Macroeconomics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN: 9781305506756

Author: James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

3. Effects of a government budget deficit

Suppose a hypothetical open economy uses the U.S. dollar as currency. The table below presents data describing the relationship between different real interest rates and this economy’s levels of national saving, domestic investment, and net capital outflow. Assume that the economy is currently operating under a balanced government budget.

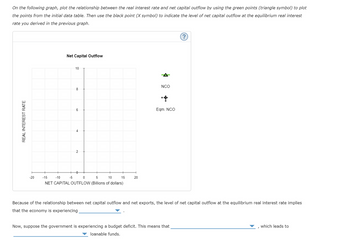

Transcribed Image Text:On the following graph, plot the relationship between the real interest rate and net capital outflow by using the green points (triangle symbol) to plot

the points from the initial data table. Then use the black point (X symbol) to indicate the level of net capital outflow at the equilibrium real interest

rate you derived in the previous graph.

REAL INTEREST RATE

-20

Net Capital Outflow

10

-5

8

6

4

2

0

-15

-10

0

5

10

NET CAPITAL OUTFLOW (Billions of dollars)

15

20

NCO

Eqm. NCO

?

Because of the relationship between net capital outflow and net exports, the level of net capital outflow at the equilibrium real interest rate implies

that the economy is experiencing

Now, suppose the government is experiencing a budget deficit. This means that

loanable funds.

which leads to

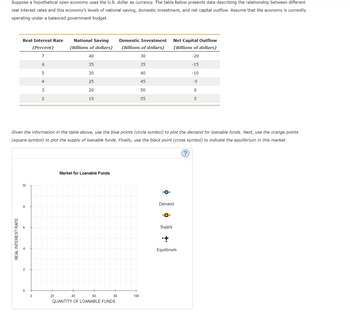

Transcribed Image Text:Suppose a hypothetical open economy uses the U.S. dollar as currency. The table below presents data describing the relationship between different

real interest rates and this economy's levels of national saving, domestic investment, and net capital outflow. Assume that the economy is currently

operating under a balanced government budget.

Real Interest Rate

(Percent)

7

6

5

4

3

2

REAL INTEREST RATE

10

8

Given the information in the table above, use the blue points (circle symbol) to plot the demand for loanable funds. Next, use the orange points

(square symbol) to plot the supply of loanable funds. Finally, use the black point (cross symbol) to indicate the equilibrium in this market.

0

0

National Saving

(Billions of dollars)

40

35

30

25

20

15

20

Market for Loanable Funds

40

60

QUANTITY OF LOANABLE FUNDS

Domestic Investment

(Billions of dollars)

30

35

40

45

50

55

80

100

o

Net Capital Outflow

(Billions of dollars)

-20

-15

Demand

CO

Supply

-10

-5

0

5

Equilibrium

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 3. Effects of a government budget deficit Consider a hypothetical open economy. The following table presents data on the relationship between various real interest rates and national saving, domestic investment, and net capital outflow in this economy, where the currency is the U.S. dollar. Assume that the economy is currently experiencing a balanced government budget. Real Interest Rate (Percent) 7 National Saving (Billions of dollars) 55 Domestic Investment (Billions of dollars) Net Capital Outflow (Billions of dollars) 30 -15 6 50 40 -10 5 45 50 -5 4 40 60 0 3 35 70 5 2 30 80 10 Given the information in the preceding table, use the blue points (circle symbol) to plot the demand for loanable funds. Next, use the orange points (square symbol) to plot the supply of loanable funds. Finally, use the black point (cross symbol) to indicate the equilibrium in this market. Market for Loanable Funds 10 O Demand 8 O Supply *+ Equilibrium 20 40 80 60 QUANTITY OF LOANABLE FUNDS REAL INTEREST…arrow_forwardREAL INTEREST RATE Suppose a hypothetical open economy uses the U.S. dollar as currency. The table below presents data describing the relationship between different real interest rates and this economy's levels of national saving, domestic investment, and net capital outflow. Assume that the economy is currently operating under a balanced government budget. Real Interest Rate (Percent) National Saving (Billions of dollars) Domestic Investment (Billions of dollars) 7 50 20 Net Capital Outflow (Billions of dollars) -10 6 45 30 -5 5 40 40 0 4 35 50 3 30 60 10 2 25 R 70 in 90 15 Given the information in the table above, use the blue points (circle symbol) to plot the demand for loanable funds. Next, use the orange points (square symbol) to plot the supply of loanable funds. Finally, use the black point (cross symbol) to indicate the equilibrium in this market. 2 10 8 0 0 20 Market for Loanable Funds 40 60 80 100 QUANTITY OF LOANABLE FUNDS Demand ㅁ Supply +- Equilibriumarrow_forwardThis is the second part to another question I asked about and I tried doing it on my own but I am not so sure if it is correct or notarrow_forward

- The following graphs depict the market for loanable funds and the relationship between the real interest rate and the level of net capital outflow (NCO) measured in terms of the Mexican currency, the peso. The Market for Loanable Funds in MexicoDemandSupply012345678987654321REAL INTEREST RATE (Percent)LOANABLE FUNDS (Billions of pesos)Demand Supply Mexican Net Capital OutflowNCO-4-3-2-10123456987654321REAL INTEREST RATE (Percent)NET CAPITAL OUTFLOW (Billions of pesos)NCO Complete the first row of the table to reflect the state of the markets in Mexico. Real Interest Rate Net Capital Outflow (NCO) (Percent) (Billions of pesos) Initial state After capital flight Now, suppose that Mexico experiences a sudden bout of political turmoil, which causes world financial markets to become uneasy. Because people now view Mexico as unstable, they decide to pull some of their assets out of Mexico and put them into more…arrow_forwardHow does the graph look for the effect of a temporary but persistent increase in total factor productivity on current investment. I know that the x axis is the real interest rate and the y axis is level of current investment but im not sure how the graph should look. Could you show me what the graph should look like?arrow_forwardGovernment purchases of goods and services = $200 $150 = Taxes Consumer spending = $700 Markets for goods and services Gross domestic product Investment spending = $120 Exports = $30 Imports = $50 Government | Households Firms Rest of world Government borrowing = $70 Government transfers = $20 Reference: Ref 7(22)-2 Figure 7-2: Expanded Circular-Flow Model Private savings = $170 Wages, profit, interest, rent = $1,000 D) net exports of $80 Wages, profit, interest, rent = $1,000 Factor markets Borrowing and stock issues by firms = $120 Foreign borrowing and sales of stock = $110 Foreign lending and purchases of stock = $130 C) investment spending of $120 (Figure 7-2: Expanded Circular-Flow Model) Use Figure 7-2: Expanded Circular-Flow Model. How does the government finance its spending? A) taxes of $150 plus borrowing of $70 Financial markets B) foreign borrowing and sales of stock of $110arrow_forward

- Give exact answer without photo answer and take a likearrow_forwardUse the following graph (shifts in the supply of loanable funds) for the next five questions. Interest 6%- S3 rate 5- 3 S₁ S₂ $200 250 300 350 400 Savings (billions of dollars) Assuming the supply of loanable funds is at S1, which of the following represents an increase in the number of retired people in a nation? no change O a shift to $3 a movement down and to the left along S1 a movement up and to the right along S1 O a shift to S2arrow_forward5. Saving and net flows of capital and goods In a closed economy, saving and investment must be equal, but this is not the case in an open economy. In the following problem, you will explore how saving and investment are connected to the international flow of capital and goods in an economy. Before delving into the relationship between these various components of an economy, you will be asked to recall some relationships between aggregate variables that will be useful in your analysis. Recall the components that make up GDP. National income (Y) equals total expenditure on the economy's output of goods and services. Thus, where C = consumption, I = investment, G = government purchases, X = exports, M = imports, and NX = net exports: Y = Also, national saving is the income of the nation that is left after paying for . Therefore, national saving (S) is defined as: S = Rearranging the previous equation and solving for Y yields Y = Plugging this into the original equation showing the…arrow_forward

- 5. Saving and net flows of capital and goods In a closed economy, saving and investment must be equal, but this is not the case in an open economy. In the following problem, you will explore how saving and investment are connected to the international flow of capital and goods in an economy. Before delving into the relationship between these various components of an economy, you will be asked to recall some relationships between aggregate variables that will be useful in your analysis. Recall the components that make up GDP. National income (Y) equals total expenditure on the economy's output of goods and services. Thus, where C = consumption, I = investment, G = government purchases, X = exports, M = imports, and NX = net exports: Y = Also, national saving is the income of the nation that is left after paying for Therefore, national saving (S) is defined as: S = Rearranging the previous equation and solving for Y yields Y = . Plugging this into the original equation showing the…arrow_forward5. Saving and net flows of capital and goods In a closed economy, saving and investment must be equal, but this is not the case in an open economy. In the following problem, you will explore how saving and investment are connected to the international flow of capital and goods in an economy. Before delving into the relationship between these various components of an economy, you will be asked to recall some relationships between aggregate variables that will be useful in your analysis. Recall the components that make up GDP. National income (Y) equals total expenditure on the economy's output of goods and services. Thus, where C = consumption, I = investment, G = government purchases, X = exports, M = imports, and NX = net exports: Y = Also, national saving is the income of the nation that is left after paying for Therefore, national saving (S) is defined as: S = Rearranging the previous equation and solving for Y yields Y = Plugging this into the original equation showing the various…arrow_forward5. Saving and net flows of capital and goods In a closed economy, saving and investment must be equal, but this is not the case in an open economy. In the following problem, you will explore how saving and investment are connected to the international flow of capital and goods in an economy. Before delving into the relationship between these various components of an economy, you will be asked to recall some relationships between aggregate variables that will be useful in your analysis. Recall the components that make up GDP. National income (Y) equals total expenditure on the economy's output of goods and services. Thus, where C = consumption, I = investment, G = government purchases, X = exports, M = imports, and NX = net exports: Y = Also, national saving is the income of the nation that is left after paying for saving (S) is defined as: S = Rearranging the previous equation and solving for Y yields Y = results in the following relationship: S This is equivalent to S= . Therefore,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Macroeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506756Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou...EconomicsISBN:9781285165875Author:N. Gregory MankiwPublisher:Cengage Learning Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Macroeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506756

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Principles of Economics, 7th Edition (MindTap Cou...

Economics

ISBN:9781285165875

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc