Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Fast answer please

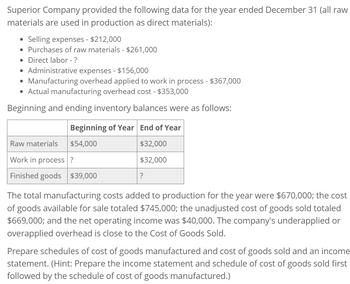

Transcribed Image Text:Superior Company provided the following data for the year ended December 31 (all raw

materials are used in production as direct materials):

• Selling expenses - $212,000

• Purchases of raw materials - $261,000

• Direct labor - ?

• Administrative expenses - $156,000

• Manufacturing overhead applied to work in process - $367,000

• Actual manufacturing overhead cost - $353,000

Beginning and ending inventory balances were as follows:

Beginning of Year End of Year

Raw materials

$54,000

Work in process?

Finished goods $39,000

$32,000

$32,000

?

The total manufacturing costs added to production for the year were $670,000; the cost

of goods available for sale totaled $745,000; the unadjusted cost of goods sold totaled

$669,000; and the net operating income was $40,000. The company's underapplied or

overapplied overhead is close to the Cost of Goods Sold.

Prepare schedules of cost of goods manufactured and cost of goods sold and an income

statement. (Hint: Prepare the income statement and schedule of cost of goods sold first

followed by the schedule of cost of goods manufactured.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- During the year, a company purchased raw materials of $77,321 and incurred direct labor costs of $125,900. Overhead Is applied at the rate of 75% of the direct labor cost. These are the inventory balances: Compute the cost of materials used in production, the cost of goods manufactured, and the cost of goods sold.arrow_forwardDuring the year, a company purchased raw materials of $77,321, and incurred direct labor costs of $125,900. Overhead is applied at the rate of 75% of the direct labor cost. These are the inventory balances: Compute the cost of materials used in production, the cost of goods manufactured, and the cost of goods sold.arrow_forwardSelected information concerning the operations of a company for the year ended December 31 is as follows: Work in process inventories at the beginning and end of the year were zero. Beginning inventory of finished goods was 9,650 (for 1,000 units). Cost of goods sold was 174,600. What was the companys finished goods inventory cost at December 31? a. 98,050 b. 29,100 c. 29,050 d. 40,600arrow_forward

- SCHEDULE OF COST OF GOODS MANUFACTURED The following information is supplied for Maupin Manufacturing Company. Prepare a schedule of cost of goods manufactured for the year ended December 31, 20--. Assume that all materials inventory items are direct materials. Work in process, January 1 77,000 Materials inventory, January 1 31,000 Materials purchases 35,000 Materials inventory, December 31 26,000 Direct labor 48,000 Overhead 20,000 Work in process, December 31 62,000arrow_forwardOReilly Manufacturing Co.s cost of goods sold for the month ended July 31 was 345,000. The ending work in process inventory was 90% of the beginning work in process inventory. Factory overhead was 50% of the direct labor cost. No indirect materials were used during the period. Other information pertaining to OReillys inventories and production for July is as follows: Required: 1. Prepare a statement of cost of goods manufactured for the month of July. (Hint: Set up a statement of cost of goods manufactured, putting the given information in the appropriate spaces and solving for the unknown information. Start by using cost of goods sold to solve for the cost of goods manufactured.) 2. Prepare a schedule to compute the prime cost incurred during July. 3. Prepare a schedule to compute the conversion cost charged to Work in Process during July.arrow_forwardGlasson Manufacturing Co. produces only one product. You have obtained the following information from the corporations books and records for the current year ended December 31, 2016: a. Total manufacturing cost during the year was 1,000,000, including direct materials, direct labor, and factory overhead. b. Cost of goods manufactured during the year was 970,000. c. Factory Overhead charged to Work in Process was 75% of direct labor cost and 27% of the total manufacturing cost. d. The beginning Work in Process inventory, on January 1, was 40% of the ending Work in Process inventory, on December 31. e. Material purchases were 400,000 and the ending balance in Materials inventory was 60,000. No indirect materials were used in production. Required: Prepare a statement of cost of goods manufactured for the year ended December 31 for Glasson Manufacturing. (Hint: Set up a statement of cost of goods manufactured, putting the given information in the appropriate spaces and solving for the unknown information.)arrow_forward

- Ellerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Refer to Exercise 2.21. Last calendar year, Ellerson recognized revenue of 1,312,000 and had selling and administrative expenses of 204,600. Required: 1. What is the cost of goods sold for last year? 2. Prepare an income statement for Ellerson for last year.arrow_forwardWhat are the total costs to account for if a companys beginning inventory had $231,432 in materials, $186,450 in conversion costs, and added direct material costs ($4,231,392), direct labor ($2,313,392), and manufacturing overhead ($1,156,696)?arrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forward

- Inventory Accounts for a Manufacturing Company Fujita Company produces a single product. Costs accumulated at the end of the period are as follows: Assume the beginning raw materials inventory was 62,800, the beginning finished goods inventory was 118,400, and there was no beginning work-in-process inventory. Required: Compute the closing account balances of each of the three inventory accounts: Raw Materials, Work in Process, and Finished Goods.arrow_forwardRexar had 1,000 units in beginning inventory before starting 9.500 units and completing 8,000 units. The beginning work in process inventory consisted of $5,000 in materials and $8,500 in conversion costs before $16,000 of materials and $18,500 of conversion costs were added during the month. The ending WIP inventory was 100% complete with regard to materials and 40% complete with regard to conversion costs. Prepare the journal entry to record the transfer of inventory from the manufacturing department to the finished goods department.arrow_forwardWyandotte Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 256,900, direct labor cost was 176,000, and overhead cost was 308,400. There were 40,000 units produced. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 6.62 is direct materials and 7.71 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,  Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub