Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

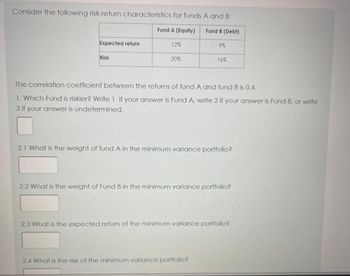

Transcribed Image Text:Consider the following risk-return characteristics for funds A and B:

Expected return

Risk

Fund A (Equity)

12%

20%

Fund B (Debt)

9%

16%

The correlation coefficient between the returns of fund A and fund B is 0.4.

1. Which Fund is riskier? Write 1 if your answer is Fund A, write 2 if your answer is Fund B, or write

3 if your answer is undetermined.

2.1 What is the weight of fund A in the minimum variance portfolio?

2.4 What is the risk of the minimum variance portfolio?

2.2 What is the weight of Fund B in the minimum variance portfolio?

2.3 What is the expected return of the minimum variance portfolio?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- At a minimum, which of the following would you need to know to estimate the amount of additional reward you will receive for purchasing a risky asset instead of a risk-free asset? 1. I. Asset's standard deviation 2. II. Asset's beta 3. III. Risk-free rate of return 4. IV. Market risk premium I, III, and IV only I, II, III, and IV I and III only II and IV only III and IV only ооо Oarrow_forwardi need the answer quicklyarrow_forwardDraw the profit diagram of the portfolio just drawn (and clearly state any assumptions you make). The profit is equal to the difference between the payoff of the portfolio at expiry (maturity) date and the cost of the portfolio. Is the cost of the portfolio positive?arrow_forward

- Fund Beta Deviation (%) Return (%) Rf (%) XXX 1.07 5.13 19 6 YYY 1.02 4.28 17 6 ZZZ 0.86 3.52 12 6 Market 1 3.8 13 6 Compute the Sharpe Measure for the XXX fund. Compute the Treynor Ratio for the ZZZ fund. Compute the Jensen Measure for the YYY fund.arrow_forwardSuppose you have an investment portfolio with fraction x invested in a market portfolio and (1-x) in a risk- free asset. Increasing fraction x invested in the market portfolio and consequently decreasing (1-x) invested in the risk-free asset shall (select any correct answer, if there are multiple correct answers) Select one or more: O decrease the Sharpe ratio of the resulting portfolio O decrease the expected return of the resulting portfolio increase the Sharpe ratio of the resulting portfolio increase the expected return of the resulting portfolio Dincrease the risk of the resulting portfolioarrow_forwardFinance Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Do not provide Excel Screet shot rather use tool table Answer completely.arrow_forward

- PLEASE PUT IT IN EXCEL, IT HAS TO BE IN EXCEL NO OTHER WAY OTHER THEN IN EXCEL. USE EXCEL! Question 2: Consider two risky assets, S and B, with the following characteristics: E(rs) 9%, Os 20% E(TB) 5%, OB 5% and PBS - 1 a) Is it possible to combine the two assets a portfolio such that the portfolio has zero risk (i.e. zero standard deviation)? If so, what is the composition of the zero risk portfolio? b) Suppose that in addition to trading in the risky assets S and B, investors can also freely buy, sell or short-sell a risk-free asset with risk-free rate rf. What must be the risk-free rate re? What would happen otherwise?arrow_forwardWhich of the following statements is true? Multiple Choice When NPV is 0, the IRR is equal to the discount rate. When NPV is 0, the investment is not making a profit. In calculating IRR, we make the assumption all cash flows are reinvested at the discount rate. NPV is a good measure to use when comparing investments of different sizes.arrow_forwardAnother name for the expected value of an investment would be: Answer a. The mean value b. The upper-end value c. The certain value d. The risk-free valuearrow_forward

- If the internal rate of return (IRR) of a well-behaved investment alternative is equal to MARR, which of the following statements about the other measures of worth for this alternative must be true? i. PW = 0 ii. AW = 0. Solve, a. I onlyb. II only c. Neither I nor II d. Both I and II.arrow_forward2. The following table gives information on the return and variance of assets A and B, whose covariance is 0.0003: A B 0} 0,0009 0,0012 E (R₂) 0,05 0,06 a. Does the portfolio (1/3 of A and 2/3 of B) dominate the portfolio (2/3 of A and 1/3 of B)? b. Does the portfolio (1/2, 1/2) belong to the efficient frontier? c. If there were the possibility of lending and borrowing at 2%, would the portfolio (1/2, 1/2) belong to the new efficient frontier?arrow_forwardThe average return, standard deviation, and beta for Fund A is given below along with data for the S&P 500 Index. Fund Average Return Standard Deviation Beta A 25.7% 29% 1.3 S&P 500 17.9% 20% 1 Risk-free 3.8% Calculate the M2 measure of performance for Fund A. Use the correct sign if the answer is negative! Example: -1.23arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education