FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

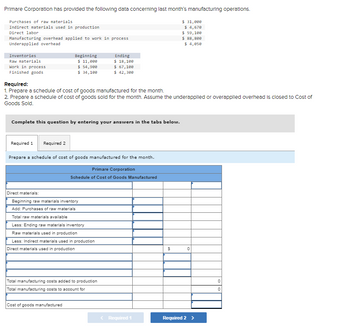

Transcribed Image Text:Primare Corporation has provided the following data concerning last month's manufacturing operations.

Purchases of raw materials

Indirect materials used in production

Direct labor

Manufacturing overhead applied to work in process

Underapplied overhead

Inventories

Raw materials

Work in process

Finished goods

Beginning

$ 11,000

$ 54,900

$ 34,100

Required 2

Required:

1. Prepare a schedule of cost of goods manufactured for the month.

2. Prepare a schedule of cost of goods sold for the month. Assume the underapplied or overapplied overhead is closed to Cost of

Goods Sold.

Complete this question by entering your answers in the tabs below.

Required 1

Prepare a schedule of cost of goods manufactured for the month.

Primare Corporation

Schedule of Cost of Goods Manufactured

Direct materials:

Beginning raw materials inventory

Add: Purchases of raw materials

Total raw materials available

Less: Ending raw materials inventory

Raw materials used in production

Ending

$ 18,100

$ 67,100

$ 42,300

Less: Indirect materials used in production

Direct materials used in production

Total manufacturing costs added to production

Total manufacturing costs to account for

Cost of goods manufactured

< Required 1

$ 31,000

$ 4,670

$ 59,100

$ 88,800

$ 4,050

$

0

Required 2 >

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Weatherhead Incorporated has provided the following data for the month of March. There were no beginning inventories; consequently, the direct materials, direct labor, and manufacturing overhead applied listed below are all for the current month. Work In Process Finished Goods Cost of Goods Sold Total Direct materials $ 4,240 $14,740 $ 41,900 $ 60,880 Direct labor 10,480 29,480 83,880 123,840 Manufacturing overhead applied 5,860 12,100 35,060 53,020 Total $20,580 $56,320 $160,840 $237,740 Manufacturing overhead for the month was overapplied by $3,100.The Corporation allocates any underapplied or overapplied manufacturing overhead among work in process, finished goods, and cost of goods sold at the end of the month on the basis of the manufacturing overhead applied during the month in those accounts.The work in process inventory at the end of March after allocation of any underapplied or overapplied manufacturing overhead for the month is closest to: (Round…arrow_forwardThe Zoe Corporation has the following information for the month of March: Cost of direct materials used in production $15,313 Direct labor 24,500 Factory overhead 38,564 Work in process inventory, March 1 15,171 Work in process inventory, March 31 21,235 Finished goods inventory, March 1 24,430 Finished goods inventory, March 31 22,114 a. Determine the cost of goods manufactured.$ b. Determine the cost of goods sold.arrow_forwardThe following data refer to the month of May for Bonita Components. Fill in the blanks. Direct materials inventory, May 1 Direct materials inventory, May 31 Work-in-process inventory, May 1 Work-in-process inventory, May 31 Finished goods inventory, May 1 Finished goods inventory. May 31 Purchases of direct materials Cost of goods manufactured during the month Total manufacturing costs Cost of goods sold Gross margin Direct labor Direct materials used Manufacturing overhead Sales revenue 3,900 4,000 5,200 2,800 500 25,000 87,000 89,300 22,000 20,500 108,000arrow_forward

- The following information is available from Gabe's LOL Co. for the month ending September 30, 20XX. Gabe's LOL Co. Information Direct materials used in production 215,500 Direct Labor 199,200 84,400 97,500 114,700 Work-in-Process, Sept. 1 Work-in-Process, Sept. 30 Total Factory Overhead Determine Gabe's LOL Co. cost of goods manufactured for the month ending September 30, 20XX. Gabe's LOL Co. Schedule of Cost of Goods Manufactured For Month Ending Sept. 30, 20xxarrow_forwardEppich Corporation has provided the following data for the most recent month: Raw materials, beginning balance Work in process, beginning balance Finished Goods, beginning balance Transactions: (1) Raw materials purchases (2) Raw materials used in production (all direct materials) (3) Direct labor (4) Manufacturing overhead costs incurred (5) Manufacturing overhead applied (6) Cost of units completed and transferred from Work in Process to Finished Goods (7) Any overapplied or underapplied manufacturing overhead is closed to Cost of Goods Sold (8) Finished goods are sold Required: Complete the following T-accounts by recording the beginning balances and each of the transactions listed above. Beginning Balance ding Balance Debit ginning Balance ng Balance Debit Raw Materials $ 22,000 $ 33,400 $ 51,400 Finished Goods Credit Credit Beginning Balance Ending Balance Debit Ending Balance Debit Beginning Balance Work in Process Manufacturing Overhead $78,800 $78,200 $ 53,400 $ 94,000 $ 73,400…arrow_forwardZoe Corporation has the following information for the month of March. Cost of direct materials used in production $15,231 Direct labor 28,865 Factory overhead 38,485 Work in process inventory, March 1 23,820 Work in process inventory, March 31 20,127 Finished goods inventory, March 1 21,652 Finished goods inventory, March 31 27,344 a. Determine the cost of goods manufactured.$fill in the blank 1 b. Determine the cost of goods sold.$fill in the blank 2arrow_forward

- Zoe Corporation has the following information for the month of March: Cost of direct materials used in production $16,307 Direct labor 24,952 Factory overhead 31,690 Work in process inventory, March 1 15,426 Work in process inventory, March 31 19,882 Finished goods inventory, March 1 23,292 Finished goods inventory, March 31 28,467 a. Determine the cost of goods manufactured. b. Determine the cost of goods sold. %24 %24arrow_forward< Zoe Corporation has the following information for the month of March: Cost of direct materials used in production Direct labor Factory overhead Work in process inventory, March 1 Work in process inventory, March 31 Finished goods inventory, March 1 Finished goods inventory, March 31 a. Determine the cost of goods manufactured. $ b. Determine the cost of goods sold. $16,971 25,726 36,875 18,297 18,757 21,733 25,034arrow_forwardDhapaarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education