FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Prepare any

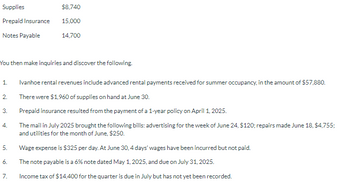

Transcribed Image Text:Supplies

Prepaid Insurance

Notes Payable

You then make inquiries and discover the following.

1.

2.

3.

4.

5.

6.

$8,740

15,000

14,700

7.

Ivanhoe rental revenues include advanced rental payments received for summer occupancy, in the amount of $57,880.

There were $1,960 of supplies on hand at June 30.

Prepaid insurance resulted from the payment of a 1-year policy on April 1, 2025.

The mail in July 2025 brought the following bills: advertising for the week of June 24, $120; repairs made June 18, $4,755;

and utilities for the month of June, $250.

Wage expense is $325 per day. At June 30, 4 days' wages have been incurred but not paid.

The note payable is a 6% note dated May 1, 2025, and due on July 31, 2025.

Income tax of $14,400 for the quarter is due in July but has not yet been recorded.

Expert Solution

arrow_forward

Step 1

Adjusting entries are journal entries usually made at the end of an accounting period to allocate income and expenditure to the period in which they actually occurred.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Crane Company Ltd. publishes a monthly sports magazine, Fishing Preview. Subscriptions to the magazine cost $28 per year. During November 2022, Crane sells 5,400 subscriptions for cash, beginning with the December issue. Crane prepares financial statements quarterly and recognizes subscription revenue at the end of the quarter. The company uses the accounts Unearned Subscription Revenue and Subscription Revenue. The company has a December 31 year-end.arrow_forwardCarla Vista Corporation has the following selected transactions during the year ended December 31, 2024: Jan. 1 Purchased a copyright for $117.480 cash. The copyright has a useful life of six years and a remaining legal life of 30 years. Mar. 1 Sept. 1 Dec. 31 Acquired a franchise with a contract period of nine years for $500,850; the expiration date is March 1, 2033, Paid cash of $38,820 and borrowed the remainder from the bank. Purchased a trademark with an indefinite life for $73,190 cash. As the purchase was being finalized, spent $33.150 cash in legal fees to successfully defend the trademark in court. Purchased an advertising agency for $640,000 cash. The agency's only assets reported on its statement of financial position immediately before the purchase were accounts receivable of $58,000, furniture of $170,000, and leasehold improvements of $320,000. Carla Vista hired an independent appraiser who estimated that the fair value of these assets was accounts receivable $58,000,…arrow_forwardPrepare a trial balance at October 31, 2025. MONTY REAL ESTATE AGENCY Trial Balance A $ Debit $ $ Creditarrow_forward

- First using cash accounting, and then accrual accounting, discuss what the balances of each account will be on May 31, 2019 at Hippie Hospital for the financial period below, taking into consideration the transactions listed. Then, discuss why/how you arrived at your answer for each ending account balance. Beginning account balances for May 2019: Assets = $1,400,000 Liabilities = $500,000 Net Assets = $890,900 Revenue = $25,000 Expenses = $15,900 Transaction #1 (May 4, 2019) - the hospital signed a purchase order for a $2,500 supply purchase, which will be delivered/completed in mid-June. Transaction #2 (May 15, 2019) - the hospital provided $15,000 in patient care services and billed patients' insurance plans. Transaction #3 (May 25, 2019) - the hospital took out a loan for $4,000 to meet future, unexpected payroll obligations.arrow_forwardTony's favorite memories of his childhood were the times he spent with his dad at camp. Tony was daydreaming of those days a bit as he and Suzie jogged along a nature trail and came across a wonderful piece of property for sale. He turned to Suzie and said, "I've always wanted to start a camp where families could get away and spend some quality time together. If we just had the money, I know this would be the perfect place." On November 1, 2025, Great Adventures purchased the land by issuing a $580,000, 6%, 8-year installment note to the seller. Payments of $7,622 are required at the end of each month over the life of the 8-year loan. Each monthly payment of $7,622 includes both interest expense and principal payments (i.e., reduction of the loan amount). Late that night, Tony exclaimed, "We now have land for our new camp; this has to be the best news ever!" Suzie said, "There's something else I need to tell you. I'm expecting!" Required: 1. Complete the first three rows of an…arrow_forwardHow would you enter this adjusted journal entry in a manual general journal: Wages of $1,020 are owed to casual employees as at 31 May 2023 and will be paid on the 6th June 2023.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education