now that your portfolio must yield an expected return of 13% and be efficient, that is, on the best feasible CAL. What is the proportion invested in the T-bill fund?arrow_forward

- The average return, standard deviation, and beta for Fund A is given below along with data for the S&P 500 Index. Fund Average Return Standard Deviation Beta A 25.7% 29% 1.3 S&P 500 17.9% 20% 1 Risk-free 3.8% Calculate the M2 measure of performance for Fund A. Use the correct sign if the answer is negative! Example: -1.23arrow_forwardState the return rate (in %) for your optimal portfolio.arrow_forwardConsider the following risk-return characteristics for funds A and B: Expected return Risk Fund A (Equity) 12% 20% Fund B (Debt) 9% 16% The correlation coefficient between the returns of fund A and fund B is 0.4. 1. Which Fund is riskier? Write 1 if your answer is Fund A, write 2 if your answer is Fund B, or write 3 if your answer is undetermined. 2.1 What is the weight of fund A in the minimum variance portfolio? 2.4 What is the risk of the minimum variance portfolio? 2.2 What is the weight of Fund B in the minimum variance portfolio? 2.3 What is the expected return of the minimum variance portfolio?arrow_forward

- he correlation between the returns on the Russell Fund and the S&P Fund is 0.7.The rate on T-bills is 6%.Question: Which of the following portfolios would you prefer to hold in combination with T-bills and why?a) WindRussell Fundb) Windsor Fundc) S&P Fundd) A portfolio of 60% Russell Fund and 40% S&P Fund.Expected Return Standard DeviationRussell Fund 16% 12%Windsor Fund 14% 10%S&P Fund 12% 8%arrow_forwardYou have estimated the single index model (SIM) fund B and found that its alpha and beta are 0.035 and 1.1 respectively. The standard deviation of Fund B's excess returns is 30% and the market portfolio excess returns have a standard deviation of 20%. What's the information ratio of Fund B?arrow_forwardAssuming a 1-year, money market account investment at 2.282.28 percent (APY), a 1.391.39 percent inflation rate, a 2525 percent marginal tax bracket, and a constant $50 comma 00050,000 balance, calculate the after-tax rate of return, the real rate of return, and the total monetary return. What are the implications of this result for cash management decisions?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education