Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

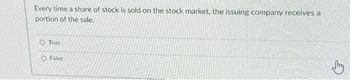

Transcribed Image Text:Every time a share of stock is sold on the stock market, the issuing company receives a

portion of the sale.

True

O False

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- What would you expect to happen to an all-equityfirm’s stock price if its management announceda recapitalization under which debt would beissued and used to repurchase common stock?arrow_forwardWhat is a stock split? How does a stock split affect the market value of a share of stock? What is a stock spin-off? In very general terms, explain how a stock spin-off works.arrow_forwardDiluted earnings per share shows dilution resulting from additional shares that may be issued for stock options or bonds that may be converted to shares of common stock in the future. True Falsearrow_forward

- If a preferred stock issue has a conversion feature, the stock can be converted into _____. Group of answer choices common stock corporate bonds founders stock cumulative stockarrow_forwardWhat is the price at which the stock of a public company trades on the stock market referred to as?arrow_forward(18) True or False : Passed dividends on cumulative preferred stock are recorded as a liability.arrow_forward

- According to the basic Dividend Discount model, the value an investor should assign to a share of stock is dependent on the length of time he or she plans to hold the stock. Is the above statement True or False? Please Explain.arrow_forwardDo preferred stockholders receive the share of the company earnings before or after bond interest is paid?arrow_forwardAn offering of shares to institutional investors at a discount to the current market price is known as a: Select one: a. Initial Public Offering (IPO). b. Private Placement c. Rights Issue d. Dividend Reinvestment Plan (DRP).arrow_forward

- 18arrow_forwardAn initial public offering (IPO) is when a corporation sells stock to the general public for the first time. Question 2 options: True Falsearrow_forwardCumulative preferred stock O requires dividends in arrears to be paid before the firm can pay dividends on common. O has a right to vote cumulatively. O has a claim to dividends before bonds. Ohas a higher required return than common stock.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education