FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

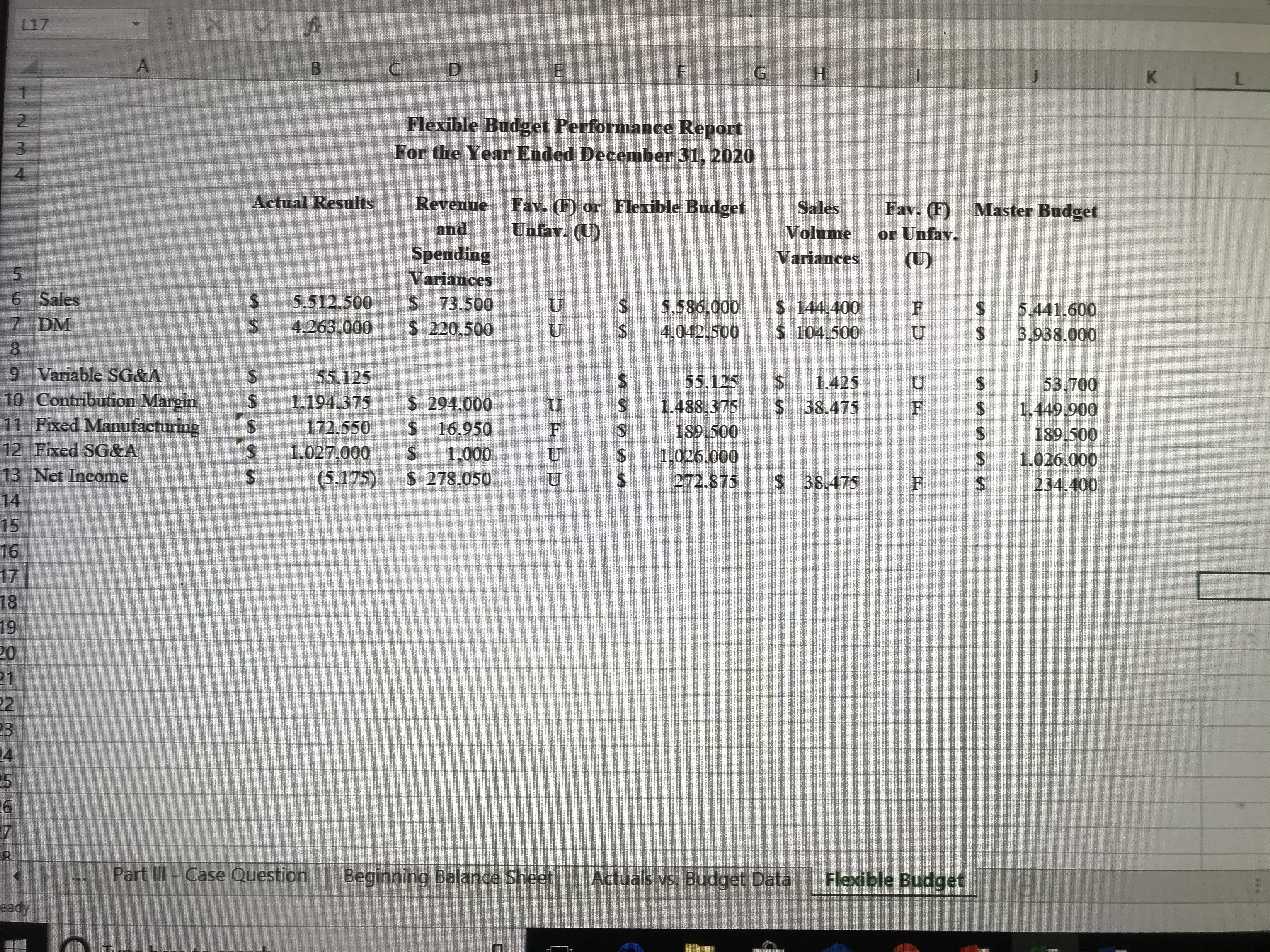

Analyze the variances from the flexible budget and identify issues that management should be concern about. You only need to highlight bariances that are a concern

Transcribed Image Text:L17

B.

H.

1.

K

1.

2.

Flexible Budget Performance Report

For the Year Ended December 31, 2020

3.

Actual Results

Revenue

Fav. (F) or Flexible Budget

Unfav. (U)

Sales

Fav. (F)

Master Budget

and

Volume

Variances

or Unfav.

Spending

Variances

(U)

5.

6 Sales

5.512,500

$ 73,500

$ 220.500

5.586.000

$ 144.400

$ 104.500

$5,441.600

3.938.000

7 DM

S.

4,263.000

4.042.500

8.

9 Variable SG&A

10 Contribution Margin

11 Fixed Manufacturing

55.125

1,194.375

172.550

55,125

U S 1.488.375

1,425

53.700

F $ 1.449.900

$ 294.000

S 38.475

$16.950

12 Fixed SG&A

13 Net Income

189.500

$1.026.000

272.875

189.500

1.026.000

234.400

1.027.000

1,000

S 278.050

S.

(5,175)

$ 38.475

14

15

16

17

18,

19

20

21

22

23

24

Part II- Case Question

Beginning Balance Sheet

Actuals vs. Budget Data

Flexible Budget

eady

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Discuss reasons for the adverse/unfavourable for Direct Material and Labour Rate variances and provide recommendationsarrow_forwardCite a specific example of the application of gross profit variance analysis. How will it help the company in its decision making?arrow_forwardUsing budgets as a performance benchmark is often since the actual performance will most likely differ from planned performance.arrow_forward

- Which of the following budgetary variances is a health services manager most likely to be held accountable for? O Labor expense variance Supply expense variance Volume variance More than one of the above is correctarrow_forwardWhen management uses variance reports to evaluate cost control, they look into which of the following? O both variable and unfavorable variances that exceed a predetermined quantitative measure such as a percentage or dollar amount. no variances O unfavorable variances only O favorable variances onlyarrow_forwardJustify the favorable or unfavorable budget variancesarrow_forward

- Which of the following describe the control aspect of the budgeting process? Please select all that apply. Rewarding the achievement of challenging targets. Checking progress towards achieving targets and objectives. Regular comparison of budgeted and actual outcomes. Investigating the causes of variations between budgeted and actual outcomesarrow_forwardWhich ONE of the following is true? a. Assume all costs are fixed when creating a flexible budget b. None of the other available answers are true c. There can only be one cost driver d. Unfavorable activity variances for costs will typically accompany a favorable activity variance for revenue. e. Variances are classified according to the impact on revenue f. Assume all costs are variable when creating a flexible budgetarrow_forwardWhich of the following budgets allows for adjustments in activity levels? a. zero-based budget b. continuous budget c. static budget Od. flexible budgetarrow_forward

- owe subject-Accountingarrow_forwardGive me a conclusion pargraph as to why budgeting impact managers' behaviorarrow_forwardThe following unemployment tax rate schedule is in effect for the calendar year 2019 in State A, which uses thereserve-ratio formula in determining employer contributions:Reserve Ratio Contribution Rate0.0% or more, but less than 1.0% ............................ 6.7%1.0% or more, but less than 1.2% ............................ 6.4%1.2% or more, but less than 1.4% ............................ 6.1%1.4% or more, but less than 1.6% ............................ 5.8%1.6% or more, but less than 1.8% ............................ 5.5%1.8% or more, but less than 2.0% ............................ 5.2%2.0% or more, but less than 2.2% ........................... 4.9%2.2% or more, but less than 2.4% ........................... 4.6%2.4% or more, but less than 2.6% ........................... 4.3%2.6% or more, but less than 2.8% ........................... 4.0%2.8% or more, but less than 3.0% ............................ 3.7%3.0% or more, but less than 3.2% ............................ 3.4%3.2% or…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education