FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

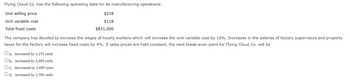

Flying Cloud Co. has the following operating data for its manufacturing operations:

| Unit selling price | $218 |

| Unit variable cost | $118 |

| Total fixed costs | $831,000 |

The company has decided to increase the wages of hourly workers which will increase the unit variable cost by 10%. Increases in the salaries of factory supervisors and property taxes for the factory will increase fixed costs by 4%. If sales prices are held constant, the next break-even point for Flying Cloud Co. will be

Transcribed Image Text:Flying Cloud Co. has the following operating data for its manufacturing operations:

Unit selling price

$218

Unit variable cost

$118

Total fixed costs

$831,000

The company has decided to increase the wages of hourly workers which will increase the unit variable cost by 10%. Increases in the salaries of factory supervisors and property

taxes for the factory will increase fixed costs by 4%. If sales prices are held constant, the next break-even point for Flying Cloud Co. will be

Oa. increased by 1,191 units

Ob. increased by 1,489 units

Oc. decreased by 1,489 units

Od. increased by 1,786 units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- XYZ Inc. sells a single product for $30 per unit. Variable production costs are $18 per unit. Fixed overhead costs amount $20,000 per month. Variable selling costs are $3 per unit. Fixed selling costs are $4,000 per month. Last month, the company produced 10,000 units and sold 8,000 units. What is the company’s margin of safety? a. $160,000 b. $80,000 c. $40,000 d. $20,000arrow_forwardThe fixed costs of Anton, Inc. are $354,000 and the total variable costs for its only product are 45% of the sales price, which is $140. Anton currently sells 5,700 units per month and is looking to sell more. Consider each of the following independently: Part A The marketing manager thinks sales are too low in Georgia and suggests that sales there would be increased by 240 units per month if an additional $8,000 per month was spent advertising there. What should be the effect on monthly income if this additional advertising is done? (Increase by 10480, 7120, 447905, or 5645?) Part B Management is considering adding a new feature to its product that will cause an increase in variable costs of $9 per unit. It is expected that sales will increase by 710 units per month if this feature is added. If the feature is added, what should be the overall effect on the company's monthly income? (Decrease by 3020, 12,960, 3519, or increase by 48280?) Part C The marketing manager is considering…arrow_forwardDrake Company produces a single product. Last year's income statement is as follows:Sales (23,000 units) $1,384,600Less: Variable costs 938,400 Contribution margin $ 446,200Less: Fixed costs 258,500 Operating income $ 187,700 3. Suppose that Drake Company is considering an investment in new technology that willincrease fixed costs by $227,800 per year, but will lower variable costs to 48 percent of sales.Units sold will remain unchanged. a) Prepare a budgeted income statement assuming Drakemakes this investment. (Round all amounts to the nearest dollar.) b) What is the new breakeven point in units, assuming the investment is made? (In your computations, round the unitcontribution margin to the nearest cent. Round your final answer to the nearest whole unit.)arrow_forward

- Flanders Manufacturing is considering purchasing a new machine that will reduce variable costs per part produced by $0.15. The machine will increase fixed costs by $18,250 per year. Flanders Manufacturing data Current Units sold 216,000 Sales price per unit $2.15 Variable cost per unit $1.75 Contribution margin per unit $0.40 Fixed costs $56,000 Break-even (in units) 140,000 Break-even (in dollars) $301,000 Sales $464,400 Variable costs $378,000 Contribution margin $86,400 Fixed costs $56,000 Net income (loss) $30,400 A) What will the impact be on the break-even point if Flanders purchases the new machinery? New break-even point in units? New break-even point in dollars? B) What will the impact be on net operating income if Flanders purchases the new machinery? New net income(loss)?arrow_forwardFlying Cloud Co. has the following operating data for its manufacturing operations: Unit selling price $239 Unit variable cost $108 Total fixed costs $842,000 The company has decided to increase the wages of hourly workers which will increase the unit variable cost by 10%. Increases in the salaries of factory supervisors and property taxes for the factory will increase fixed costs by 4%. If sales prices are held constant, the next break-even point for Flying Cloud Co. will be Oa. increased by 858 units Ob, decreased by 858 units Oc. increased by 686 units Od. increased by 1,029 unitsarrow_forwardBrecht Ltd produces a standard product which is sold for £85 each. The business incurred variable costs of £550,000 last year and total costs were £850,000. The business sold 11,000 units during the year and was operating at full capacity. The business intends to expand its output. This will involve building a factory extension, which will increase annual fixed costs by £120,000 per year. 1. Calculate the number of products that need to be sold in order for the business to break even, after the new factory extension has been built. 2. Calculate the profit (loss) that would be generated if the business sold 10,000 units (i) before the factory extension is built. (ii) after the factory extension is built.arrow_forward

- Sue Bee Honey is one of the largest processors of its product for the retail market. Assume that one of its plants has annual fixed costs totaling $16,317,500, of which $5,250,500 is for administrative and selling efforts. Sales are anticipated to be 950,000 cases a year. Variable costs for processing are $35 per case, and variable selling expenses are 10% of selling price. There are no variable administrative expenses If the company desires a pretax profit of $9,000,000, what is the selling price per case?arrow_forwardFlying Cloud Co. has the following operating data for its manufacturing operations: Unit selling price $202 Unit variable cost $103 Total fixed costs $801,000 The company has decided to increase the wages of hourly workers which will increase the unit variable cost by 10%. Increases in the salaries of factory supervisors and property taxes for the factory will increase fixed costs by 4%. If sales prices are held constant, the next break-even point for Flying Cloud Co. will be a.increased by 1,561 units b.increased by 1,301 units c.decreased by 1,301 units d.increased by 1,041 unitsarrow_forwardFlying Cloud Co. has the following operating data for its manufacturing operations: Unit selling price $ 250 Unit variable cost 100 Total fixed costs 840,000 The company has decided to increase the wages of hourly workers which will increase the unit variable cost by 10%. Increases in the salaries of factory supervisors and property taxes for the factory will increase fixed costs by 4%. If sales prices are held constant, the next break-even point for Flying Cloud Co. will be a. increased by 800 units b. increased by 640 units c. decreased by 640 units d. increased by 400 unitsarrow_forward

- Burgandy Manufacturing produces a single product that sells for $100. Variable costs per unit equal $40. The company expects total fixed costs to be $80,000 for the next month at the projected sales level of 2300 units. In an attempt to improve performance, management is considering a number of alternative actions. Each situation is to be evaluated separately. What is the current breakeven point in terms of number of units? (Round the final calculation up to the next whole number.) O A. 800 units OB. 1227 units O C. 1334 units OD. 2000 unitsarrow_forwardHoupe Corporation produces and sells a single product. Data concerning that product appear below: Per Unit Percent of Sales Selling price $ 140 100% Variable expenses 42 30% Contribution margin $ 98 70% Fixed expenses are $490,000 per month. The company is currently selling 6,000 units per month. The marketing manager would like to introduce sales commissions as an incentive for the sales staff. The marketing manager has proposed a commission of $11 per unit. In exchange, the sales staff would accept a decrease in their salaries of $58,000 per month. (This is the company's savings for the entire sales staff.) The marketing manager predicts that introducing this sales incentive would increase monthly sales by 100 units. What should be the overall effect on the company's monthly net operating income of this change?arrow_forwardAlpine Luggage has a capacity to produce 430,000 sultcases per year. The company is currently producing and selling 350,000 units per year at a selling price of $400 per case. The cost of producing and selling one case follows: Variable manufacturing costs Fixed manufacturing costs Variable selling and administrative costs Fixed selling and administrative costs Total costs Selling price per case Variable manufacturing costs Fixed manufacturing costs Variable selling and administrative costs Fixed selling and administrative costs Net profit (loss) per case The company has received a special order for 40,000 sultcases at a price of $249 per case. It will not have to pay any sales commission on the special order, so the variable selling and administrative costs would be only $52 per sultcase. The special order would have no effect on total fixed costs. The company has rejected the offer based on the following computations: Sales revenue Variable costs Manufacturing Selling and…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education