ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

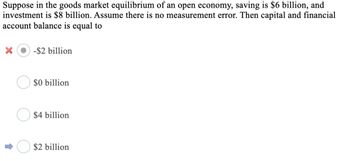

Transcribed Image Text:Suppose in the goods market equilibrium of an open economy, saving is $6 billion, and

investment is $8 billion. Assume there is no measurement error. Then capital and financial

account balance is equal to

X

-$2 billion

$0 billion

$4 billion

$2 billion

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Discuss the role of budget surpluses and trade surpluses in national saving and investmentarrow_forwardA large country imposes capital controls that prohibit foreign borrowing and lending bydomestic residents. The country is currently running a financial account deficit. The imposition of the capital controls will causeB) real domestic interest rates to rise.A) net exports to increase.C) real world interest rates tofall.D) desired national saving to fallarrow_forwardBecause of the increased global unrest, citizens in a small open economy are no longer travelling abroad for their holiday. As a consequence, in the long term the net exports of that small open economy will _____ a) increase because the national savings increased as well b) be unchanged because only the demand for net exports has increased c) fall because the national savings fell as well d) be unchanged because only the demand for net exports has decreasedarrow_forward

- 37. Assume the Marshall-Lerner condition holds. Which of the following will cause an increase in net exports? A) an increase in government spending B) an increase in investment C) a reduction in foreign output D) a reduction in the real exchange rate E) all of the above 38. In an open economy, an increase in government spending will cause A) a reduction in domestic output. B) a reduction in imports. C) a reduction in net exports. D) all of the above E) none of the above 39. Suppose that the rest of the world experiences an economic boom causing an increase in foreign output (Y*). This increase in Y* will not cause which of the following to occur? A) the domestic country's output to increase B) the domestic country's consumption to increase C) the domestic country's output to increase and its trade balance to worsen as imports increase D) all of the above E) none of the above 40. We will generally observe that the more open an economy A) the larger the effect of fiscal policy on output…arrow_forwardHow should appreciation of a firm’s home country currency generally affect its cash inflows? How should depreciation of a firm’s home country currency generally affect its cash outflows?arrow_forwardIf national income Y = 10,000, disposable income Yd = 8,000 , consumption is C = 7,500, transfer payments TR = 100 and the budget deficit is BD = 150, what is the level of private domestic investment, I ? (please insert the round number without the Euro symbol)arrow_forward

- Which of the following statements is true? A)The open-economy IS curve is derived in the same way that the closed-economy IS curve is derived. B)The closed-economy IS curve is downward sloping, but the open-economy IS curve is upward sloping. C)Some factors that shift the IS curve in the closed economy in one direction will shift the IS curve in the open economy in the opposite direction. D)Factors that raise a country's current net exports, given domestic output and the domestic real interest rate, shift the open-economy IS curve up.arrow_forwardI am a bit confused on how to identify whether the problems are decreasing/increasing in Net Exports and Net Capital Flowarrow_forwardConsider and economy described by the following equations: Y=C+I+G+NX Y = 10000 G= 2000 T= 1500 C = 300 +.7 (Y-T) I= 500 – 25r NX = 1000 - 1000€ r=r* = 6 a) In this economy, solve for national savings, investment, the trade balance, and the equilibrium exchange rate. b) Suppose now that G falls to 1,500. Solve for national savings, investment, the trade balance, and the equilibrium exchange rate. c) Now suppose the world interest rate falls from 6 percent to 5 percent. G is again 2000. Solve for national savings, investment, the trade balance, and the equilibrium exchange rate.arrow_forward

- Imagine that the U.S. economy finds itself in the following situation: a government budget deficit of $100 billion, total domestic savings of $1,500 billion, and total domestic physical capital investment of $1,600 billion. According to the national saving and investment identity, what will be the trade balance? What will be the trade balance if investment rises by $50 billion, while the budget deficit and national savings remain the same?arrow_forwardGraphs and questions in images. Thank you!arrow_forwardIf the economy enters a recessionary gap, then incomes in the economy decrease, which reduce income tax revenues earned by the government. When the economy enters a recession, unemployment compensation increases due to an increase in jobless claims. In other words, the government budget deficit increases. Begin with the open economy financial market in equilibrium. What will happen to the U.S. savings and net capital inflow function if the U.S. budget deficit increases? What will to the investment function if the U.S. budget deficit increases? What will happen to the real rate of interest if the U.S. budget deficit increases? What will happen to the quantity saved/invested if the U.S. budget deficit increases? Given the change in the level of savings, what would happen to the level of consumption?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education