Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

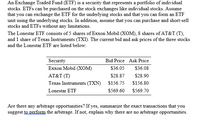

Transcribed Image Text:An Exchange Traded Fund (ETF) is a security that represents a portfolio of individual stocks, which can be bought and sold on stock exchanges like individual stocks. This example assumes that the ETF can be exchanged for the underlying stocks and that an ETF unit can be formed using the underlying stocks. Additionally, it is assumed that stocks and ETFs can be purchased and short-sold without any limitations.

**Lonestar ETF Composition:**

- 5 shares of Exxon Mobil (XOM)

- 8 shares of AT&T (T)

- 1 share of Texas Instruments (TXN)

**Current Bid and Ask Prices:**

| Security | Bid Price | Ask Price |

|--------------------------|-----------|------------|

| Exxon Mobil (XOM) | $36.05 | $36.08 |

| AT&T (T) | $28.87 | $28.90 |

| Texas Instruments (TXN) | $156.75 | $156.80 |

| Lonestar ETF | $569.60 | $569.70 |

**Arbitrage Analysis:**

To determine arbitrage opportunities:

1. Calculate the cost of acquiring the underlying stocks at the ask prices:

- Exxon Mobil: 5 × $36.08 = $180.40

- AT&T: 8 × $28.90 = $231.20

- Texas Instruments: 1 × $156.80 = $156.80

- Total cost: $180.40 + $231.20 + $156.80 = $568.40

2. Compare the total cost ($568.40) with the bid price of the Lonestar ETF ($569.60).

The cost of acquiring the underlying stocks is lower than the bid price of the Lonestar ETF, presenting an arbitrage opportunity.

**Arbitrage Strategy:**

- Buy the underlying stocks at their respective ask prices (total = $568.40).

- Simultaneously sell the Lonestar ETF at the bid price ($569.60).

This transaction can earn an arbitrage profit of $1.20 per ETF unit (i.e., $569.60 - $568.40).

If no arbitrage opportunity existed, the combined price of the underlying stocks would equal the ETF's bid price. However, in this case, there is a profit to be made by executing the described transactions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- With firm commitment underwriting, the investment banker O A. purchases all of the shares of stock from the company and then sells them to the investing public O B. does it best to sell as many securities as possible O C. receives a fee for each security sold O D. All things being equal, the issuing company (going public) would prefer the firm commitment basis since this assures from the that all of the shares are sold. O E. Both A & Darrow_forwardCostco (NASDAQ: COST) proving its strength as a consumer staples stalwart and has seen its share price strongly outperform the S&P 500 over the last month. Suppose you have purchased a Costco stock, which type of option should be chosen for hedging? Based on the option you selected, choose the appropriate strike price to calculate the option price, assuming the Costco is on a non-dividend-paying stock and the current stock price and strike price are given in the question, the risk-free interest rate is 3% per annum, the volatility is 30% per annum, and the time to maturity is four months.arrow_forwardCompanies sometimes go through stock splits or repurchase of their own shares. What is the importance of stock split, stock repurchase, and reverse stock splits? List a pro and con of each along with an example of a company that has gone through this.arrow_forward

- q2a- List and compare three different ways of issuing shares in the primary market. (6 mark worth question)arrow_forwardIn a targeted stock repurchase, ... O A. ... a firm uses a tender offer to buy back a large number of own shares. O B. ... a firm buys back own stock from shareholders on the open market. O C. ... a firm distributes put options on its own shares to its shareholders. O D.... a firm buys back own shares from one or few major shareholders.arrow_forwardWhat is a stock split? How does a stock split affect the market value of a share of stock? What is a stock spin-off? In very general terms, explain how a stock spin-off works.arrow_forward

- You bought a convertible bond issued by Zip Corp which has a conversion ratio of 50 common shares for each $1,000 bond. A) At what stock price per share would you make a profit (“in the money”) if you bought the bond at par? B) What would you expect the bond to sell for in the market if Zip Corp’s stock trades at $28.50 per share?arrow_forwardDo not give image formatarrow_forwardhello, I need help pleasearrow_forward

- If a certain stock sells for 626.659 dollars on the NYSE, how much will it sell for, in dollars, on the LSE(London stock exchange). Remember that the distance between NYSE and LSE is about 3,460 miles.arrow_forwardIn what way is a preferred stock usually more similar to a bond than to a common stock? O a. Preferred stockholders are more risky than common stocks O b. Preferred stockholders elect the board of directors of the organization O c. Preferred bondholders participate in the growth of the company through increases in dividends and stock prices O d. Preferred stockholders are typical entitled fixed payments O e. If the company were to go into liquidation, preferred stockholders will be entitled to payments after common stockholders are paid-offarrow_forwardThe purpose of a lockup provision is to: Question 22 options: keep individual investors from buying and selling stock. prevent downward pressure on the stock's price. increase the number of outstanding shares. allocate a larger proportion of stock to institutional investors.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education