Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

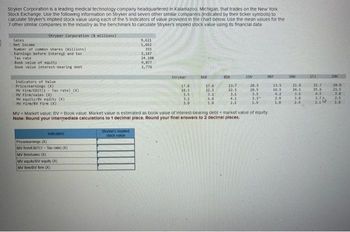

Transcribed Image Text:Stryker Corporation is a leading medical technology company headquartered in Kalamazoo, Michigan, that trades on the New York

Stock Exchange. Use the following information on Stryker and seven other similar companies (indicated by their ticker symbols) to

calculate Stryker's implied stock value using each of the 5 indicators of value provided in the chart below Use the mean values for the

7 other similar companies in the industry as the benchmark to calculate Stryker's Implied stock value using its financial data

Stryker Corporation (5 millions)

Sales

Net Income

Number of common shares (millions)

Earnings before interest and tax

Tax rate

Book value of equity

Book value interest-bearing debt

Indicators of Value

Price/earnings (X)

My firm/EBIT(1- Tax rate) (X)

MV firm/sales (X)

MV equity/BV equity (X)

HV Firm/BV firm (X)

Indicators

Pricelearnings X)

MV fem/EBIT(1-Tax rate) (X)

MV firmsales (X)

MV equity EV equity (X)

MV fim/BV 6mm (X)

9,621

1,662

Stryker's implied

stock value

355

2,187

24.10%

9,077

2,776

Stryker

17.8

18.3

3.5

3.2

2.0

BAX

17.6

22,3

3.1

4.6

1.8

BOX

23.7

22.5

3.1

4.2

2.1

cov

MV Market value, BV Book value. Market value is estimated as book value of interest-bearing debt market value of equity.

Note: Round your Intermediate calculations to 1 decimal place. Round your final answers to 2 decimal places.

20.3

20.5

3.5

3.3

1.9

HOT

13.5

16.5

4.3

2.9

SAN

21.0

24.1

3.6

3.8

513

22.7

25.6

4,5

1.7

2MH

20.0

21.5

3.8

2.5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Identifying Comparables and Valuation using PB and PE Tailored Brands Inc.'s book value of equity is $4.563 million and its forward earnings estimate per share is $1.10, or $55.7 million in total earnings. The following information is also available for TLRD and a peer group of companies (identified by ticker symbol) from the specialty retail sector. Market Ticker Cap($ mil.) TLRD GCO ZUMZ GES ANF TLYS M 585.7 789.7 1,147,0 988.2 293.7 4,760.0 PB Forward Current PE (FY1) 1.00 9.699 1.95 14.17 2.07 13.19 1.00 19.69 1.68 11.6 0.75 5.458 EPS 5-Year Historical ROE Growth Rate (T 4Q) (0.47% 22.50% (323.73) (5.86 ) % 3.28% 13.85% (37.69% 1.90% 9.37% 6.35% 5.51% 13,93% (1.74 % 16.70% Debt-to- Equity (Prior Year) 2.53 0.13 0.00 0.56 0.25 0.00 0.74 (a) Identify a set of three companies from this list to use as comparables for estimating the equity intrinsic value of TLRD using the market multiples approach. ZUMZ, TLYS, M + (b) Assume that you use as comparables the following set of companies:…arrow_forwardPlease do not give solution in image formatarrow_forwardSuppose on May 31, 2022, the DJIA opened at 33,324.59. The divisor at that time was 0.15359. In June 2022, United Healthcare (UNH) was the highest-priced stock in the DJIA and Walgreens (WBA) was the lowest. The opening price for UNH on May 31, 2022, was $536.78, and the closing price for WBA was $47.03. Suppose this day the other 29 stock prices remained unchanged and UNH increased 5.4 percent. What would the new DJIA level be? Now assume only WBA increased by 5.4 percent. Find the new DJIA level. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. DJIA if UNH increases 5.4 percent DJIA if WBA increases 5.4 percentarrow_forward

- Copperhead Trust has the following classes of stock: LOADING... (Click the icon to view the data.) Read the requirements LOADING... . Requirement 1. Copperhead declares cash dividends of $44,000 for 2024. How much of the dividends goes to preferred stockholders? How much goes to common stockholders? (Complete all input boxes. Enter "0" for any zero amounts.) Copperhead's dividend would be divided between preferred and common stockholders in this manner: Total Dividend Dividend to preferred stockholders: Dividend in arrears Current year dividend Total dividend to preferred stockholders Dividend to common stockholders Data Table Preferred Stock—6%, $12 Par Value; 8,500 shares authorized, 7,000 shares issued and outstanding Common Stock—$0.10 Par Value; 2,100,000 shares authorized, 1,400,000 shares issued and outstanding Requirements 1. Copperhead…arrow_forward1. Match the stock with its stock sector: DuPont De Nemours Inc. Exxon Mobil Corp. Nike Inc. Public Service Enterprise Group Inc. Coca-Cola Co. AT&T Inc. 2. Walt Disney Co. belongs to ____ the stock sector. 3. Boeing Co. belongs to ____ the stock sector. 4. Which company has the stock (ticker) symbol PSA? 5. How many stock sectors are there?arrow_forwardRead the transactions carefully and prepare the Journal Entry. Med-care incorporated is a health insurance company. The following account balances appear on the statement of financial position of Doc med-care Incorporated. Ordinary Shares P10 par, P400,000; Share Premium Ordinary, P42, 500; Retained Earnings P299,500. The board of Directors declared a 3 pesos dividend per share. Required: Journalize the entriesto record The declaration of the Dividend The issuance of the dividendarrow_forward

- Sheridan Corporation's suite of software products and services provides secure and scalable solutions for global companies. The following is an extract from the company's 2024 and 2023 comparative income statements and statement of financial position. The market price of Sheridan's common shares was $40.21 and $38.40 on June 30, 2024, and June 30, 2023, respectively. Sheridan declared dividends per common share of $0.473 and $0.412 for 2024 and 2023, respectively. SHERIDAN CORPORATION Years Ended June 30, 2024 and 2023 (in thousands) Comparative Income Statement Total revenues Total cost of goods sold 2024 2023 $2,292,471 $1,839,262 760,877 570,223 Total operating expenses Net income Statement of Financial Position Total assets 1,252,907 884,482 278,787 299,938 2024 2023 $7,435,933 $5,165,034 Total liabilities 3,940,763 3,795,325 Common share capital 1,449,399 809,798 Total shareholders' equity 3,495,170 1,369,709 Weighted average number of common shares outstanding 252,275 245,016…arrow_forwardNakamura,Incorporated, has a total debt ratio of. 75, total debt of $576,000, aND net income of $27,340. What is the companys reternal on equity?arrow_forwardPrepare a comprehensive summary assesment detailing the story those ratios are telling you about the company and its ability to effectively position itself within the stock market through its dividend policy and finacial performancearrow_forward

- Calculate the dividend payout ratio and the dividend yield for 2020 and 2019. (Round answers to 1 decimal place, eg. 15.2%) Dividend payout ratio Dividend yield 2020 % 2019 % %arrow_forwardThe discounted cash flow model and the corporate valuation model are the most widely used valuation techniques. Often these valuations are accompanied by market multiple analysis, which is based on the fundamental concept that sinar assets should have simlar values. Carlson Co, is a privately owned firm with few investors. Investors forecast their eamings per share (EPS) to reach $3 this coming year The average price-to-earnings (P/E) ratio for similar companies in the S&P 500 is 11. The estimated intrinsic value of Carlson Co.'s stock will be Market multiple analysis is also used to calculate the value of a company, which is further used to calculate the intrinsic vakre per share of the fim Suppose you have the information given in the following table for Company X. EBITDA Total value of equity Total firm value per share. Year 1 Year 2 $10,680 $12,375 $121,500 $112,500 $182,250 $202,500arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education