FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Q.Compute the professional labor price and efficiency variances for the third quarter of 2017.

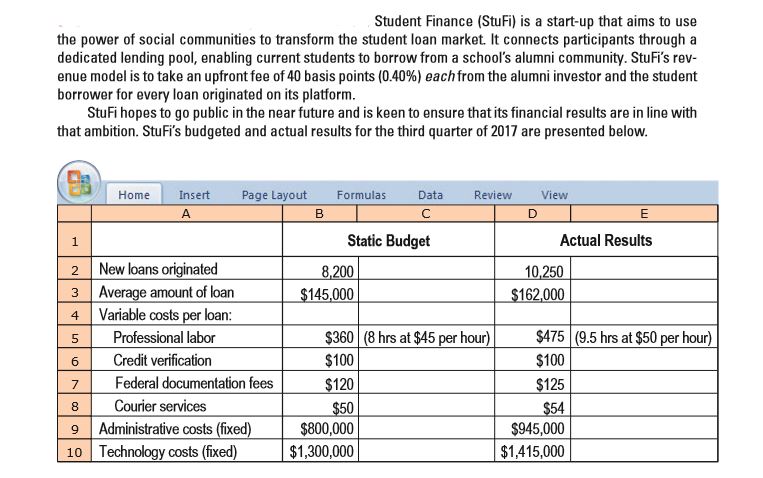

Transcribed Image Text:Student Finance (StuFi) is a start-up that aims to use

the power of social communities to transform the student loan market. It connects participants through a

dedicated lending pool, enabling current students to borrow from a school's alumni community. StuFi's rev-

enue model is to take an upfront fee of 40 basis points (0.40%) eachfrom the alumni investor and the student

borrower for every loan originated on its platform.

StuFi hopes to go public in the near future and is keen to ensure that its financial results are in line with

that ambition. StuFi's budgeted and actual results for the third quarter of 2017 are presented below.

Page Layout

в

Insert

Formulas

Data

Review

View

Home

Static Budget

Actual Results

1.

New loans originated

Average amount of loan

Variable costs per loan:

Professional labor

Credit verification

8,200

10,250

$145,000

$162,000

4

$360 (8 hrs at $45 per hour)

$475 (9.5 hrs at $50 per hour)

$100

$100

Federal documentation fees

$125

$120

Courier services

9 Administrative costs (fixed)

10 Technology costs (fixed)

$50

$800,000

$1,300,000

$54

$945,000

$1,.415,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required: Calculate all variances and prepare an operating statement for the month endedJune 2015 by using the following table format. Sales variances £ Favourable (F)/Adverse (A) Sales price variance: Sales volume variance: Total sales variance Direct material variances £ Favourable (F)/Adverse (A) Material price variance: Material usage variance: Total direct material variance Direct labour variances £ Favourable (F)/ Adverse (A) Labour rate variance: Labour efficiency variance: Total direct labour variance Variable overhead variances £ Favourable (F)/ Adverse (A) Variable…arrow_forwardprepare an income statement for last year using variable costingarrow_forwardBudgetarrow_forward

- Question 3 A shoe company had the following journal entries recorded for the end of June. Materials Control 300,000 Direct Materials Price Variance 10,000 Accounts Payable Control 290,000 Work-in-Process Control 120,000 8,000 Direct Materials Efficiency Variance Materials Control 128,000 Standard cost for direct labor per pair of shoes: 1 hour at a standard price of $100 each. The company produced 8,500 shoes in June with 8,470 hours and incurred total direct labor costs of $832,000.arrow_forwardHarrow_forwardHelp question 37arrow_forward

- 1. Prepare a report showing the conpany's activity variances for July. 2. Which of the activity variances should be of concern to management? Explain.arrow_forwardRequired information [The following information applies to the questions displayed below.] Antuan Company set the following standard costs per unit for its product. Direct materials (3.0 pounds @ $4.00 per pound) Direct labor (1.8 hours @ $12.00 per hour) $ 12.00 21.60 33.30 Overhead (1.8 hours @ $18.50 per hour) Standard cost per unit $ 66.90 The standard overhead rate ($18.50 per direct labor hour) is based on a predicted activity level of 75% of the factory's capacity of 20,000 units per month. Following are the company's budgeted overhead costs per month at the 75% capacity level. Overhead Budget (75% Capacity) Variable overhead costs Indirect materials $ 15,000 Indirect labor 75,000 Power 15,000 Maintenance 30,000 135,000 Total variable overhead costs Fixed overhead costs Depreciation-Building 24,000 70,000 Depreciation-Machinery Taxes and insurance 16,000 Supervisory salaries 254,500 Total fixed overhead costs 364,500arrow_forward5arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education