FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

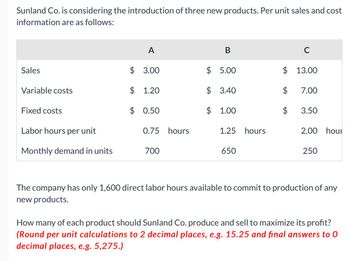

Transcribed Image Text:Sunland Co. is considering the introduction of three new products. Per unit sales and cost

information are as follows:

Sales

Variable costs

Fixed costs

Labor hours per unit

Monthly demand in units

A

$ 3.00

$ 1.20

$ 0.50

0.75 hours

700

B

$ 5.00

$ 3.40

$ 1.00

1.25 hours

650

C

$ 13.00

$ 7.00

$ 3.50

2.00 hour

250

The company has only 1,600 direct labor hours available to commit to production of any

new products.

How many of each product should Sunland Co. produce and sell to maximize its profit?

(Round per unit calculations to 2 decimal places, e.g. 15.25 and final answers to 0

decimal places, e.g. 5,275.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Gentry, Inc. sells only two products, Product A and Product B. The following data relate to expected sales for the coming period: Product A Product BSales units 20,000 30,000Sales revenue $240,000 $300,000Variable costs $140,000 $120,000Fixed costs $89,168 $73,820 16. How many units of each product are needed for Gentry to breakeven at the given sales mix? (Do not round relevant intermediate calculations, such as percentages). a. 10,980 units of Product A and 16,470 units of Product Bb. 5,976 units of Product A and 8,963 units of Product Bc. 8,810 units of Product A and 13,215 units of Product Bd. 2,166 units of Product A and 17,697 units of Product Be. 17,834 units of Product A and 12,303 units of Product Bf. 11,642 units of Product A and 17,463 units of Product B g. 11,146 units of Product A and 10,546 units of Product Bh. None of the above. 17. Given their current operating income, by…arrow_forwardFlying Cloud Co. has the following operating data for its manufacturing operations: Unit selling price $239 Unit variable cost $108 Total fixed costs $842,000 The company has decided to increase the wages of hourly workers which will increase the unit variable cost by 10%. Increases in the salaries of factory supervisors and property taxes for the factory will increase fixed costs by 4%. If sales prices are held constant, the next break-even point for Flying Cloud Co. will be Oa. increased by 858 units Ob, decreased by 858 units Oc. increased by 686 units Od. increased by 1,029 unitsarrow_forwardFlying Cloud Co. has the following operating data for its manufacturing operations: Unit selling price $202 Unit variable cost $103 Total fixed costs $801,000 The company has decided to increase the wages of hourly workers which will increase the unit variable cost by 10%. Increases in the salaries of factory supervisors and property taxes for the factory will increase fixed costs by 4%. If sales prices are held constant, the next break-even point for Flying Cloud Co. will be a.increased by 1,561 units b.increased by 1,301 units c.decreased by 1,301 units d.increased by 1,041 unitsarrow_forward

- Gyro Company manufactures Products T and W and is operating at full capacity. Manufacturing Product W requires three times the number of machine hours required for Product T. Market research indicates that 1,000 additional units of Product W could be sold. The contribution margin by unit of product is as follows: Product T Product W Sales price $300 $325 Variable cost of goods sold (235) (250) Manufacturing margin $65 $75 Variable selling and administrative expenses (25) (10) Contribution margin $40 $65 Determine the increase or decrease in total contribution margin if 1,000 additional units of Product W are produced and sold. $ Decrease or Increasearrow_forwardZeus, Incorporated produces a product that has a variable cost of $6 per unit. The company's fixed costs are $40,000. The product sells for $11 a unit and the company desires to earn a $25,000 profit. What is the volume of sales in units required to achieve the target profit? Note: Do not round Intermediate calculations. Multiple Choice 8,500 units 13,000 units 8,000 units 7,625 unitsarrow_forwardThe Atlantic Company sells a product with a break-even point of 4,247 sales units. The variable cost is $73 per unit, and fixed costs are $110,422. Determine the following: a. Unit sales price b. Break-even point in sales units if the company desires a target profit of $24,986 unitsarrow_forward

- Flying Cloud Co. has the following operating data for its manufacturing operations: Unit selling price $ 250 Unit variable cost 100 Total fixed costs 840,000 The company has decided to increase the wages of hourly workers which will increase the unit variable cost by 10%. Increases in the salaries of factory supervisors and property taxes for the factory will increase fixed costs by 4%. If sales prices are held constant, the next break-even point for Flying Cloud Co. will be a. increased by 800 units b. increased by 640 units c. decreased by 640 units d. increased by 400 unitsarrow_forwardNorthwest Technology Inc. manufactures and sells two products, digital game players and computer tablets. The fixed costs are $936,000, and the sales mix is 70% game players and 30% computer tablets. The unit selling price and the unit variable cost for each product are as follows: Products Unit Selling Price Unit Variable Cost Game players $ 50 $30 Tablets 120 80 a. Compute the break-even sales (units) for the overall product, E.units b. How many units of each product, game players and tablets, would be sold at the break-even point? Digital game players units Computer tablets unitsarrow_forwardZeta Company sells a single product with a selling price of $300 per unit. Per unit variable costs are $82.00 and total fixed costs are $127,500. The number of units Zeta needs to sell to achieve its target profit of $50,000 is closest to: 610 814 a. b. C. d. 1,555 2,165arrow_forward

- Giddings Company manufactures and sells a single product, Product G. The product sells for $60 per unit and has a contribution margin ratio of 40 percent. The company's monthly fixed expenses are $28,800. If the selling price is reduced by 5%, variable costs per unit reduced by $1.00, and fixed costs increased to a total of $40,750, how many units would need to be sold to earn operating income equal to 10% of sales revenue? (Ignore income taxes.)arrow_forwardHoupe Corporation produces and sells a single product. Data concerning that product appear below: Per Unit Percent of Sales Selling price $ 140 100% Variable expenses 42 30% Contribution margin $ 98 70% Fixed expenses are $490,000 per month. The company is currently selling 6,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $11 per unit. In exchange, the sales staff would accept a decrease in their salaries of $58,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units. What should be the overall effect on the company's monthly net operating income of this change?arrow_forwardWhat is the break-even point in sales units? (see attached)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education