Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

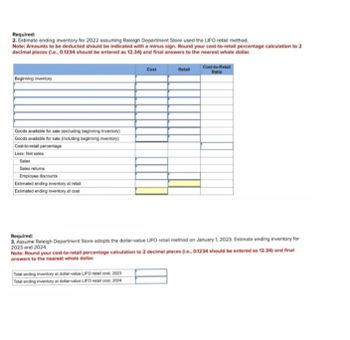

Transcribed Image Text:Required:

2. Estimate ending inventory for 2022 assuming Raleigh Department Store used the LIFO retail method.

Note: Amounts to be deducted should be indicated with a minus sign. Round your cost-to-retail percentage calculation to 2

decimal places (i.e., 0.1234 should be entered as 12.34) and final answers to the nearest whole dollar.

Beginning inventory

Goods available for sale (excluding beginning inventory)

Goods available for sale (including beginning inventory)

Cost-to-retail percentage

Less: Net sales

Sales

Sales returns

Employee discounts

Estimated ending inventory at retail

Estimated ending inventory at cost

Cost

Retail

Cost-to-Retail

Ratio

Required:

3. Assume Raleigh Department Store adopts the dollar-value LIFO retail method on January 1, 2023. Estimate ending inventory for

2023 and 2024.

Note: Round your cost-to-retail percentage calculation to 2 decimal places (ie., 0.1234 should be entered as 12.34) and final

answers to the nearest whole dollar.

Total ending inventory at dollar-value LIFO retail cost, 2023

Total ending inventory at dollar-value LIFO retail cost, 2024

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.)

Raleigh Department Store uses the conventional retail method for the year ended December 31, 2022. Available

information follows:

a. The inventory at January 1, 2022, had a retail value of $53,000 and a cost of $36,930 based on the conventional retail

method.

b. Transactions during 2022 were as follows:

Gross purchases

Cost

Retail

$327,870

$570,000

Purchase returns

6,700

18,000

Purchase discounts

5,800

Sales

568,000

Sales returns

7,500

Employee discounts

2,000

Freight-in

30,500

Net markups

Net markdowns

33,000

18,000

Sales to employees are recorded net of discounts.

c. The retail value of the December 31, 2023, inventory was $61,880, the cost-to-retail percentage for 2023 under the

LIFO retail method was 70%, and the appropriate price index was 104% of the January 1, 2023, price level.

d. The retail value of the December 31, 2024, inventory was $53,500, the cost-to-retail percentage for 2024 under the

LIFO retail method was 69%, and the appropriate price index was 107% of the January 1, 2023, price level.

Required:

1. Estimate ending inventory for 2022 using the conventional retail method.

Note: Amounts to be deducted should be indicated with a minus sign. Round your cost-to-retail percentage calculation to 2

234 should be entered as 12.34) and final answers to the nearest whole dollar.

Beginning inventory

Goods available for sale

Cost-to-retail percentage

Less: Net sales

Sales

Sales returns

Employee discounts

Estimated ending inventory at retail

Estimated ending inventory at cost

Cost

Cost-to-Retail

Retail

Ratio

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Retail Inventory Method The following data were available from Hegge Department Stores records for the year ended December 31, 2019: Required: Using the retail method, what is the estimate of the merchandise inventory at December 31, 2019, valued at the lower of cost or market: Round the cost-to-retail ratio to 3 decimal places.arrow_forwardThe moving average inventory cost flow assumption is applicable to which of the following inventory systems? Questions M7-6 and M7-7 are based on the following data: City Stationers Inc. had 200 calculators on hand on January 1, 2019, costing 18 each. Purchases and sales of calculators during the month of January were as follows: City uses a periodic inventory system. According to a physical count, 150 calculators were on hand at January 31, 2019.arrow_forwardQuestions M7-6 and M7-7 are based on the following data: City Stationers Inc. had 200 calculators on hand on January 1, 2019, costing 18 each. Purchases and sales of calculators during the month of January were as follows: City uses a periodic inventory system. According to a physical count, 150 calculators were on hand at January 31, 2019. M7-6 The cost of the inventory on January 31, 2019, under the FIFO method is: a. 400 b. 2,700 c. 3,100 d. 3,200 M7-7 The cost of the inventory on January 31, 2019, under the LIFO method is: a. 400 b. 2,700 c. 3,100 d. 3,200arrow_forward

- Beginning inventory, purchases, and sales for Item ProX2 are as follows: Assuming a perpetual inventory system and using the first-in, first-out (FIFO) method, determine (a) the cost of merchandise sold on January 25 and (b) the inventory on January 31.arrow_forwardOn June 30, 2019, the balances of the accounts appearing in the ledger of Simkins Company are as follows: Instructions 1. Does Simkins Company use a periodic or perpetual inventory system? Explain. 2. Prepare a multiple-step income statement for Simkins Company for the year ended June 30, 2019. The merchandise inventory as of June 30, 2019, was 508,000. The adjustment for estimated returns inventory for sales for the year ending December 31, 2019, was 33,000. 3. Prepare the closing entries for Simkins Company as of June 30, 2019. 4. What would the net income have been if the perpetual inventory system had been used?arrow_forwardOn December 31, 2019, the balances of the accounts appearing in the ledger of Wyman Company are as follows: Instructions 1. Does Wyman Company use a periodic or perpetual inventory system? Explain. 2. Prepare a multiple-step income statement for Wyman Company for the year ended December 31, 2019. The merchandise inventory as of December 31, 2019, was 305,000. The adjustment for estimated returns inventory for sales for the year ending December 31, 2019, was 30,000. 3. Prepare the closing entries for Wyman Company as of December 31, 2019. 4. What would the net income have been if the perpetual inventory system had been used?arrow_forward

- Beginning inventory, purchases, and sales for WCS12 are as follows: Assuming a perpetual inventory system and using the weighted average method, determine (a) the weighted average unit cost after the October 22 purchase, (b) the cost of the merchandise sold on October 29, and (c) the inventory on October 31.arrow_forwardBeginning inventory, purchases, and sales for 30xT are as follows: Assuming a perpetual inventory system and using the weighted average method, determine (a) the weighted average unit cost after the May 23 purchase, (b) the cost of the merchandise sold on May 26, and (c) the inventory on May 31.arrow_forwardBeginning inventory, purchases, and sales for WCS12 are as follows: Assuming a perpetual inventory system and using the weighted average method, determine (a) the weighted average unit cost after the October 22 purchase, (b) the cost of goods sold on October 29, and (c) the inventory on October 31.arrow_forward

- Hurst Companys beginning inventory and purchases during the fiscal year ended December 31, 20-2, were as follows: There are 1,200 units of inventory on hand on December 31, 20-2. REQUIRED 1. Calculate the total amount to be assigned to the cost of goods sold for 20-2 and ending inventory on December 31 under each of the following periodic inventory methods: (a) FIFO (b) LIFO (c) Weighted-average (round calculations to two decimal places) 2. Assume that the market price per unit (cost to replace) of Hursts inventory on December 31 was 18. Calculate the total amount to be assigned to the ending inventory on December 31 under each of the following methods: (a) FIFO lower-of-cost-or-market (b) Weighted-average lower-of-cost-or-market 3. In addition to taking a physical inventory on December 31, Hurst decides to estimate the ending inventory and cost of goods sold. During the fiscal year ended December 31, 20-2, net sales of 100,000 were made at a normal gross profit rate of 35%. Use the gross profit method to estimate the cost of goods sold for the fiscal year ended December 31 and the inventory on December 31.arrow_forwardGoods in Transit Gravais Company made two purchases on December 29, 2019. One purchase for 3,000 was shipped FOB destination, and the second for 4,000 was shipped FOB shipping point. Neither purchase had been received nor paid for on December 31, 2019. Required: Which of these purchases, if either, does Gravais include in inventory on December 31, 2019? What is the cost?arrow_forwardJessie Stores uses the periodic system of calculating inventory. The following information is available for December of the current year when Jessie sold 500 units of inventory. Using the FIFO method, calculate Jessies inventory on December 31 and its cost of goods sold for December. RE7-11 Using the information from RE7-10, calculate Jessie Storess inventory on December 31 and its cost of goods sold for December using the LIFO method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning