ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

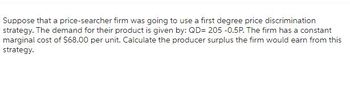

Transcribed Image Text:Suppose that a price-searcher firm was going to use a first degree price discrimination strategy. The demand for their product is given by: QD = 205 - 0.5P. The firm has a constant marginal cost of $68.00 per unit. Calculate the producer surplus the firm would earn from this strategy.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Consider a monopolist that sells in two separated markets. The inverse demand curve in market 1 is given by P₁ = 800-2Q₁, and the inverse demand curve in market 2 is given by P₂ = 600-Q₂- The firm's total cost function is given by TC(Q) = Q², where Q = Q₁+Q2. Since the two markets are totally separated, and any resale opportunity is not there, the monopolist wants to maximize the profit by charging different prices. (a) What is this pricing strategy called? (b) Find the profit-maximizing quantities (Q₁,Q) for each market. (c) Find the profit-maximizing prices (P₁, Pi) for each market.arrow_forwardSuppose that a monopoly firm supplies to two different markets with the demand functions: Market 1: q, = 100 – 2p1 +P2 (1.1) Market 2: q2 = 150 + p1 – 3p2 (1.2) ( Assume that the firm's cost function is (q1 + 92)². a. Suppose there is a restriction of q2 < 20 in the market for good 2. What is the profit maximising price and output? Now suppose the firm has a resource constraint such that it can produce a maximum of 40 units of both goods in total, i.e., q, + q2 5 40. b. What is the impact on the firm's output in both markets, as well as on the maximum profit?arrow_forwardDemand Q(P)= 16,137-489P and Cost Function C(Q)= 11,296+17Q Calculate profit maximizing quantity under monopolyarrow_forward

- The average consumer at a firm with market power has an inverse demand function of P = 9 − Q . The firm's total cost function is C = 3Q. If the firm engages in two-part pricing, what is the optimal fixed fee to charge each consumer? Multiple Choice $2 $18 $25 $10arrow_forwardThe market demand function for birthday cards in Greenwich Village is: P = 100 − 10Q. The total cost function for producing birthday cards is: C= 60 + 20q. Suppose that a firm can perfectly price discriminate (i.e. conduct first-degree price discrimination). How much will its profits be? Please explianarrow_forwardImagine that the cell-phone market is made up of one large firm that leads the industry and sets its own price first, while smaller firms in the industry follow. There are 20 such smaller firms, each with a supply function of q; = 67.50 + for i = 1,2, ..., 20 firms, while pis the per-unit price. Total market demand for cell phones is given by the function Q = 6, 700.00 – p. If the cost function for the leading firm is CL(qL) = 109L, calculate the following values: %3D Leading firm's production: q1 = (Round to two decimals if necessary.) Total follower firm production: qF = (Round to two decimals if necessary.) Equilibrium price: p = $ (Round to two decimals if necessary.)arrow_forward

- Yongling is a monopoly seller of a good in a town. She has a fixed supply of 8 units and no other costs. The market demand curve for the product is P = 20-q. What is her profit if she sells to all her clients at the same price?arrow_forwardSuppose that Noah and Naomi have a monopoly in the garden bench market. Their weekly demand is D(P) = 500 - 4P. What is the inverse demand functionarrow_forwardA city in a developing country does not have a provider of water and sanitation services, leading to poor health outcomes for its citizens. A firm is considering entering thatmarket. The cost curve is C(g) = 10 + 2q, and the inverse demand is P(g) = 10-q. Thegovernment of that city knows that, because of the high fixed cost to operate in this market, any entrant is likely to become a monopolist. Thus, they decide to implement the following regulation: the firm is not allowed to choose a price above an upper limit of p (which the government chooses and sets in the law before the firm decides to enter).There will be no transfers between the government and the firm.Assume that the firm only enters the market if it can get profits of at least zero, given the government's choice of p. Suppose that the government's goal is to maximize consumer surplus. Which of the following statements is the most correct? The government needs to set p = 2, because it's the marginal cost. That eliminatesthe…arrow_forward

- Consider a monopoly with inverse demand given by P(q)=a-bq and cost function c(q)=cq, where a>c>0 and b>0 are parameters, and q is the quantity supplied by the monopoly. Find the monopoly’s profit-maximizing price and output, and calculate the output and the welfare loss compared to the competitive outcome.arrow_forwardSuppose a firm faces an identical inverse demand curve of p = 100 - q for each consumer in the market. Currently, the firm's average cost = marginal cost = $40. Determine the profit-maximizing price and identical lump-sum fee to charge with a two-part tariff. The profit-maximizing price to charge is $ (Enter a numeric response using a real number rounded to two decimal places.)arrow_forwardA firm charges different prices, P1 and P2, for its domestic and industrial customers. The corresponding demand functions are P1 = 125 - 2Q1; and P2 = 310 - 3Q2. The total cost function is TC = 2000 + 30Q. Determine the value of Q, sum of Q1 and Q2, that maximizes profit with price discrimination. Note: Round to 1 decimal place (type the value with no additional text or explanation).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education