Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Suppose that $10,000 is borrowed now at 15% interest per year.

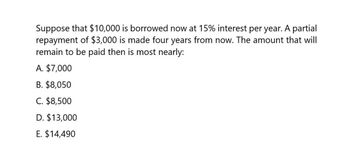

Transcribed Image Text:Suppose that $10,000 is borrowed now at 15% interest per year. A partial

repayment of $3,000 is made four years from now. The amount that will

remain to be paid then is most nearly:

A. $7,000

B. $8,050

C. $8,500

D. $13,000

E. $14,490

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- General Accountingarrow_forwardFinancial Accountingarrow_forward16. You borrow $27,000 to purchase a plane. The loan will be paid in monthly installments over one year at 30% interest annually. The first payment is due one month from today. What is the amount of each monthly payment? (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)arrow_forward

- Your company has just taken out a loan for $25,000 to be repaid in equal installments at the end of each of the next 3 years. The interest rate is 10% compounded annually. What percentage of the 2nd payment will be interests? A. 17.36% B. 19.36% C. 18.36% D. 21.36% E. 20.36%arrow_forwarda. Set up an amortization schedule for a GHȼ 25,000 loan to be repaid in equal installments at the end of each of the next 5 years. The interest rate is 10%. b. How large must each annual payment be if the loan is for GHȼ 50,000? Assume that the interest rate remains at 10% and that the loan is still paid off over 5 years. c. How large must each payment be if the loan is for GHȼ 50,000, the interest rate is 10%, and the loan is paid off in equal installments at the end of each of the next 10 years? This loan is for the same amount as the loan in part b, but the payments are spread out over twice as many periods. Why are these payments not half as large as the payments on the loan in part b?arrow_forwardAssume that you can invest to earn a stated annual rate of return of 12 percent, but where interest is compounded semi-annually. If you make 20 consecutive semi-annual deposits of $500 each, with the first deposit being made today, what will your balance be at the end of Year 20?a. $52,821.19b. $57,900.83c. $58,988.19d. $62,527.47e. $64,131.50arrow_forward

- You make an investment into a money market account at time T=0. In year T=5, the value of the money market account will be $5,000. The money market account pays an annual interest of R=6%, and interest is compounded on a quarterly basis. What is the present value of this account?arrow_forwardConsider a loan of 800,000 which is to be amortized by 60 monthly payments. The interest rate is 12% converted monthly. 1. How much is the outstanding balance after the 36th payment? 2. How much of the 37th payment goes to pay the interest the principal?arrow_forwardFind the accumulated value of an investment of $15,000 for 5 years at an interest rate of 1.45% if the money is a. compounded semiannually; b. compounded quarterly; c. compounded monthly d. compounded continuously. Click the icon to view some finance formulas. c. What is the accumulated value if the money is compounded monthly? $ 16127.15 (Round to the nearest cent as needed.). d. What is the accumulated value if the money is compounded continuously? S (Round to the nearest cent as needed.) ▼ Xarrow_forward

- Suppose that $30,000 is invested at 9% interest. Find the amount of money in the account after 7 years if the interest is compounded annually. If interest is compounded annually, what is the amount of money after t = 7 years? $ (Do not round until the final answer. Then round to the nearest cent as needed.)arrow_forwardSuppose you borrow $8500 for a term of five years at a simple interest and 8.25% APR. how much is the total (principal plus interest) you must pay back on the loan?arrow_forwardConsider a loan of 1,000,000 which is to be amortized by 60 monthly payments. The interest rate is 10% converted monthly. How much of the 47th payment goes to pay the interest? How much of the 47th payment goes to pay the principal?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you