Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

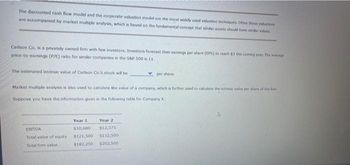

Transcribed Image Text:The discounted cash flow model and the corporate valuation model are the most widely used valuation techniques. Often these valuations

are accompanied by market multiple analysis, which is based on the fundamental concept that sinar assets should have simlar values.

Carlson Co, is a privately owned firm with few investors. Investors forecast their eamings per share (EPS) to reach $3 this coming year The average

price-to-earnings (P/E) ratio for similar companies in the S&P 500 is 11.

The estimated intrinsic value of Carlson Co.'s stock will be

Market multiple analysis is also used to calculate the value of a company, which is further used to calculate the intrinsic vakre per share of the fim

Suppose you have the information given in the following table for Company X.

EBITDA

Total value of equity

Total firm value

per share.

Year 1

Year 2

$10,680

$12,375

$121,500

$112,500

$182,250 $202,500

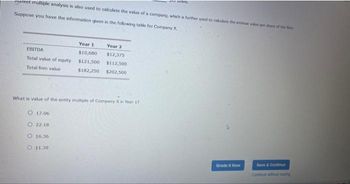

Transcribed Image Text:anket multiple analysis is also used to calculate the value of a company, which is further used to calculate the intrinsic valun per share of the fam

Suppose you have the information given in the following table for Company X.

EBITDA

Total value of equity

Total firm value

Year 1

Year 2

$10,680

$12,375

$121,500

$112,500

$182,250 $202,500

What is value of the entity multiple of Company X in Year 17

O 17.06

O22.18

O 16:36

O 11.38

Stare.

Grade It Now

Save & Continue

Continue without saving

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- IV. Conclusion: Based on your findings on ratio analysis and interpretation, what conclusion can you make? V. Recommendations: - What recommendations can you give to the company with regards to your findings? - What recommendations can you give to the investor with regards to your findings?arrow_forwardConsider the following table of Earnings Components: Reported EPS Analyst's EPS composition: Permanent component (Bp = 5) Transitory component (BT = 1) Value-irrelevant component (BØ = 0) The implied share price of Firm C's stock is: Firm A $ 12 80% 10% 10% Firm B $ 15 60% 35% 5% Firm C $18 75% 25% 0%arrow_forwardConsider the following partial income statements and balance sheets for Lillard Corp. For the year ended December 31, Net income Less income attributable to noncontrolling 5,700 interests Net income attributable to Lillard Corp. 100,400 107,300 Lillard Corp. shareholders' equity Noncontrolling interests Total equity What is Lillard's return on equity for 2024? 11.7% O 11.5% 12.3% 11.9% 2024 2023 108,000 113,000 11.1% 7,600 Dec. 31, 2024 Dec. 31, 2023 861,000 888,000 32,400 30,600 893,400 918,600arrow_forward

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education