ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

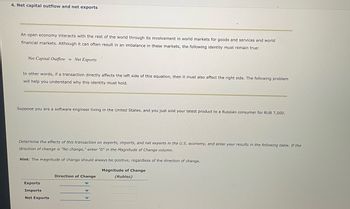

Transcribed Image Text:## 4. Net Capital Outflow and Net Exports

An open economy interacts with the rest of the world through its involvement in world markets for goods and services and world financial markets. Although it can often result in an imbalance in these markets, the following identity must remain true:

**Net Capital Outflow = Net Exports**

In other words, if a transaction directly affects the left side of this equation, then it must also affect the right side. The following problem will help you understand why this identity must hold.

---

Suppose you are a software engineer living in the United States, and you just sold your latest product to a Russian consumer for RUB 7,000.

**Determine the effects of this transaction on exports, imports, and net exports in the U.S. economy, and enter your results in the following table. If the direction of change is “No change,” enter “0” in the Magnitude of Change column.**

*Hint: The magnitude of change should always be positive, regardless of the direction of change.*

| | Direction of Change | Magnitude of Change (Rubles) |

|--------------------|---------------------|------------------------------|

| **Exports** | | |

| **Imports** | | |

| **Net Exports** | | |

![**Transcription:**

Because of the identity equation that relates to net exports, the _______ in U.S. net exports is matched by _______ in U.S. net capital outflow. Which of the following is an example of how the United States might be affected in this scenario? *Check all that apply.*

- [ ] You purchase RUB 7,000 worth of stock in a Russian corporation.

- [ ] You buy RUB 7,000 worth of Russian bonds.

- [ ] You store the rubles in your safety deposit box at home.](https://content.bartleby.com/qna-images/question/aa3bff2c-2743-4a14-b17f-30b2784a9b02/3da1a365-ab19-4e41-8234-845f272e4633/uuk24d_thumbnail.jpeg)

Transcribed Image Text:**Transcription:**

Because of the identity equation that relates to net exports, the _______ in U.S. net exports is matched by _______ in U.S. net capital outflow. Which of the following is an example of how the United States might be affected in this scenario? *Check all that apply.*

- [ ] You purchase RUB 7,000 worth of stock in a Russian corporation.

- [ ] You buy RUB 7,000 worth of Russian bonds.

- [ ] You store the rubles in your safety deposit box at home.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Help on all parts please.arrow_forwardBriefly explain any one component of the capital accountarrow_forwardprovides some hypothetical data on macroeconomicaccountsforthreecountriesrepresented by A, B, and C and measured in billions of currency units. In Table, private household saving is SH, tax revenue is T, government spending is G, and investment spending is I. a. Calculate the trade balance and the net inflow of foreign saving for each country. b. State whether each one has a trade surplus or deficit (or balanced trade). c. State whether each is a net lender or borrower internationally and explain.arrow_forward

- Give correct answer with short explanationarrow_forwardPick a good that is bought and sold internationally...the only condition is that you can find the price in the United States and the foreign price online (e.g., the iPhone sold in Mexico versus the United States). Next, find the foreign price, domestic price, and the exchange rate before "testing" the degree to which purchasing power parity holds. Elaborate upon why PPP might better hold for certain goods for certain countries, but not for others? In other words, if we observe major departures from PPP, what might be the cause?arrow_forwardD6: Please Discuss/Calculate The Gold Standard System or the GSS (Hint: Chapter 3 in G (e) book/book). Exactly; thus: 1. Define the genesis & evolution of the GSS. 2. Define & exemplify gold parity and gold export-import points. 3. Would you prefer a globalisation GSS for the current world economy? Why? Why not?arrow_forward

- 4. Net capital outflow and net exports An open economy interacts with the rest of the world through its involvement in world markets for goods and services and world financial markets. Although it can often result in an imbalance in these markets, the following identity must remain true: Net Capital Outflow = Net Exports In other words, if a transaction directly affects the left side of this equation, then :must also affect the right side. The following problem will help you understand why this identity must hold. Suppose you are a fashion designer living in the United States, and a trendy boutique in Bangkok just purchased your entire inventory for THB 90,000. Determine the effects of this transaction on exports, imports, and net exports in the U.S. economy, and enter your results in the following table. If the direction of change is "No change," enter "0" in the Magnitude of Change column. Hint: The magnitude of change should always be positive, regardless of the direction of change.…arrow_forward9. Consider savings-investment diagrams assuming that there are two countries in the world, A and B. Initially, both countries are identical, i.e., they have the same supply of savings and demand for investment. Therefore, even as open economies, they both have balanced current accounts, i.e., neither has a deficit or surplus. Now assume that in country A, the government increases the budget deficit, shifting the supply of savings to the left. If all other curves (A s investment demand, B s savings supply, B s investment demand) stay the same, what will the effect of the increase in A's budget deficit? a. Country B will have a CA surplus. b. Country A will have a KFA deficit. c. Investment in country B will increase. d. The world real interest rate will fall.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education