ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

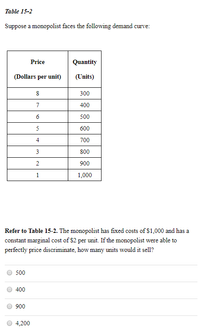

Transcribed Image Text:Table 15-2

Suppose a monopolist faces the following demand curve:

Price

Quantity

(Dollars per unit)

(Units)

8

300

7

400

6

500

5

600

4

700

3

800

2

900

1

1,000

Refer to Table 15-2. The monopolist has fixed costs of $1,000 and has a

constant marginal cost of $2 per unit. If the monopolist were able to

perfectly price discriminate, how many units would it sell?

500

400

900

4,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- What determines whether or not a monopolist is able to charge different prices for the same product? Discuss the conditions necessary for successful price discrimination and offer a few examples where you think price discrimination is being practiced. Remember that the product has to be the same for it to be price discrimination. So if I pay more for overnight delivery of an item I am paying for that convenience and it is not price discriminationarrow_forwardpic 1 : Many schemes for price discriminating involve some cost. For example, discount coupons take up the time and resources of both the buyer and the seller. This question considers the implications of costly price discrimination. To keep things simple, suppose that our monopolist's production costs are simply proportional to output, so that average total cost and marginal cost are constant and equal to each other. On the following graph, use the grey point (star symbol) to indicate the price and quantity that would emerge under a monopoly without price discrimination. Then use the purple point (diamond symbol) to shade the area corresponding to the monopolist's profit, and use the green point (triangle symbol) to shade the area corresponding to consumer surplus. Finally, use the black point (plus symbol) to shade the area corresponding to deadweight loss. Let the region representing monopolist's profit be called XX, consumer surplus YY, and deadweight loss ZZ. Suppose the…arrow_forward1arrow_forward

- Graph shows the cost and revenue Information for Shitotsu the monopolist. What are the levels of price, output, total (sales) revenue, and total profits if the monopolist were to produce at the positions (a) through (d) indicated in table below? Costs and revenues 40 36 32 28 24 20 16 12 8 4 0 5 10 15 20 25 30 35 Quantity per period a. Total revenue maximization b. Profit-maximization c. Socially optimum price d. Fair-return price MR D=AR MC AC Price ($) 16 G 15 141 Output 20 20 22.5 Total Revenue ($) 320 300 315 Total Profits ($) 120 180arrow_forward6. The following graph shows the demand, marginal revenue, and marginal cost curves for a single-price monopolist that produces a drug that helps relieve arthritis pain.arrow_forwardAnswer everything in the photo please.arrow_forward

- E PRICE (Dollars per gigabyte of data) The following graph gives the demand (D) curve for 5G LTE services in the fictional town of Streamship Springs. The graph also shows the ma revenue (MR) curve, the marginal cost (MC) curve, and the average total cost (ATC) curve for the local 5G LTE company, a natural monopolist On the following graph, use the black point (plus symbol) to indicate the profit-maximizing price and quantity for this natural monopolist. 20 18 ATC 2 MR MC D 0 0 1 2 3 4 5 6 7 8 9 10 QUANTITY (Gigabytes of data) Monopoly Outcome Which of the following statements are true about this natural monopoly? Check all that apply. In order for a monopoly to exist in this case, the government must have intervened and created it. The 5G LTE company is experiencing diseconomies of scale. The 5G LTE company is experiencing economies of scale. It is more efficient on the cost side for one producer to exist in this market rather than a large number of producers. True or False: Without…arrow_forwardGiven the following demand schedule for a monopolist in the diamond industry, assume the marginal cost of producing diamonds is constant and equal to 200 and that there are no fixed costs. Quantity 1 2 3 4 5 Price $500 400 300 200 100 Suppose that rival producers enter the market and the market becomes perfectly competitive. How large is the deadweight loss associated with monopoly in this case? Explain the excess capacity problem. (Note: I am not asking for a definition. I want an explanation of the problem.) Explain what is meant when we say that monopolistic competition is a "second-best" outcome. (Note: I am not asking for a definition. I want an explanation of the problem.)arrow_forward2. A monopolist produces its output in two factories, whose cost curves are given by C1 (q1) = 10q and C2 (q2) demand for the firm's product is given by P = 700 – 5Q where Q is the total quantity sold by the monopolist. (a) On a diagram, illustrate the monopolist's decision about how much to produce at each factory and overall and the price to charge. Briefly explain your diagram. (b) Numerically calculate the monopolist's optimal choices for qı, q2, Q, and P. (c) Suppose that labor costs increase in Factory 1 but not in Factory 2. How should the firm change (i.e. raise, lower, or leave unchanged) each of the values you found in (b)? Your answer should be qualitative, not quantitative. 10q3 where q1 and q2 are the amounts produced at each factory. The diagram might be useful but is not necessary.arrow_forward

- Define price discrimination. Give two examples of price discrimination. How does perfect price discrimination affect consumer surplus, producer surplus and total surplus?arrow_forwardThe figure on the right shows the demand schedule for a product produced by a single-price monopolist. Price ($) 10 987654 Quantity demanded A. 9; 10; -1 B. 40; 45; 5 C. 36; 41; 5 D. 5; 4; 1 E. 15; 15; 0 4 567892 10 Using the graph on the right, suppose this single-price monopolist is initially selling 4 units at $10 each and then reduces the price of the product to $9. By making this change, the firm is giving up revenue of Its and gaining revenue of marginal revenue is therefore (All figures are dollars.) Price ($) 141 13- 12- 11- 10- 9- 6- 5- 4- 3- 2- 1- -N 4 5 6 7 8 9 10 11 12 13 14 15 16 Quantity Q Qarrow_forwardattached image thankyouarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education