Entrepreneurial Finance

6th Edition

ISBN: 9781337635653

Author: Leach

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

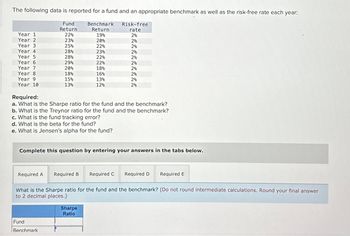

Transcribed Image Text:The following data is reported for a fund and an appropriate benchmark as well as the risk-free rate each year:

Benchmark

Return

19%

20%

22%

23%

22%

22%

18%

16%

13%

12%

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

Year 8

Year 9

Year 10

Required A

Fund

Return

Required:

a. What is the Sharpe ratio for the fund and the benchmark?

b. What is the Treynor ratio for the fund and the benchmark?

c. What is the fund tracking error?

d. What is the beta for the fund?

e. What is Jensen's alpha for the fund?

22%

23%

25%

28%

28%

29%

20%

18%

15%

13%

Complete this question by entering your answers in the tabs below.

Fund

Benchmark

Required B

Risk-free

rate

2%

2%

2%

2%

2%

2%

2%

2%

2%

2%

Required C

Sharpe

Ratio

What is the Sharpe ratio for the fund and the benchmark? (Do not round intermediate calculations. Round your final answer

to 2 decimal places.)

Required D

Required E

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- questions to be answeredarrow_forwardWhen evaluating a fund based on its cash-on-cash returns, what other considerations should you keep in mind?arrow_forwardWhat are the advantages of evaluating fund performance based on Internal Rate of Return (IRR)? Why would an investor prefer to evaluate a fund based on a cash-on-cash return?arrow_forward

- Managed funds are often categorised by the type of investments purchased by the fund. These include capital stable funds, balanced growth funds and managed capital growth funds. For each of these funds, discuss the types of investments the fund might accumulate and explain the purpose of the investment strategies.arrow_forwardThe financial statements of an Enterprise fund are prepared using the Full Accrual Modified Accrual Economic Resources Current Financial Resources Basis Basis Measurement Focus Measurement Focus A.) No Yes Yes No B.) Yes No No Yes C.) No Yes No Yes D.) Yes No Yes Noarrow_forwardDoes a credit balance in the fund balance account(s) at the end of the year necessarily mean the fund has sufficient cash to pay its liabilities in a timely manner? Explain.arrow_forward

- How do you find historical returns and benchmarks on different funds?arrow_forward1. A savings account should be used for your emergeney fund and your O Short-term savings goals O Long-term savings goalsarrow_forwardIndicate whether the item in each column is reported in the financial statements of the fund types listed below by clicking the corresponding boxes. If an item does not apply, leave the corresponding box blank. You may check more than one box for each item. Statement Capital assets Long - term liabilities Encumbrances 1. General fund 2. Special revenue funds 3. Capital projects funds 4. Debt service funds 5. Permanent funds 6. Enterprise funds 7. Internal service funds 8. Pension (and other employee benefit) trust funds 9. Investment trust funds 10. Private-purpose trust funds 11. Custodial fundsarrow_forward

- The total cash count minus the amount of the Change Fund should be equal to: a.the total current liabilities. b.the expenses incurred. c.the income earned. d.the total revenue earned.arrow_forwardWhen do the funds earn interest at the MARR?arrow_forwardEmergency Fund Ratio reveals: Group of answer choices How readily a client would be able to meet all current obligations immediately A person's level of preparedness for job loss or short-term disability The level of debt that has been used to finance the present lifestyle The client's savings and spending patterns over a period of time.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning