ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

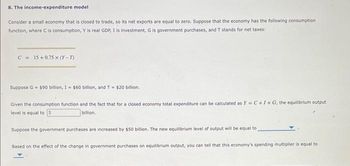

Transcribed Image Text:8. The income-expenditure model

Consider a small economy that is closed to trade, so its net exports are equal to zero. Suppose that the economy has the following consumption

function, where C is consumption, Y is real GDP, I is investment, G is government purchases, and T stands for net taxes:

C = 15+0.75 x (Y-T)

Suppose G = $90 billion, 1 = $60 billion, and T = $20 billion.

Given the consumption function and the fact that for a closed economy total expenditure can be calculated as Y=C+I+G, the equilibrium output

level is equal to 5

billion.

Suppose the government purchases are increased by $50 billion. The new equilibrium level of output will be equal to

Based on the effect of the change in government purchases on equilibrium output, you can tell that this economy's spending multiplier is equal to

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 5. Algebra of the income-expenditure model Consider a small economy that is closed to trade, so its net exports are equal to zero. Suppose that the economy has the following consumption function, where C is consumption, Y is real GDP, / is investment, G is government purchases, and T is for net taxes: C 40+0.5x (Y-T) Suppose G $265 billion, 7- $50 billion, and T $10 billion. Given the consumption function and the fact that, in a closed economy, total expenditure can be calculated as Y = C+I+G, the equilibrium output level is s billion. Suppose the government purchases are reduced by $100 billion. The new equilibrium level of output will be equal to s billion. Based on the effect of the change in government purchases on equilibrium output, you can tell that this economy's spending multiplier is equal toarrow_forward8. The income-expenditure model Consider a small economy that is closed to trade, so its net exports are equal to zero. Suppose that the economy has the following consumption function, where C is consumption, Y is real GDP, I is investment, G is government purchases, and T stands for net taxes: C = 20+0.75 x (Y-T) Suppose G = $35 billion, I = $60 billion, and T = $20 billion. Given the consumption function and the fact that for a closed economy total expenditure can be calculated as Y = C + I + G, the equilibrium output level is equal to $ billion. Suppose the government purchases are increased by $50 billion. The new equilibrium level of output will be equal to Based on the effect of the change in government purchases on equilibrium output, you can tell that this economy's spending multiplier is equal toarrow_forward52)Consider the following consumption function: C = 800 + 0.75 YD for the fictitious economy of Zapland. If the government increases taxes by $200 million, what is the change in GDP? Assume that there is no increase in the price level. Select one: a. -$800 million b. $600 million c. $800 million d. -$600 million e. -$300 millionarrow_forward

- 2. Public consumption of a country (two sectors) is indicated by the function C = 60 + 0.4Y. Calculate:a. Find the saving function.b. If the investment that occurs is 300, determine the balance national income.c. What is the consumption of the people of the country if the national income is 400.d. How much is the savings of the people of the country if the national income is 400.e. Make a graphical sketch of the consumption and saving functions in one image. Please solve sub parts a,b,c thank uarrow_forward2. Public consumption of a country (two sectors) is indicated by the function C = 60 + 0.4Y. Calculate:a. Find the saving function.b. If the investment that occurs is 300, determine the balance national income.c. What is the consumption of the people of the country if the national income is 400.d. How much is the savings of the people of the country if the national income is 400.e. Make a graphical sketch of the consumption and saving functions in one image. Please solve subparts d,e thank uarrow_forward7. Marginal propensity to import and net exports The following graph shows net exports for a hypothetical country. U 50 50 40 20 20 NET EXPORTS (Billions of dollars) 10 10 -10 20 -20 300 400 ⑦? 500 600 700 REAL GDP (Billions of dollars) 0 100 200 13 and According to the graph, when the country is producing a real GDP of $400 billion, exports are function is equal to the than imports. The slope of the net exports and thus tells you that for every $1 increase in real GDP, do not change (because they are assumed to be autonomous with respect to real GDP). byarrow_forward

- . Suppose the United States economy is repre- sented by the following equations: Z = C + I + G, C = 500 + 0.75YD, T = 600, I = 300, YD = Y − T , G = 2000 Given the above variables, calculate the equilibrium level of output. assume that government spending decreases from 2000 to 1900. What is the new equilibrium level of output? How much does income change as a result of this event? What is the multiplier for this economy?arrow_forward4. Deriving net exports By definition, net exports from Japan are equal to exports from Japan minus imports into Japan. In a hypotheticall two-country world, imports into Japan are equal to exports from the United States. So the value for net exports from Japan is equal to exports from Japani minus exports from the United States, Graphically, at each exchange rate, the value for net exports is the horizontal distance from U.S. exports to Japanese exports. Use the graph input tool to answer the following questions. You will not be graded on any changes you make to this graph. (Note: To avoid dealing with decimal places, this calculator reports the price of yen in terms of dollars per 1,000 yen. That is, the price on the vertical axis is the dollar price of a 1,000-yen note instead of a single yen. As you have already seen, a price of 8 dollars per 1,000 yen is the same as 125 yen per dollar. Once you enter a value in a white field, the graph and any corresponding amounts in each grey…arrow_forwardAssume that a nation's marginal propensity to consume (MPC) is 0.75. A highiy productive, cost-cutting technology is developed for the production of commercial airplanes. The total industry expenditure in this nation is $100 million for the immediate acquisition and adoption of this technology. (a) For this nation, identify and explain how much this spending on new technology will change each of the following in the first round: i. Income (GDP) L. Saving i. Consumption (b) Assuming a closed economy and no leakages, identify and explain how much this spending on new technology will change each of the following at the end of the final round: i. Income (GDP) ii. Saving li. Consumptionarrow_forward

- 3. Suppose an economy had aggregate demand components with the following relationships: Consumption Spending, C-140 +0.60*(DY) Investment Spending, I-25 +0.15"Y Government Spending, G-0 Net Export Spending, X=0 Tax Collections, Tx = 0 a. What is the equilibrium income for this economy (Show your work)? b. If the Government decided to Increase G spending by 6, what would be the new equilibrium income for this economy (Show your work)? Page 2 bed tooing c. If instead the Government decided to Reduce Tx (taxes) by 10 (i.e., send checks to people), what would be the new equilibrium income for this economy (Show your work)? d. If instead the Government decided to Increase G spending and Increase Tx (taxes) by 20, what would be the new equilibrium income for this economy (Show your work)?arrow_forwardThe table contains information about the nation of Syldavia. There are no income taxes or imports in this nation. Consumption expenditure, C (billions of 2012 dollars) Government Real GDP, Y (billions of 2012 dollars) Investment, / (billions of 2012 dollars) expenditure, G (billions of 2012 dollars) 15 6. 20 10 25 14 30 18 35 22 The equilibrium expenditure is O A. $20 billion. O B. $30 billion. O C. $15 billion. O D. $10 billion. O E. $25 billion.arrow_forward2. Consider an economy that is characterised by the following set of equations: C co + c¡Yp Yp Y – T I bo + bịY Government spending (G) and taxes (T) are constant. Note that investment (1) is proportional to output (Y). a) Solve for equilibrium output. b) Using your answer derived in (a) identify and discuss the multiplier. How does the relation between investment and output affect the value of the multiplier? c) For the multiplier to be positive what condition must be satisfied? Please note: The two questions are equally weighted in terms of marks. To help explain your answers and analysis, you should always attempt to use diagrams, mathematical demonstration where applicable and convey the economic intuitions behind the results. Do not forget to label your graphs. Key Marking criteria will include: • Initiative: Originality, innovativeness of answer • Assignment Structure: Clarity of aims, objective, structure and presentation • Quality of Writing: Readability and ability to convey…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education